Bitcoin Chain Data Says No Sign Of FUD Among Binance Users

Regardless of CFTC suing Binance, Bitcoin on-chain information has to this point proven no indicators of FUD growing amongst merchants on the cryptocurrency change.

Bitcoin On-Chain Metrics Associated To Binance Are So Far All Normal

Yesterday, information got here out that the US Commodity Futures Buying and selling Fee (CFTC) has filed a lawsuit in opposition to Binance and its CEO, Changpeng Zhao, for violating derivatives buying and selling guidelines within the US. Following the announcement, the market reacted with the value of Bitcoin, which went under the $27,000 degree.

Users on the change itself, nonetheless, appear to be calm to this point. As an analyst in a CryptoQuant post defined, FUD across the change is at present not seen in BTC on-chain information.

The primary related indicator right here is the change netflow, which measures the web quantity of Bitcoin getting into into or exiting the wallets of the change. The under chart exhibits the current information for this metric.

The worth of the metric appears to have been barely unfavorable in current days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin Binance netflow has had a unfavorable worth not too long ago, which means that buyers have withdrawn a web variety of cash from the platform.

Normally, when exchanges have bother surrounding them, buyers develop FUD, and lots of withdrawals are seen from the change. Nonetheless, whereas some withdrawals have been seen, their magnitude remains to be comparatively low.

From the chart, it’s obvious that greater spikes had been seen earlier this month alone. This implies that customers haven’t gone right into a state of panic but as they really feel secure sufficient to maintain their cash within the custody of Binance.

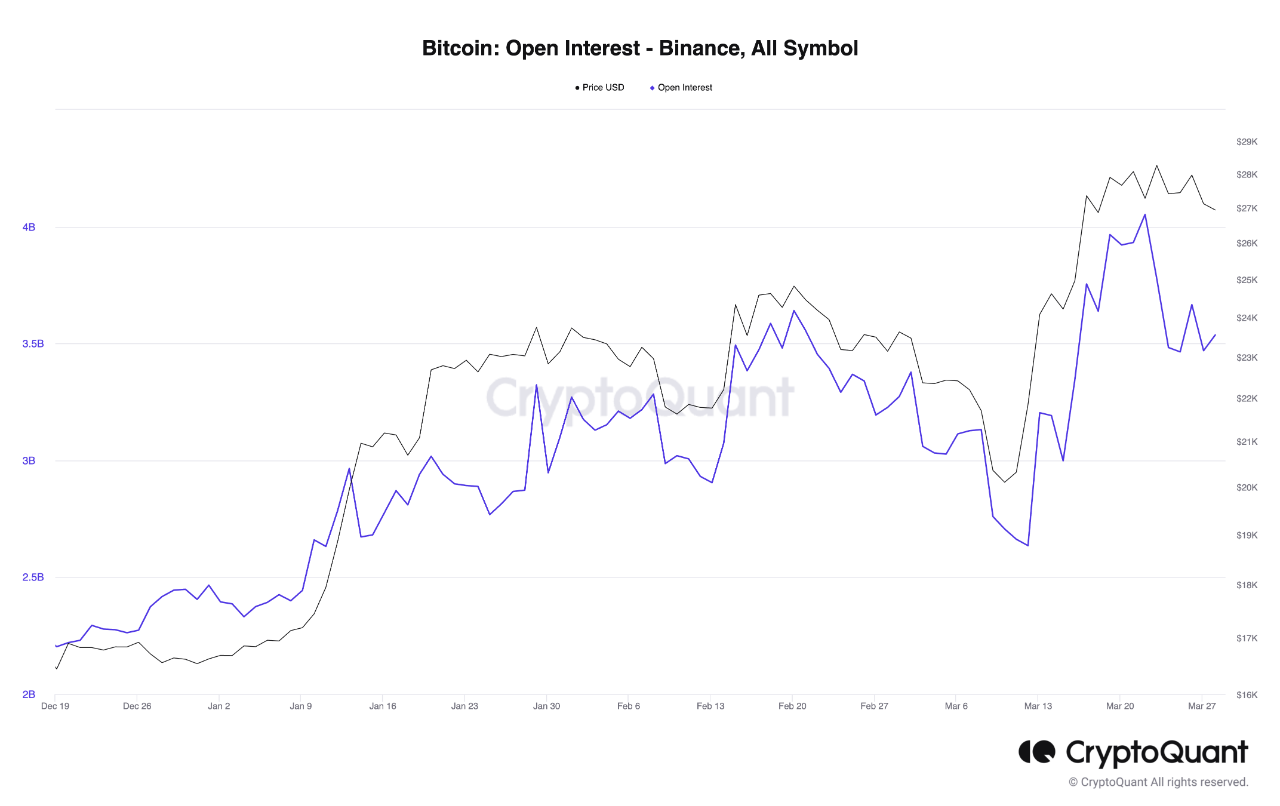

Subsequent is the metric associated to the spinoff market, the open curiosity, which measures the full quantity of Bitcoin futures buying and selling contracts which can be open on Binance.

