How The Bitcoin Market Reacted To Federal Reserve Comments On Ongoing Inflation

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

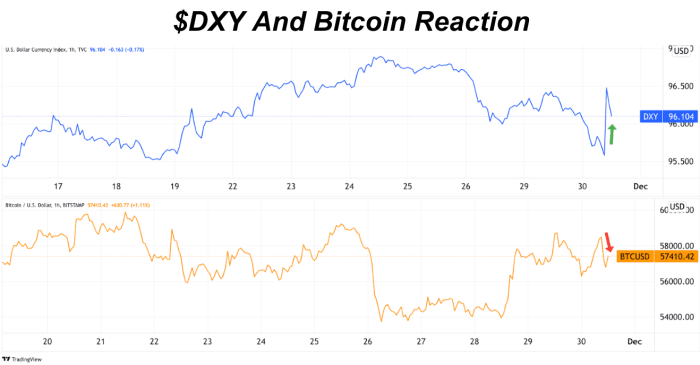

The $DXY and $SPX react to Powell’s comments regarding inflation and tapering.

The bitcoin market fell following Powell’s comments.

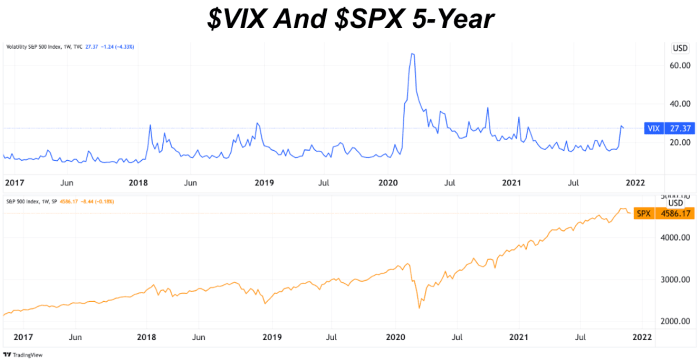

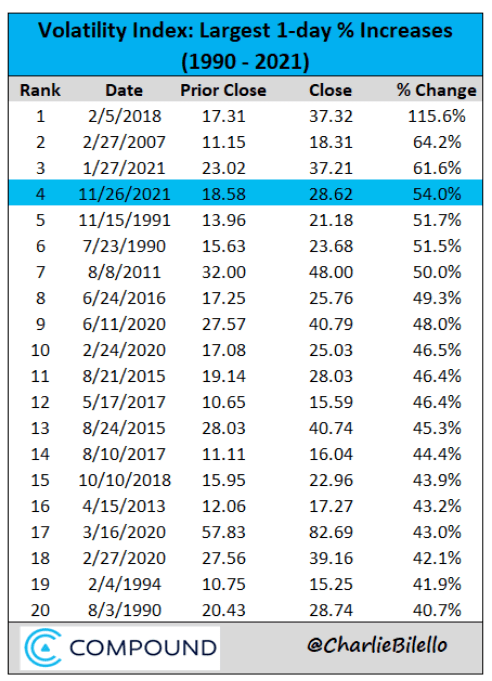

Over the last few days, we’re seeing rising and elevated market volatility as well with the VIX spiking over 54% last Friday, which is the fourth largest one-day percentage increase in its history. This is a cautious sign for investors to expect volatility in the near term.

$VIX saw one of its largest increases in history.

Source: Charlie Bilello, Compound

The Federal Reserve’s position is an incredibly difficult one: the choice between saving the bond market or sustaining the U.S. economy. An accelerated taper brings us closer to interest rate hikes which are the only way to help fixed-income investors saddled with real negative yielding U.S. debt, as inflation runs hot over 6%.

On the other hand, expectations of accelerated tapering with plans for interest rate hikes will drive down asset prices as extra liquidity in the system winds down and the cost of capital increases, negatively affecting current equity valuations. The SPX fell 1% in 15 minutes on yesterday’s announcement.

Source link

#Bitcoin #Market #Reacted #Federal #Reserve #Comments #Ongoing #Inflation