Token.com’s metaverse subsidiary acquires NFT minting platform CocoNFT

Metaverse Group goals to make use of CocoNFT’s platform to broaden within the creator economic system.

Vancouver-based startup CocoNFT, which supplies an NFT minting platform for social media posts, has been acquired by Tokens.com’s metaverse subsidiary.

Metaverse Group, a Tokens.com subsidiary, introduced on Tuesday that it acquired Coco to advance the latter’s providing and combine it with Metaverse’s digital world B2B merchandise.

NFT gross sales have dropped to a 16-month low.

Based in 2019 as a three way partnership between GDA Capital Company and Wolfest Woods, Metaverse consists of a number of companies centered on totally different areas of the metaverse trade together with actual property growth, metaverse capital markets, and different associated providers.

Metaverse, which has its world headquarters within the digital world “Crypto Valley” from “Decentraland,” additionally gives extra providers resembling help in advertising and marketing and promoting within the metaverse.

With Coco, Metaverse goals to be on the “forefront of developing and expanding Web3 and NFT use cases,” based on Tokens.com CEO Andrew Kiguel, who can also be the chief chair at Metaverse.

NFT gross sales skyrocketed in early 2021, ushered in by the climbing recognition of play-to-earn video games like Dapper Labs’ CryptoKitties, and digital collectibles resembling NBA Top Shot. This led to many in style manufacturers like Nike, Balenciaga, and even public figures such Snoop Dog shopping for into the crypto craze.

Because the sector noticed extra scams, theft, and tax laws, the worth of NFTs and exercise throughout the area have gone down considerably. Bloomberg reported in December 2022 that NFT Gross sales have dropped to a 16-month low.

The general decline within the crypto market has hit Toronto-based Tokens.com, which trades on the NEO Change and Frankfurt Inventory Change. Its inventory value is down 95 % over the past yr, buying and selling at 0.10 USD by press time. In distinction, Tokens.com’s share value was hovering round $2.75 USD in November 2021.

RELATED: Amid NFT boom, Liquid MarketPlace aims to turn physical sports and Pokémon cards into tokens

As a part of the deal, Coco’s co-founders Mark Allen and Brody Berson will be part of Metaverse as chief expertise officer and chief product officer, respectively. Coco’s third co-founder, Reid Robinson, has not publicly confirmed whether or not or not he has joined Metaverse. He has, nonetheless, introduced through Twitter that extra particulars shall be introduced “soon.”

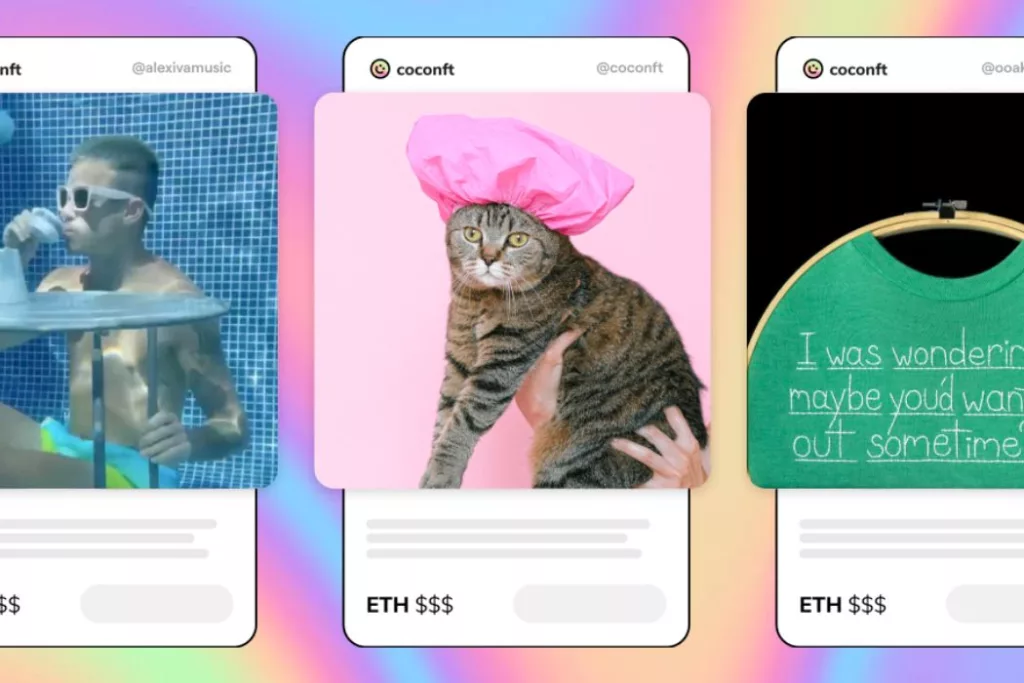

Established in 2021, Coco’s NFT generator permits customers with no Web3 information to transform Instagram posts into shoppable NFTs, with no up-front price. Coco makes cash via fee, amassing a 5 % royalty for all preliminary and future gross sales. Coco’s companion, Rarible, additionally takes a 2.5 % service price if the NFT purchaser checks out at Rarible.com. Along with Rarible, Coco additionally has a partnership with OpenSea, the biggest digital market for NFTs and different crypto collectibles.

Berson made a press release on Twitter in February 2022 that talked about Coco raised a spherical of pre-seed investments, however didn’t disclose the quantity. BetaKit has reached out for particulars.

Based on Metaverse, Coco will assist in broadening the previous’s attain throughout the creator economic system. Metaverse stated that it’s going to use Coco’s platform to interact with creators and types, and finally develop “one on one marketing strategies.” It’s going to additionally allow Metaverse to “come to market” with its personal proprietary NFT and digital world merchandise.

Source link

#Token.coms #metaverse #subsidiary #acquires #NFT #minting #platform #CocoNFT