Seems like the worth of the metric has been comparatively excessive not too long ago | Supply: CryptoQuant

As is seen within the graph, the Bitcoin open curiosity on Binance has climbed too excessive values with the current worth surge. The metric’s worth has registered no important change following the CFTC information, suggesting that the spinoff merchants have additionally not closed a lot of contracts and, thus, haven’t proven any indicators of FUD.

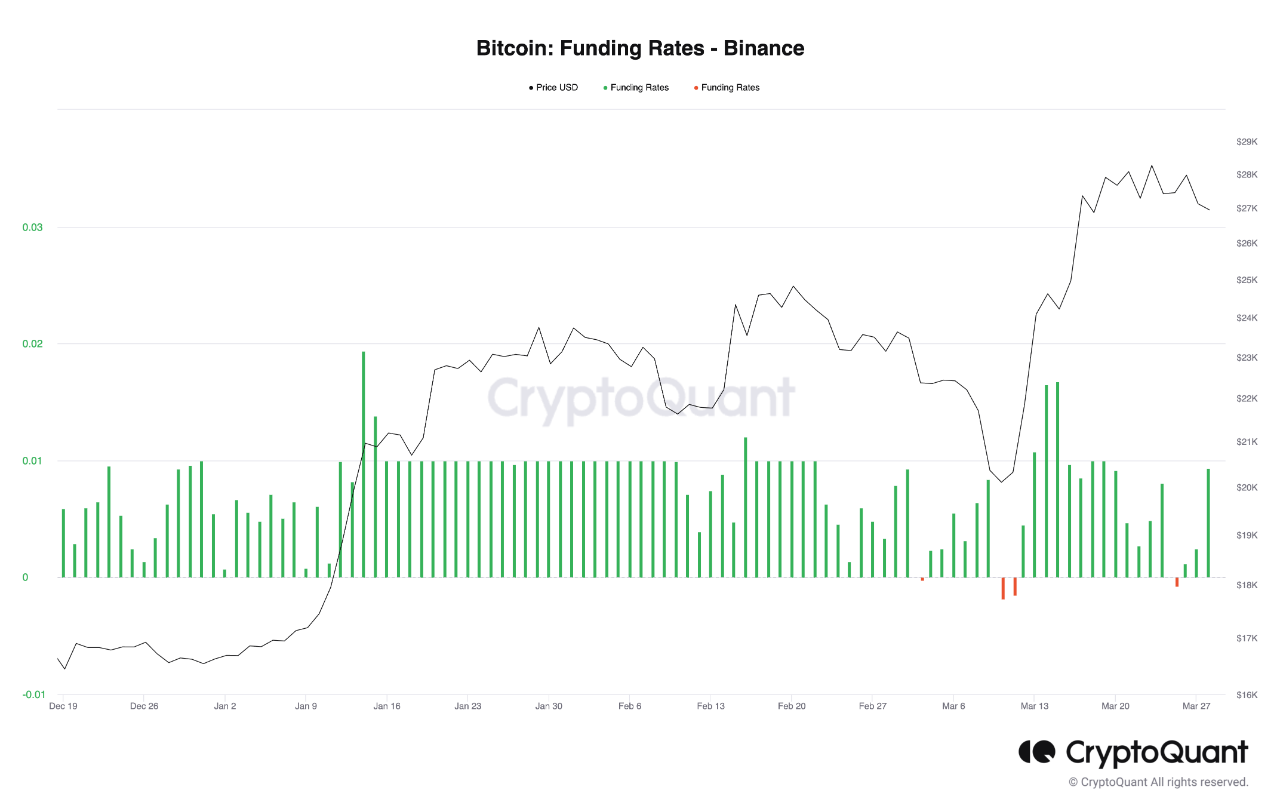

The funding charge, a measure of the periodic payment that futures contract merchants are exchanging with one another, has additionally remained optimistic, displaying that buyers on the platform proceed to be bullish about BTC.

The metric has a inexperienced worth in the meanwhile | Supply: CryptoQuant

All these indicators present that merchants on the platform, whether or not spot or spinoff ones, haven’t proven any noticeable response to CFTC suing the change. That’s, in fact, not less than the story to this point; it’s at present unclear whether or not issues may change within the coming days.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,800, down 4% within the final week.

BTC has declined under $27,000 | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Source link

#Bitcoin #Chain #Data #Sign #FUD #Among #Binance #Users