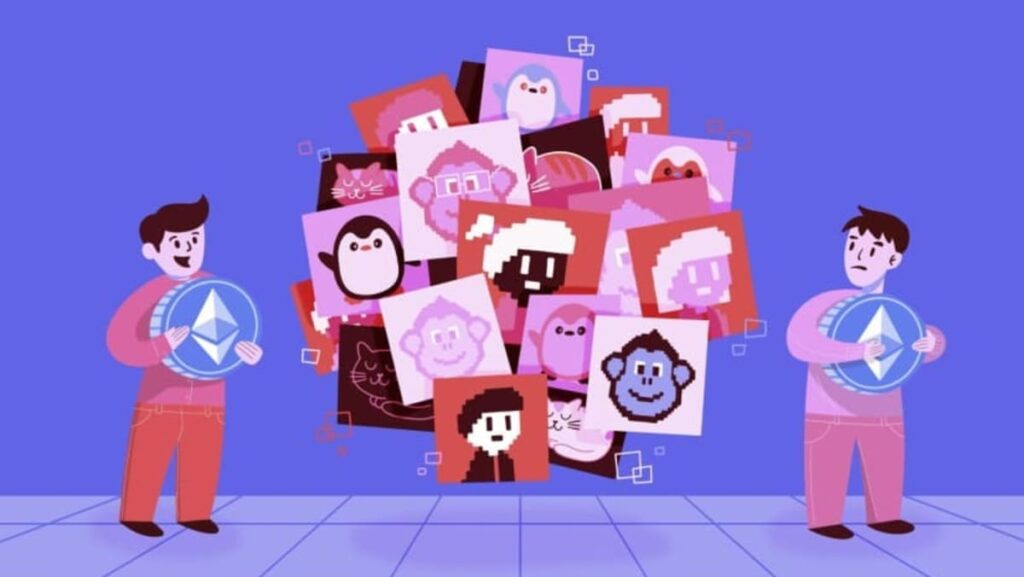

Reviving NFTs: Can they make a comeback after the hype and crash?

According to an industry report by independent cryptocurrency data aggregator CoinGecko, trading volume for NFTs plunged to US$11.8 billion in 2023, down from US$26.3 billion the year before.

A report by crypto news site dappGambl in September last year found that of 73,257 NFT collections it analysed, 69,795 of them have a market cap of 0 Ether (ETH) – referring to the cryptocurrency commonly used to transact such tokens.

This downturn led to comparisons to the Dutch “tulip mania” of the 1630s, with media reports suggesting an allusion to that historical financial bubble.

Celebrities such as Justin Bieber, Madonna, Paris Hilton, and Jimmy Fallon who were seen as promoters fueling the NFT craze were named in a class action suit by investors who claimed they were misled into buying the collectibles by the celebrities when prices of NFTs crashed.

The factors behind the fall in prices of NFTs were aplenty, from the crash of cryptocurrencies, which are used to buy these digital tokens, to the cooling down of the initial euphoria, as business experts and industry players told TODAY.

Yet, there is potential for a resurgence in NFTs, as media reports have highlighted the experimentation of major companies and brands with NFTs as digital collectibles.

Interviews with those familiar or involved with NFTs by TODAY reflected a sense of measured confidence in these tokens’ future.

While prices might not reach the lofty heights seen in 2021 or 2022, these tokens could still see an appreciation in value, especially among the projects that have managed to survive the bear market and are backed by teams with active plans on providing value to token holders.

Beyond trading, the technology underpinning NFTs can have widespread use, not least in the digital art space, according to industry players.

VALUE DOWN, BUT HOPES UP FOR SOME TRADERS

Mr Bobby Lim, who has been investing in cryptocurrencies since about 2018, said he was exposed to investing in NFTs in early 2020 at the suggestion of his friend.

Despite some early success, he has seen substantial losses in his NFT collection. For 30-year-old Gautham Rajadanran, he began trading NFTs in November 2021 and has just “broken even” on his investments.

While little data on NFT trading activities among Singaporeans is available, those involved in the market generally observed that a noticeable number of people in their network had left since the end of the bull run, after suffering losses from the crypto and NFT downturn.

Mr Clement Chia, co-founder of Imaginary Ones company and NFT project, said there was a silver lining to the crash. “A lot of bad projects actually got flushed out of the system. People that were here just to cash grab, they’re out of the system,” he said.

Source link

#Big #Read #hype #crash #NFTs #lease #life