Utilizing the Williams Alligator Indicator for Trading ATOM/USDT on Binance: Insights by Skyrex on TradingView

“`html

Understanding the Alligator Indicator

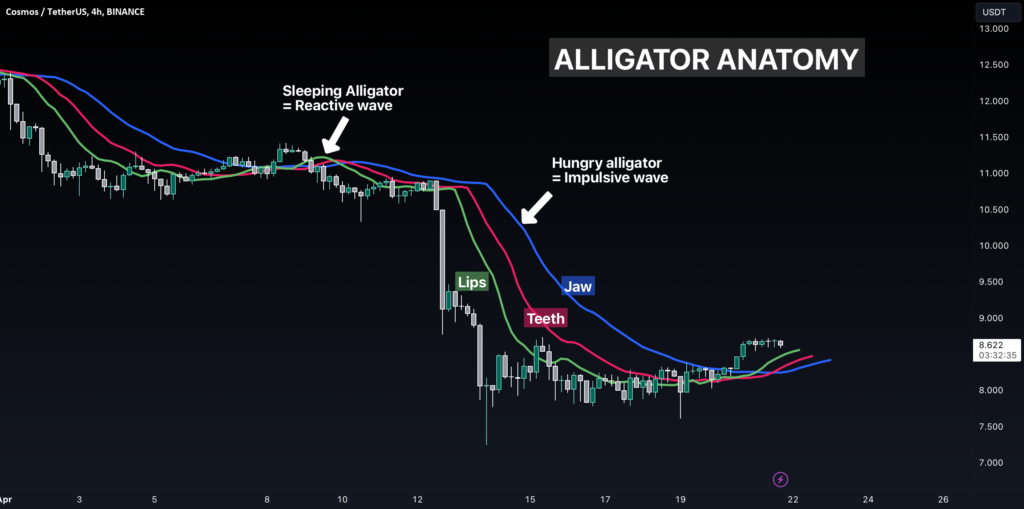

The Alligator indicator excels in pinpointing market trends. It incorporates three distinct moving averages known as the jaw, teeth, and lips. These moving averages, commonly utilized in algorithmic trading bots, can adopt various forms such as exponential, smoothed, or weighted, based on the specific trading algorithm. For our discussion, we will focus on smoothed moving averages (SMA).

- Jaw (blue line) – Represented by a 13-period SMA shifted forward by 8 bars, it serves as the balance line for the chosen time frame, such as 1D.

- Teeth (red line) – An 8-period SMA projected 5 bars into the future, representing the balance line for a shorter time frame, like 4h.

- Lips (green line) – This 5-period SMA, shifted 3 bars into the future, acts as the balance line for a time frame twice as short, such as 1h.

Please exercise caution when configuring the Alligator on various cryptocurrency trading platforms. Verify the proper settings and moving average types. Rest assured, the settings on TradingView are accurate.

Trend Detection Using the Alligator

The primary strength of the Alligator is identifying trends and markets primed for a breakout. This tool, when used adeptly, can amplify your crypto trading results. By examining the ATOM price chart, for instance, one can discern two Alligator states: sleeping and hungry.

When the Alligator is ‘sleeping,’ the moving averages intertwine, and consolidation occurs—this typically encompasses about 80% of the market’s cycles. It’s a stage to be wary of trading and anticipate trend emergence.

A ‘hungry’ Alligator emerges after prolonged consolidation, signaling a trend direction with an impulsive rally. The Alligator’s jaw widens, no longer intersecting with the price. Such trending markets offer lucrative profit-making opportunities, unlike range-bound markets with limited potential. Additionally, integrating Elliott wave analysis allows traders to capitalize on impulsive movements and avoid corrections without needing extensive wave pattern understanding.

How to Engage in Crypto Trading with the Alligator

Embarking on trading with the Alligator starts with observing price formations. The basic strategy involves waiting for the price to form the first fractal above the Alligator’s mouth and placing a conditional order slightly above the fractal’s peak. In-depth discussions on fractals will follow. Initially, it’s essential to grasp the Alligator’s application.

A tip from seasoned traders is to engage with fractals when the Alligator has been dormant for an extended period – as exemplified in the BTC chart where, following a protracted hibernation and subsequent fractal breakout, Bitcoin embarked on a historic bull run.

Bearing in mind the optimal time to exit a trade is crucial. Capitalizing on a bull run using a 1W time frame allows for retention of assets throughout and selling just before a bearish downturn.

Conclusion

We’ve explored ways the Alligator indicator can be seamlessly integrated into your trading practices, assisting in steering clear of lackluster markets prone to losses and seizing significant market movements. Furthermore, it even caters to identifying range-bound markets, beneficial for bots that profit in such conditions. However, this is only one of the myriad strategies where the Alligator can prove its worth. In subsequent discussions, we’ll delve deeper into complementary tools that further enhance profitability when used with the Alligator. Plus, we’re excited to offer a live stream soon where we’ll showcase practical trading using the Alligator. Stay tuned for more!

Best regards,

Skyrex Team

“`

Source link

#Williams #Alligator #Indicator #crypto #trading #BINANCEATOMUSDT #Skyrex #TradingView