Why Jerome Powell’s Policies Are Bullish For Bitcoin

This article was highly inspired by a conversation I had with Tom Luongo in October 2021, and his thesis on geopolitics and the macro economic landscape of today. You can hear the conversation on my podcast, A Boy Named Pseu, and listen to episodes 75, 76, and 77 of Tom’s podcast, Gold, Goats, and Guns for more context. Much of the credit and information in order to write this piece goes to the great work and research Tom has done over the years. I am but a pleb-learner and like Mr. Luongo, stand on the shoulders of giants.

As the lender of last resort, the Federal Reserve Board wields powerful weapons from its arsenal in order to save the world’s economy from collapsing. Although the outcomes and tactics vary, the Fed’s main trick up its sleeve is to manipulate the money supply through controlling interest rates. When there’s a liquidity crisis, the Fed lowers rates to make borrowing money cheaper, which pumps liquidity into the market. To avoid an inflationary crisis after “printing” said liquidity, the Fed simply increases the cost of borrowing by raising rates. This disincentivizes the velocity of money from flowing out of control into the greater economy, with the hopes of also avoiding a deflationary death spiral. It’s straight from the Keynesian handbook; the classic teeter-tottering of monetary chaos every Fed Chairman is burdened with managing.

Federal Reserve Chairman, Jerome Powell, is using these tactics to keep the economy afloat amidst a global pandemic. In March of 2020, Powell leveraged the Fed’s printer to create what now accounts for approximately 40% of all US dollars in the global economy. With expectations of inflation projected for 2022, he is faced with no other choice but to wield a most “nuclear option” from the Fed’s arsenal: drying up the world economy.

In June of 2021, Powell made a major shift in monetary policy with a surprised 0.05% rise in two crucial interest rates: interest on excess reserves (IOER) and interest on reverse repo contracts. This article will break down these technical monetary instruments, the basics of how the Fed operates, analyze Powell’s recent change in policy, and reveal what this all could mean for both the bitcoin price, and the global economy moving forward.

How The Fed Works:

The Fed is ultimately beholden to its cartel of shareholders, or member banks. This distributive system of banking and investment is what mandates the world’s monetary policy.

The primary dealers: J.P. Morgan & Chase Co., Goldman Sachs, Bank of America, Wells Fargo, Morgan Stanley, etc., are important because they buy all the excess supply of US Treasury paper (reserves) that’s auctioned off by the Treasury department in order to fund operations and keep the economy going. These primary members scoop up 50% of the issued treasuries and immediately sell them to the Fed in exchange for cash. This is how treasuries (U.S. debt) are monetized. In contrast, foreign central banks only buy up to 30% of the three years issuance of the new supply of treasuries, and the remaining 20% is left to the private sector.

Therefore, when the banks control the flow of capital, it’s the Fed that controls the overall health and well-being of the entire world by the ruling currency, the dollar. Let’s start with the basics of how this monetary spigot drips by analyzing the Fed’s common practices.

The Fed Funds Rate

The most prominent tool the Fed uses to manage the economy is the Federal funds rate, which is the gross cost to borrow funds from the Fed. Being the lender of last resort, the Fed can theoretically print unlimited amounts of elastic money in order to cover any amount of time mismatches in the money markets. If banks lend out too much money and can’t pay each other back to meet their required reserve rates before closing time, the Fed can bail them out at cheap, preferential interest rates.

For example — if a bank needs $10 billion by 5 P.M. to cover its payroll and lending obligations, they can just get that money from the Fed at a very cheap rate to save their butt. The amount of money the Fed can print to prevent these imbalances is unlimited, unless the people’s confidence in this system erodes. As long as the sheep don’t ask where the money comes from, the party keeps going.

Bernanke’s Bailout Bag

During the Lehman Brothers crisis in 2008, then Fed Chairman, Ben Bernanke, instituted two important monetary programs: interest on excess reserves (IOER), and the reverse repo window. Both policies are used to tighten or remove liquidity from the markets. Banks continued tightening for years in order to sterilize all the QE money the Fed created for bailouts during the Great Recession. Bernanke’s self-coined “sterilization” is why there was no hyperinflation during the Great Recession. Had the banks not been incentivized to tighten, all that money would have chased the limited supply of goods in the economy.

IOER

With IOER, any excess reserves in the banking system could be held at the Fed and earn interest. This dries up liquidity in the market because banks don’t have the excess capital to make loans. In the past, banks didn’t use IOER because what the Fed paid was usually below the going rate that was offered in the money market, so nobody used the facility because rates were 0-bound.

In the wake of Lehman and quantitative easing (QE), Bernanke raised IOER to 25 basis points. Naturally, banks responded and rolled with the new policy and parked $2.8 trillion at the Fed to earn a quarter point in interest. If IOER is higher than what banks can make in the overnight money market, then they’ll park their reserves at the Fed.

Repo 101

Another tightening tool the Fed utilizes is a repurchase agreement. This tool is similar to Bernake’s method of quantitative easing during the Great Recession. In an economic crisis, desperate times certainly call for desperate measures. However, repo contracts take place in a much shorter time-frame. Therefore, repo is a little something I like to refer to as “high time-preference QE.”

