Stablecoins Are Becoming Increasingly Key To The Bitcoin Economy

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

One of the most important economic discussions this year, apart from Bitcoin, is around the rise of stablecoins, and especially the rise of stablecoins pegged to the U.S. dollar. As the world reserve currency, everyone around the world demands U.S. dollars. Stablecoins can help satisfy that demand by enhancing the U.S. dollar’s features across accessibility and efficiency.

2021 has been a transformative year for the aggregate supply of USD stablecoins in the market with total supply reaching near $140 billion. That’s 401% year-to-date growth from a circulating supply of just $27.67 billion back in January.

Stablecoins have become an increasingly large part of the bitcoin/cryptocurrency economy, doing everything from giving offshore exchanges dollar on/off-ramps, as well as allowing traders/speculators a way to borrow against their assets.

Just since April, the type of margin used in the bitcoin futures/derivatives market has dropped from 70% to approximately 45%, meaning that bullish traders/speculators increasingly no longer need to worry about a declining collateral value when the market faces a downturn.

The type of margin used in the bitcoin futures/derivatives market has dropped significantly.

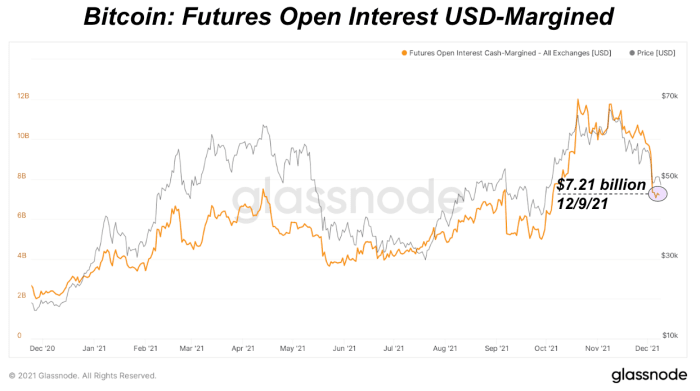

There is currently $7.21 billion of bitcoin futures open interest that is collateralized by stablecoins.

Bitcoin futures open interest collateralized by stablecoins.

The exponential growth being witnessed in stablecoins is occurring while the U.S. is holding congressional hearings in regards to “digital assets” and stablecoins. One clip from the hearing in particular stood out:

In the clip, it was discussed how the growth of stablecoins in the crypto industry are actually strengthening the dollar’s hold as the world reserve currency, and increasing the demand for dollars. Empirically, this seems to be the case.

Source link

#Stablecoins #Increasingly #Key #Bitcoin #Economy