ETF Prime: Dave Nadig Talks Credit Suisse ETNs, Banking Crisis & Crypto Regulation

Within the latest episode of ETF Prime, VettaFi’s Monetary Futurist Dave Nadig spoke with host Nate Geraci about Credit Suisse ETNs, the latest banking disaster, and crypto regulation, amongst different subjects. Plus, State Street’s Matt Bartolini mentioned first-quarter ETF flows and efficiency.

ETNs: Largely Innocent

Change traded notes (ETNs), that are unsecured debt securities, are again within the headlines with the banking disaster, since UBS Group’s takeover of Credit Suisse poses questions for what this implies for Credit Suisse’s ETNs.

Ought to buyers be involved about these Credit Suisse ETNs? In keeping with Nadig, not likely. Every thing within the unwind to UBS means that the senior debt that these ETNs symbolize “is going to be just fine.”

“The only reason I would be concerned is if you don’t want to have timing exercised against you. I think there’s very little chance that you get wiped,” Nadig mentioned, including that “it’s much more likely that UBS calls these notes and therefore you just basically get your cash handed back to you at a fair value.”

“That’s a fine outcome. You get to do that without transaction costs if you just want to wait,” he mentioned earlier than including that “if for some reason you care about when you’re going to sell those things, you might want to do that on your own time.”

As for why UBS would name these ETNs, Nadig mentioned it’s “just hair.”

“These things effectively have to be repapered as UBS debt at some point in this process. I don’t think they’re going to bother doing that,” he mentioned.

Since UBS has its personal in depth ETN division with ETRACS, Nadig mentioned that “it doesn’t seem that likely that they would want to hang on to this.”

“I suspect whoever’s in charge of doing this merger is going to see this as nothing but more hair in the derivatives book, and they’re going to want to clean that up as fast as possible,” Nadig mentioned. “So, I would be a little surprised if they tried to extend these products’ lifetimes, remarket them, [and] rebrand them.”

Nadig thinks will probably be “much more likely to see them just close down.”

He clarified, nevertheless, that he doesn’t discover something “inherently evil” in regards to the construction of ETNs. Actually, they’ve some good options. For one factor, they’ll promise any sample of return, and the financial institution is compelled to ship it. Plus, they get taxed as pay as you go ahead contracts so long as they don’t present foreign money returns.

However finally, they’re innocent.

“I don’t think there’s any point in shutting them down. Nobody’s getting hurt by these things,” Nadig mentioned. “So, I’m fine that they continue to exist. I don’t think it’s worth bothering to regulate them out of existence.”

A Banking Crisis Tailwind

The banking disaster may very well be an enormous tailwind for short-term money administration ETFs just like the JPMorgan Ultra-Short Income ETF (JPST) or the PIMCO Enhanced Short Maturity Active ETF (MINT). Roughly $20 billion has gone into short-term treasury ETFs this yr, with seven of the highest 20 ETFs measured by inflows being treasury associated.

“I definitely expect you will see continued flows into that sort of that short, middle part of the curve,” Nadig mentioned. “And what that means, obviously, is people will big those things up, which means yields will come down.”

He doesn’t assume a lot cash goes to flood the brief finish of the curve we’ll all of a sudden return to a normalized curve. “I think we have a ways to go before we get there,” he mentioned. “But there’s no question we’re going to see the short end of the Treasury curve played around with by investors managing their cash.”

The Return of Crypto?

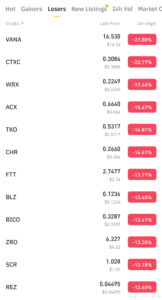

Whereas banks have been going through turmoil, cryptocurrency has been doing nicely, with Bitcoin up almost 65% year-to-date.

“What we’ve seen since this mini banking crisis is the reversion to the narrative of bitcoin being the counter-systemic asset,” Nadig mentioned. “It’s actually really good that this is happening after tis crypto winter we had.”

“I like the fact that we flushed a little bit of the hype out of the market before we had this test case of the safety scenario for bitcoin,” he added.

Whereas there’s this crackdown on cryptocurrency coming from U.S. regulators (“which I am absolutely not a fan of,” Nadig identified), bitcoin appears “have some sort of regulatory halo,” that’s defending the foreign money from scrutiny.

“Nobody seems to be coming after bitcoin directly the way they’re going after Binance and FTX,” Nadig mentioned, including that that is “shaking some folks both out of the fringes of crypto and back into bitcoin as well.”

Relating to the latest SEC crackdown on cryptocurrency, whereas Nadig has “been a fan of early and proactive regulation,” he mentioned that “we as a country are doing precisely the wrong thing.”

Whereas coming in a lot sooner “would have been the key to making the U.S. the center of innovation in this space,” Nadig mentioned: “I think that ship has sailed.”

In keeping with Nadig, in case you take a look at there the brand new and attention-grabbing crypto initiatives are popping up, they’re not within the U.S. Actually, the U.S. is now on an inventory of nations that features Iran, Syria, and North Korea that may’t take part in new crypto initiatives.

“That’s terrible,” Nadig mentioned.

Take heed to the whole episode of ETF Prime That includes Dave Nadig:

For extra ETF Prime podcast episodes, go to our ETF Prime Channel.

Source link

#ETF #Prime #Dave #Nadig #Talks #Credit #Suisse #ETNs #Banking #Crisis #Crypto #Regulation