Simply put, a repo contract is an agreement the Fed makes with a bank to temporarily buy a security (collateral) with a promise of returning it with a small return or higher price (interest). In the case of a liquidity crisis, the bank is short on cash and taps the Fed window and requests a securitized loan. The Fed gives the bank cash and in exchange, receives a security from the bank. The cash helps with the bank’s lending obligations and adds liquidity in the economy which eases market tension and uncertainty (aka bailing out the “too-big-to-fail” institutions with QE). Once the loan comes to term, the Fed and bank swap assets for cash, and the bank pays the interest owed (supposedly).

A reverse repo contract is the exact opposite of the above. In this scenario, the Fed sends securities to the bank in exchange for cash. This reallocation of capital into accounts at the Fed tightens and dries up liquidity from the market.

Powell Marks His Territory

During the June 2021 Federal Open Market Committee meeting, Powell raised the IOER and reverse repo rates by five basis points. Like Bernanke’s strategy, Powell began his process of sterilizing the markets of cash to avoid inflation. Moreover, Powell made a defensive strategy of tapering to remove money from the global economy to put asymmetric stress on Europe. By mid-June, $250 billion was removed from the markets and crashed the euro.

Unlike The Federal Reserve, the European Central Bank (ECB) can (and most likely plans to) go bankrupt by intentionally destroying the Euro with negative interest rates. Tom refers to this in the interviews. Their plan allegedly is to wreak their sovereign bond market, and to dry up the banking industry. The Great Reset is Europe’s Trojan Horse to gain control over the world’s monetary flow by undercutting the Fed’s banking cartel. This is all part of the EU’s goal to destroy the US’s ability to taper money printing through astronomical Build Back Better programs that would cost America trillions.

These policies were designed to ensure that the Fed has no option but to monetize all the spending and force negative interest rates onto Americans, just as Europe has done to its citizens. This would create a weak dollar and strong euro, preventing Europe from imploding on its debt as the ECB implements a CBDC to institute capital controls over individuals, and establish monetary and economic hegemony over the world. Powell’s decision to raise rates prevented this monetary flippening from happening.

Since the passing of The CARES Act, now both corporates and non-financial corporates have access to the Fed window that was originally exclusive to the Fed’s banking cartel. Since COVID-19, IOER was zero, and the repo window was only available to the Fed’s primary dealers. Now, they’re being cut out of the monetary transmission system (aka the money making machine) by the likes of BlackRock. Simply put, Powell is tightening to protect the US banking cartel and dollar hegemony.

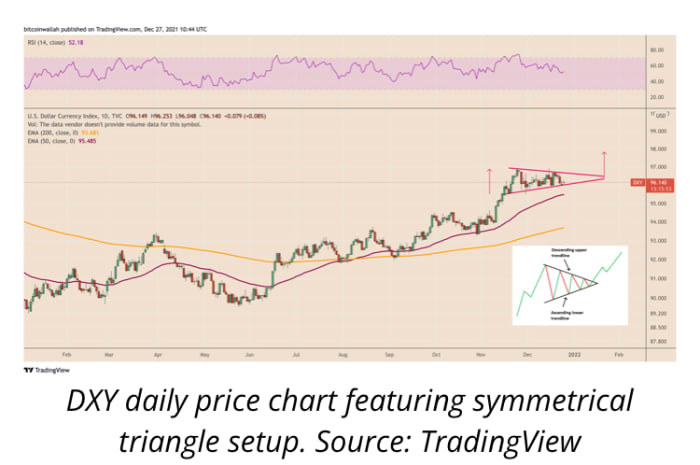

The Fed’s expectations of raised interest rates will only strengthen the dollar, crush the euro, and reallocate capital into more sound investments. In December 2021 the Fed signaled its willingness to aggressively taper with three rate hikes in 2022. Coin Telegraph’s Yashu Gola demonstrates in the graphics below how Powell’s tightening policies is bullish for the dollar by creating capital flight from Europe back to America.

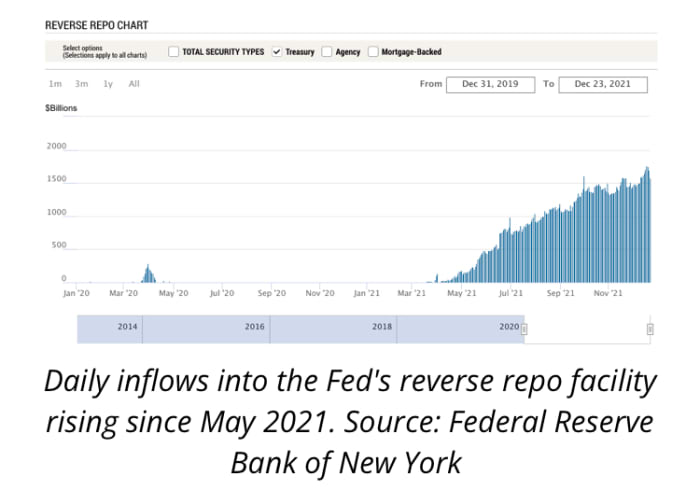

Powell’s policies are being implemented overseas via the opening of foreign repo facilities. European banks are increasingly strengthening the greenback by exchanging their extra euros for dollars they can now park at the Fed. On December 20, 2021, approximately $1.7 trillion flowed into the Fed’s repo facility, making it the highest one-day cash injection to date. When your government’s debt is offering you negative yields on excess euros, a positive yield of 0.05% in the world’s reserve currency is mighty attractive.

