Is It Possible for Them to Propel Bitcoin’s Value to a New All-Time High in the Near Future?

“`html

The value of Bitcoin has witnessed an impressive rally over recent months, skyrocketing from below $20,000 to beyond $50,000 since June 2023.

This meteoric rise was largely fueled by the growing expectation and eventual green lighting of a series of spot Bitcoin ETFs within the United States. However, with the retail investors seemingly on the sidelines, it raises intriguing possibilities about the potential impact of their entry into the market in the imminent future.

The Journey to the Current Bitcoin Landscape

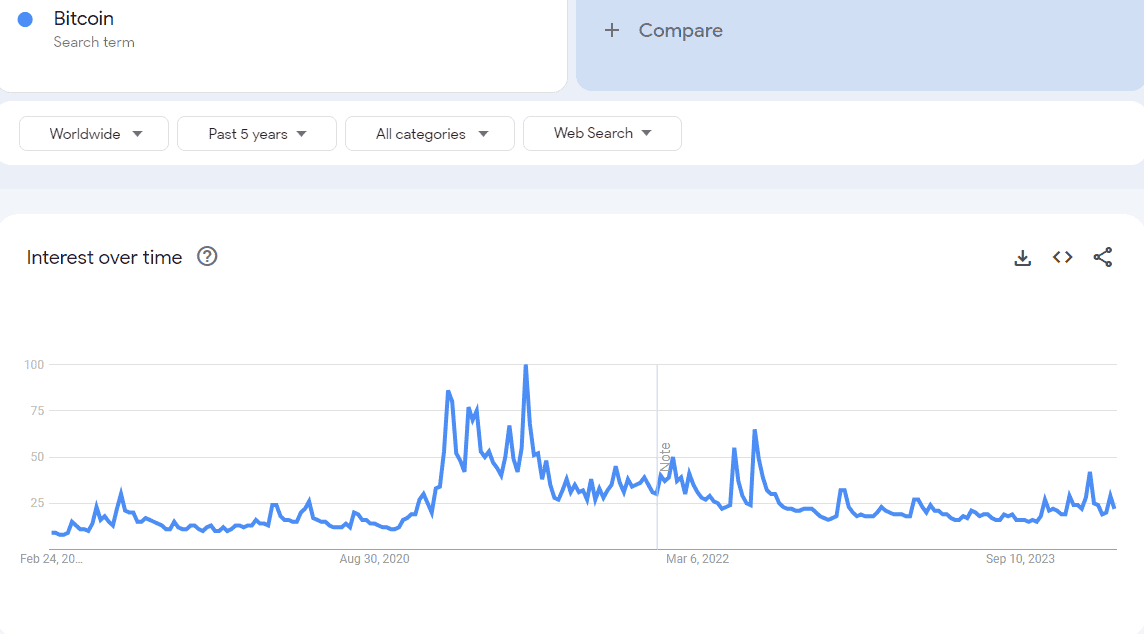

Insights from Google Trends illustrate typical retail investor behavior, as they often intensify their search for trending investment opportunities, leading to what’s known as the FOMO (fear of missing out) phenomenon.

The crypto markets are especially prone to such abrupt sentiment shifts, with prices often surging as a result of a spike in demand from such investors, followed by inevitable price corrections when the frenzy dies down.

We witnessed this cycle previously during the euphoric phase of 2021, with Bitcoin’s value soaring and the retail masses fully engaged, driven by visions of Bitcoin reaching $100,000. However, these dreams remained unfulfilled as Bitcoin’s price plummeted, taking the crowd of retail investors with it.

June 2023 marked a significant recovery for Bitcoin as BlackRock submitted an application to introduce their spot BTC ETF. With the corporation’s famous track record with ETFs, institutional attention towards Bitcoin intensified. The narrative surrounding the SEC’s stance shifted from skepticism to an imminent approval expectation.

This shift in outlook led to renewed excitement that triggered another surge in Bitcoin’s price, catapulting it from under $20,000 in June to over $40,000 by early January. The approval of 11 spot BTC ETFs followed, which briefly triggered a ‘sell the news’ dip. However, the cryptocurrency rebounded and shattered the $50,000 ceiling for the first time in over two years based on genuine demand for these investment products.

Yet, it appears something is still amiss.

The Unseen Retail Crowd

While heavyweight investors and institutions have been actively acquiring Bitcoin, reports indicate that smaller scale holders have been offloading their BTC. Concurrently, Google Trends data points to a relatively subdued level of global interest in Bitcoin when compared to the peaks of 2017 and 2021, or even the tumultuous events of 2022.

Despite a slight search interest spike coinciding with the ETF approvals in January, the figures have scarcely outperformed those during the bearish market of 2019 or the 2020 pandemic-driven downturn.

These observations suggest that the retail investors are lagging behind, despite Bitcoin’s price more than doubling since the previous June. Yet, the next Bitcoin halving event might turn the tables, as price trends post-halving have historically been encouraging.

Therefore, it remains to be seen whether the retail sector will spearhead another staggering price surge, possibly leading Bitcoin towards unprecedented heights in the coming months.

“`

Source link

#Push #Bitcoins #Price #ATH