Bitcoin Liquidity Is Drying Up as Crypto ‘Tourists’ Recoil From Industry Disorder

(Bloomberg) — By nearly any measure, Bitcoin liquidity stays low, regardless of the cryptocurrency’s eye-catching upsurge this yr.

Most Learn from Bloomberg

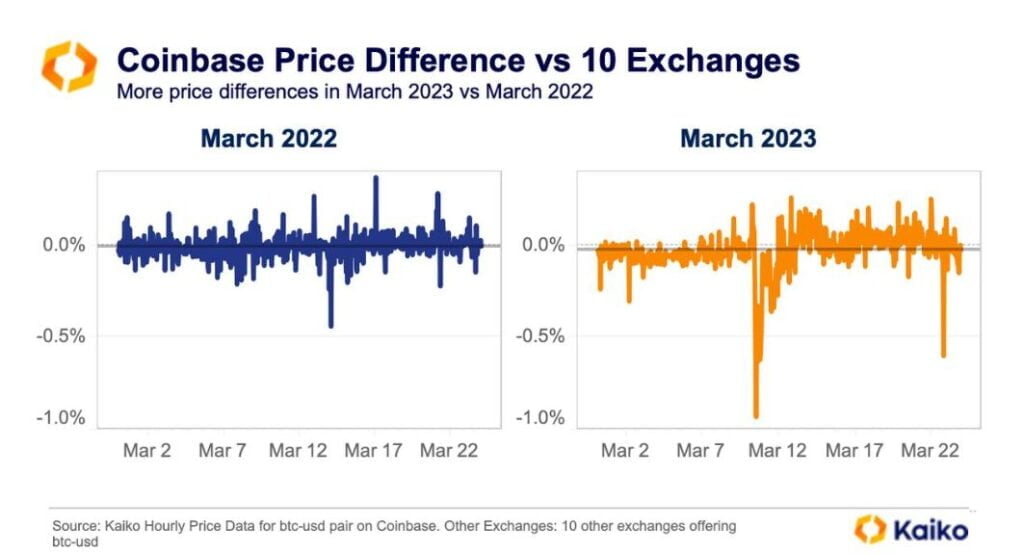

Buyers have been paying extra on trades due to slippage, or the distinction between the anticipated value of a transaction and the worth at which it’s absolutely executed, an indication of worsening liquidity, based on Conor Ryder at Kaiko. The upper the issue in buying and selling, the extra buyers are uncovered to potential unstable value swings.

This could occur attributable to a change within the bid-ask unfold in between the time a commerce is positioned and stuffed, or when there’s inadequate order-book depth to help massive orders.

Whilst a rebound in Bitcoin this yr made it the best-performing asset within the first quarter, a widening US regulatory crackdown and the collapse of some crypto-adjacent banks has tempered some buyers’ enthusiasm.

“It’s more indicative of the institutional reluctancy to offer liquidity in the space,” Ryder, a analysis analyst on the Paris-based agency, mentioned. Quite a lot of crypto companies don’t wish to get caught in the course of a battle between US regulators and exchanges.”

Although costs have recovered initially of 2023, buying and selling volumes and liquidity within the crypto market have dried up when measured over the previous yr amid an general plunge in costs, which has seen Bitcoin drop about 38% — to round $28,000 — and another cash much more. Buyers retreated over that interval as a string of scandals scared them away. Analysts at the moment are significantly tuned into how smaller retail buyers could behave as they’ve been an integral a part of the system, serving to to drive up costs through the early pandemic increase.

Story continues

“The tourists are definitely gone,” mentioned Mark Connors, head of analysis at digital asset administration agency 3iQ. “If you’re in this, you have to understand that the volatility is there, you don’t know where it goes day-to-day, but you understand the trajectory, the adoption, etc.”

Spot volumes on a number of the hottest crypto exchanges additionally assist to inform this story. Binance, the most important buying and selling platform, on the finish of March noticed normalized 24-hour buying and selling volumes of greater than $6 billion, with month-to-month visits of about 65 million. By comparability, Coinbase, the second-biggest, noticed buying and selling volumes of about $1.3 billion, with roughly 33 million month-to-month visits, based on CoinGecko information and numbers compiled by the corporate.

‘Volatile Market’

Bitcoin buying and selling volumes have collapsed, “which inevitably makes for a more volatile market,” mentioned Fiona Cincotta, senior monetary markets analyst at Metropolis Index. “The sharp drop in volumes means that it’s easier for large orders to move the BTC prices. So sit tight, there could be more wild swings coming.”

She added: “Falling volumes points to waning appetite for Bitcoin at its recent higher levels amid easing concerns surrounding the banking sector and as crypto regulation is under the spotlight.”

Learn extra: Crypto’s Most Highly effective Man Has Extra Than ‘FUD’ to Fear Him Now

In latest days, information emerged that the US Commodity Futures Buying and selling Fee sued founder Changpeng Zhao and his Binance cryptocurrency change for alleged violations of derivatives rules. Binance has mentioned it didn’t agree with the characterization of lots of the points alleged within the criticism.

“It remains to be seen how the case will impact Binance’s operations,” mentioned Strahinja Savic, head of information and analytics at FRNT Monetary. “In this context, the liquidity status quo in the crypto space has not been affected by the charges.”

Bitcoin slipped as a lot as 1.7% on Monday and was buying and selling at about $27,700 as of 1 p.m. in Singapore. Smaller tokens akin to Ether, Solana and Avalanche had been additionally on the again foot. That was a part of a wider retreat in riskier investments sparked by a leap in oil costs that would stoke inflationary pressures and the necessity for greater rates of interest.

(Updates with market costs within the remaining paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.

Source link

#Bitcoin #Liquidity #Drying #Crypto #Tourists #Recoil #Industry #Disorder