Bitcoin and Ethereum Fees Jump Up As Holders Rush To Sell | Bitcoinist.com

Data shows both Bitcoin and Ethereum have noticed a spike in the exchange expenses over the recent days as holders have hurried to sell in the midst of the crash.

Bitcoin and Ethereum Transaction Fees Shoot Up

The “transaction fees” is a sum that clients causing exchanges on the organization to need to pay to send the exchanges through.

Depending on the crypto network, either some portion of the exchange charge or its sum goes to the excavators (or the validators).

When there are countless exchanges occurring on the organization and the mempool becomes obstructed, these diggers begin focusing on exchanges with the most elevated charges connected to them.

Related Reading | Market Liquidations Cross $1.22 Billion Following Bitcoin’s Decline Below $23,000

In such occasions, clients who believe that their exchanges should go through faster and not be stuck holding up begin putting a higher fee.

If network action stays raised, clients begin paying a significantly higher expenses to outcompete the others, hence prompting the organization normal shooting up.

As brought up by an examiner in a CryptoQuant post, the Bitcoin mean expenses per exchange noticed an enormous spike as the crypto’s cost plunged down.

The underneath outline shows this pattern in the indicator.

Seems to be the normal expenses on the BTC network shot up yesterday | Source: CryptoQuant

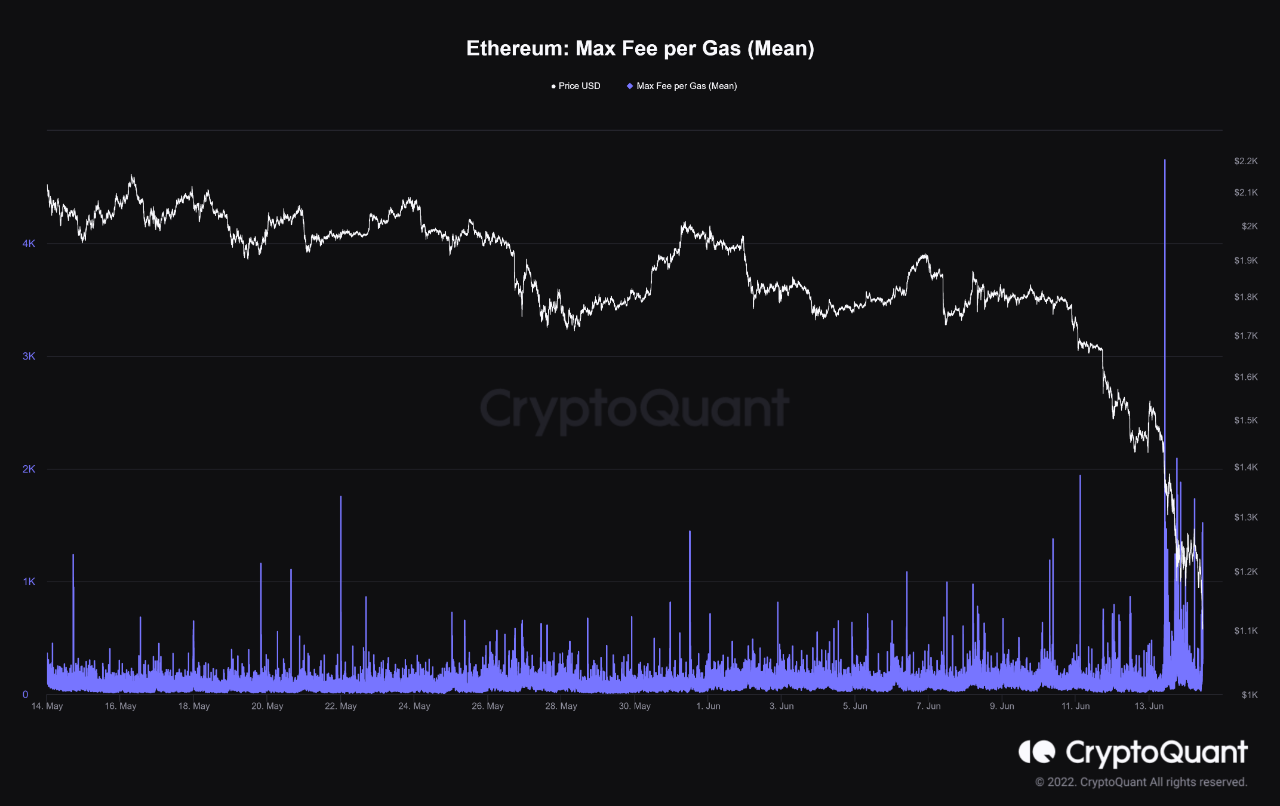

Much like BTC, the Ethereum blockchain additionally saw an enormous expansion popular throughout the last day as financial backers hurried to sell during the crash.

Here is a diagram that shows the pattern in the ETH mean max charges per gas over the beyond few weeks:

The worth of the measurement appears to have been raised over the recent days | Source: CryptoQuant

The “max fee” is the charge per gas that clients can maximally join while presenting an exchange on the Ethereum network.

Related Reading | Bitcoin Will Hit $100K In 12 Months, Ex-White House Chief Predicts, Despite Crypto Carnage

BTC and ETH Price

At the hour of composing, Bitcoin’s cost floats around $22k, down 25% over the most recent seven days. Over the course of the last month, the crypto has shed 25% in value.

The underneath diagram shows the pattern in the cost of the coin over the last five days.

BTC went to as low as underneath $21k prior to bouncing back to the ongoing degree of $22k | Source: BTCUSD on TradingView

As for Ethereum, the crypto is exchanging around $1.2k at this moment, down 32% in the previous week. Month to month misfortunes for the coin stand at 41%.

Below is the cost outline for ETH over the last five days.

ETH went down to a low of under $1.1k during the accident over the recent days | Source: ETHUSD on TradingView

Highlighted picture from Unsplash.com, outlines from TradingView.com, CryptoQuant.com

Source link

#Bitcoin #Ethereum #Fees #Jump #Holders #Rush #Sell #Bitcoinist.com