Cryptocurrency Trading Volumes Skyrocket to Record $17.5 Billion High

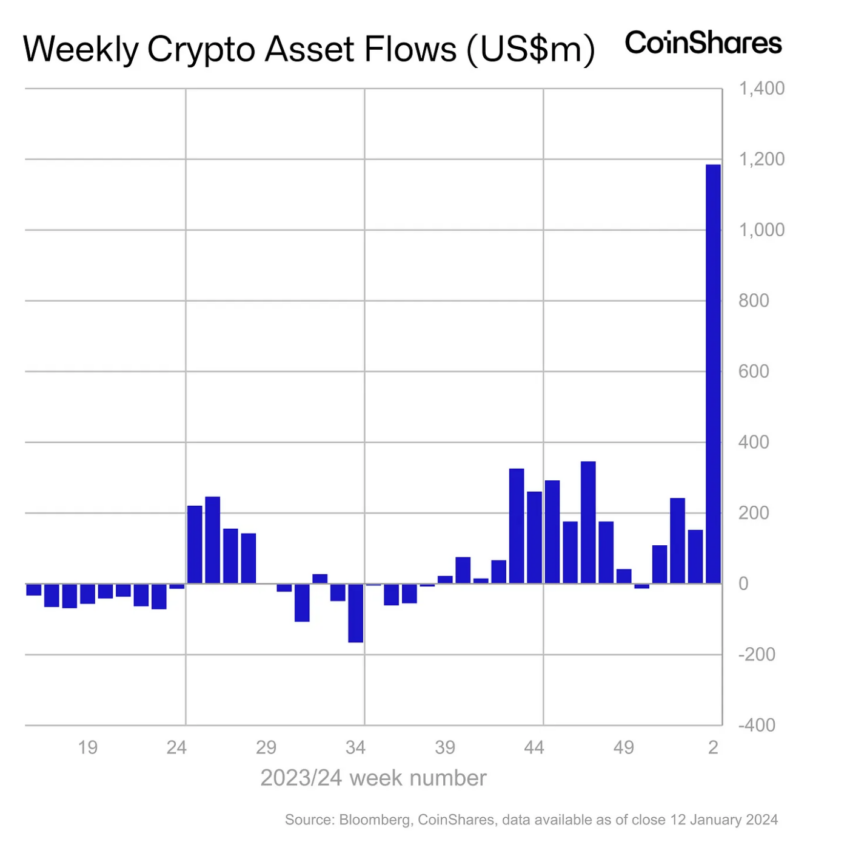

In the cryptocurrency market, the previous week was pivotal as trading volumes for exchange-traded products (ETPs) soared to a new high, hitting an all-time peak of $17.5 billion. Concurrently, fund inflows into these ETPs have reached their highest point since October 2021.

Compared to the 2022 weekly average of $2 billion, this number represents a significant increase and highlights the mounting interest and trust that investors have in the cryptocurrency sphere.

Record-Breaking Crypto Trading Volumes

CoinShares reports that last week digital asset investment products saw an inflow of $1.18 billion. However, this impressive figure did not surpass the $1.5 billion inflow record set during the October 2021 launch of futures-based Bitcoin ETFs.

The dramatic rise in cryptocurrency flows is largely attributed to the US Security and Exchange Commission’s (SEC) green light for spot Bitcoin exchange-traded funds (ETFs). Market experts, such as Mati Greenspan of Quantum Economics, foresee the Bitcoin ETF’s approval as a catalyst for substantial institutional involvement.

“Spot Bitcoin ETFs are expected to simplify institutional involvement, enabling the addition of Bitcoin into their portfolios in adherence to regulatory requirements and various fund structures,” Greenspan commented to BeInCrypto.

Read more: Navigating the Advent of a Bitcoin ETF: A Step-by-Step Guide

The United States led the way with $1.24 billion in inflows, whereas Switzerland contributed $21 million. In contrast, certain regions in Europe and Canada saw minor outflows; specifically, outflows totaled $44 million in Canada, $27 million in Germany, and $16 million in Sweden.

Bitcoin, the premier cryptocurrency, garnered inflows of $1.16 billion last week, amounting to 3% of its total assets under management (AuM). Additionally, products betting against Bitcoin also experienced inflows, albeit small, totaling $4.1 million.

Read more: Expert Guide on How to Short Bitcoin

Inflows into other cryptocurrencies were also observed. Ethereum drew $26 million, XRP attracted $2.2 million, and Solana noted an influx of $0.5 million. This broadening interest in a variety of digital assets hints at a more mature market scenario with investors diversifying their portfolios.

Additionally, blockchain-related stocks have not gone unnoticed, pulling in $98 million in the last week alone. This marks a commendable $608 million cumulative inflow over the preceding seven weeks.

Disclaimer

BeInCrypto adheres to Trust Project principles, ensuring an unbiased and transparent journalistic approach. This article is intended for informational purposes and should be considered accurate as of its publishing time; however, readers should conduct their own validation and seek professional advice before making investment decisions. Note that updates to our Terms and Conditions, Privacy Policy, and Disclaimers are applicable.

Source link

#Crypto #Trading #Volumes #Soar #Billion #AllTime #High