As deflationary pressures like this set in, an inevitable correction will occur during this reallocation of capital. Higher interest rates will quell asset price inflation in common “tried and true” investment vehicles. A strong dollar will make debt more expensive, and disincentivize businesses and individuals to leverage themselves up to their eyeballs. Assets such as equities, real estate, treasuries, beanie babies — you name it, it will be repriced in hard tangible assets like gold and oil. However, the alpha gained in tangible assets will be laughable compared to the appreciation seen in bitcoin.

Trojan Horsing A Bitcoin Standard

“I do not believe that the solution to our problem is simply to elect the right people. The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing. Unless it is politically profitable for the wrong people to do the right thing, the right people will not do the right thing either, or if they try, they will shortly be out of office.” – Milton Friedman

With a more sound monetary policy focused on fiscal responsibility, Powell and his shareholders may be incentivized to maintain their economic rule by embracing bitcoin as a legitimate asset that will ensure the dollar’s hegemony.

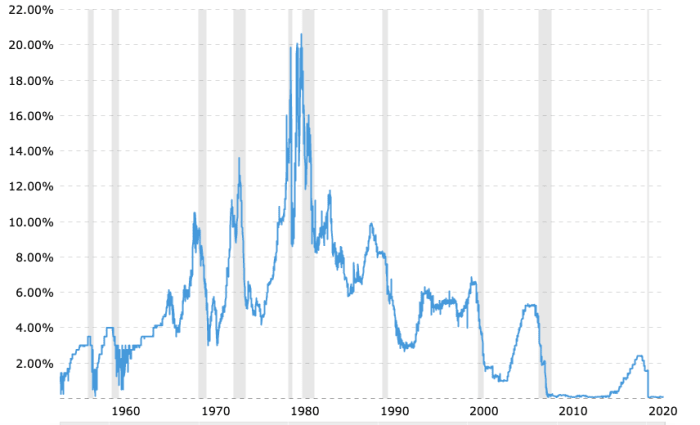

During times of economic uncertainty, the world pulls back on liquidity not knowing what the Fed’s monetary policy will be. Powell’s hawkish policies are signals that the Fed needs to gain back the market’s trust, and raising interest rates is the only way to do so. This is the narrative that dominates market thinking, and was best demonstrated when Paul Volcker was Fed chairman. Volcker was forced to raise rates in order to combat the excessive inflation from the early 70’s to maintain dollar hegemony. During that inflationary period, the price of gold rallied from 1971-1980. As Volcker raised the Fed Funds Rate, the market tightened. Powell is faced with the same dilemma and will use his monetary tightening tools to protect the dollar.

Federal Funds Rate – 62 Year Historical Chart

With Bitcoin’s fixed supply cap of 21 million, and institutional money entering the playing field, it’s value proposition could far outpace gold’s during times of economic uncertainty and become a safe haven for capital. Capital flows to where it is treated best, and with treasuries yielding negative in real terms, parking capital at the Fed is an obvious liability for any investor. As a result, nations will sell off their U.S. treasuries as individuals realize that “the full faith and credit of the United States government” is the largest counterparty risk overall.

Confidence in America’s credit worthiness will wane as financial institutions become impaired once people realize the moral hazard between banks and Fed bailouts. A decoupling of the legacy financial system will occur as market participants seek a new form of collateral to replace the U.S. treasuries. Bitcoin is primed for this opportunity because it is absent a counterparty risk, making it the pristine collateral needed to be leveraged by the commercial banking industry, businesses of all kinds and even the Fed. Or, as Michael Saylor so aptly puts it, businesses will plug into the Bitcoin network and become applications on top of it. Banks will be forced to offer bitcoin financial services to their customers in order to compete and stay relevant until their services are no longer needed as individuals take self-custody of their funds and become their own banks.

The reallocation of capital could also demonetize US treasuries and be redirected into bitcoin as a new pristine form of collateral, creating a quasi bitcoin/dollar-hybrid standard. However, history reminds us that central planning always fails, and thus a bitcoin-backed dollar will be ephemeral. Bureaucrats at the Fed will cave to the temptations to debase the money supply, and the experiment will inevitably fail. Thus, the dependence on central banks and fiat money will have evaporated from existence. However, a violent collapse and transition will not have to be a requirement for this new economy.

As Satoshi so eloquently said:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Powell’s monetary policies of tightening to strengthen the dollar will have been the ultimate speculative attack on the dollar itself and will be the Trojan horse for a new era of sound money. The experimentation of the legacy system gradually adopting bitcoin will be the serendipitous process the world needs to ease into a Bitcoin standard.

This is a guest post by Phil Gibson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

Source link

#Jerome #Powells #Policies #Bullish #Bitcoin