Binance Introduces New Cryptocurrency Exchange in Thailand

A collaboration between Binance Thailand and Gulf Innova resulted in the formation of Gulf Binance, a cryptocurrency trading platform now operational in Thailand.

The partnership is intended to offer a trustable venue for trading digital currencies with Thai currency pairings. The Thai Ministry of Finance sanctioned Gulf Binance in May 2023, a vital development in the advancement of cryptocurrency use in that territory.

The issue of inconsistent regulatory frameworks persists as a challenge in the crypto sphere, influencing the global cryptocurrency landscape. Different countries have taken varied regulatory approaches towards cryptocurrencies, leading to ambiguity for businesses and investors alike.

In 2022, Thailand enforced a prohibition on cyptocurrencies such as Bitcoin as payment methods for goods and services. The regulation restricts digital asset business operators from promoting or facilitating cryptocurrency transactions to buy goods and services.

Despite attempts to refine regulatory efforts post the 2022 cryptocurrency downturn, regulatory transparency is still lacking, especially concerning stablecoins and custody services. The U.S. Securities and Exchange Commission’s proactive approach to cryptocurrency enforcement adds complexity to the situation, instigating lawsuits against notable platforms such as Binance and Coinbase. The ongoing dispute over regulatory jurisdiction among U.S. agencies is stymieing the sector’s expansion, sparking debate over the necessity for a more streamlined U.S. regulatory system.

Regions including the EU, Singapore, Japan, and the UAE are gradually advancing in their regulatory frameworks for cryptocurrencies, whereas the U.S. is comparatively behind, prompting firms like Coinbase to mull relocation or international market expansion.

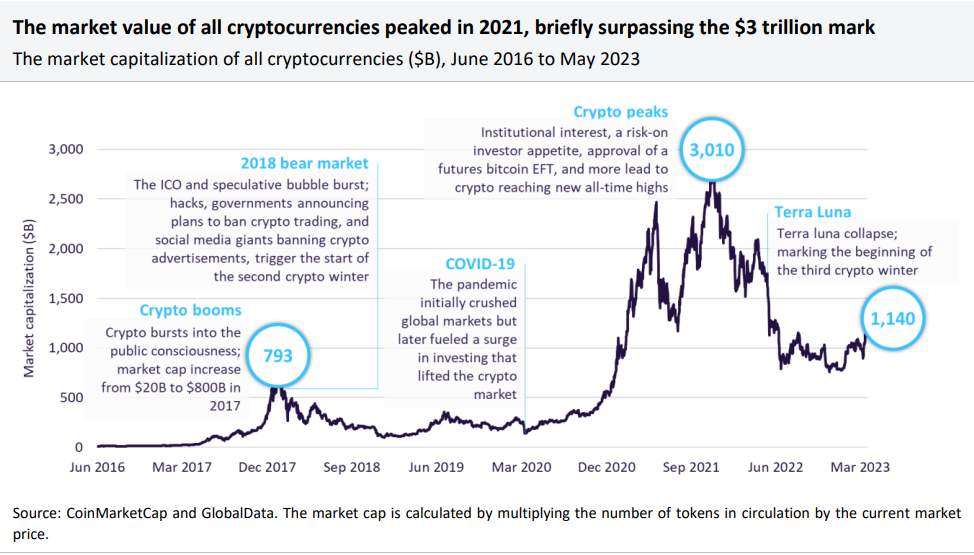

GlobalData’s Thematic Intelligence: Cryptocurrencies (2023) report reveals that the total valuation of all cryptocurrencies spiked to a historic $3trn in November 2021, but descended to $2.2trn at the year’s end, driven by apprehensions over increasing interest rates.

Unlock detailed Company Profiles with GlobalData. Streamline your research and gain a competitive edge.

Free sample Company Profile

Thank you!

Your download email will arrive shortly.

To aid your decision-making process, we offer a complimentary sample of our Company Profiles, which can be obtained by submitting the form below.

By GlobalData

The turbulent market backdrop of 2022, with pivotal incidents like Terra’s downfall and the FTX collapse, led to a 64% drop in the crypto market to under $800bn. However, it revived to $1.1trn as of May 16, 2023, showcasing resilience and the potential for growth within the cryptocurrency sector.

Our signals coverage is enhanced by GlobalData’s Thematic Engine, capable of tagging myriad data points across multiple datasets — including patents, jobs, deals, company filings, social media mentions, and news — correlating them to themes, sectors, and companies. These signals bolster our prognostic capabilities, enabling us to pinpoint the most disruptive challenges in each sector and identify the companies best equipped to succeed.

Source link

#Signal #Binance #launches #Thai #cryptocurrency #exchange