Bitcoin ETFs have been achieving consistent success for nine days straight

3h30 ▪

4

min of reading ▪ by

Great news for the crypto world! The SEC has given the green light to Ethereum spot ETFs. Four and a half months after Bitcoin ETFs, cryptos are seeing their popularity skyrocket. With these new trackers, Ethereum will gain even more visibility and value. It remains to be seen whether Bitcoin will keep pace or stumble on the track.

Bitcoin: Spot ETFs on the Rise!

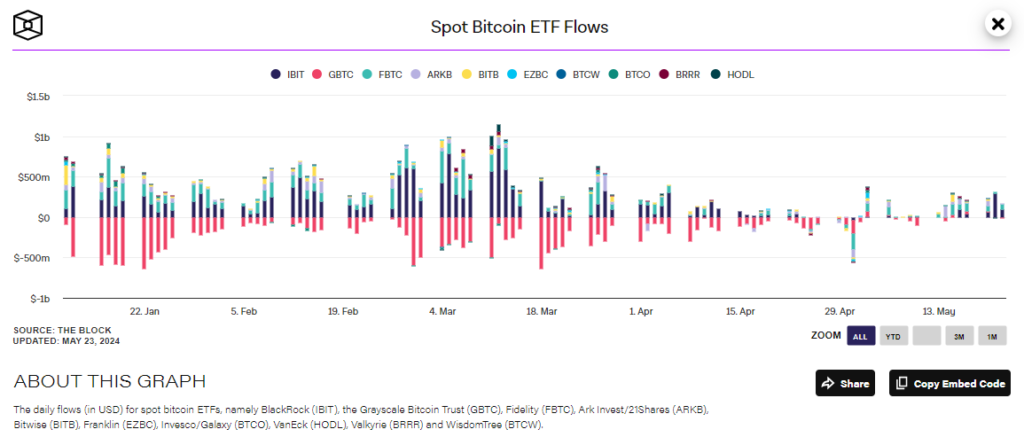

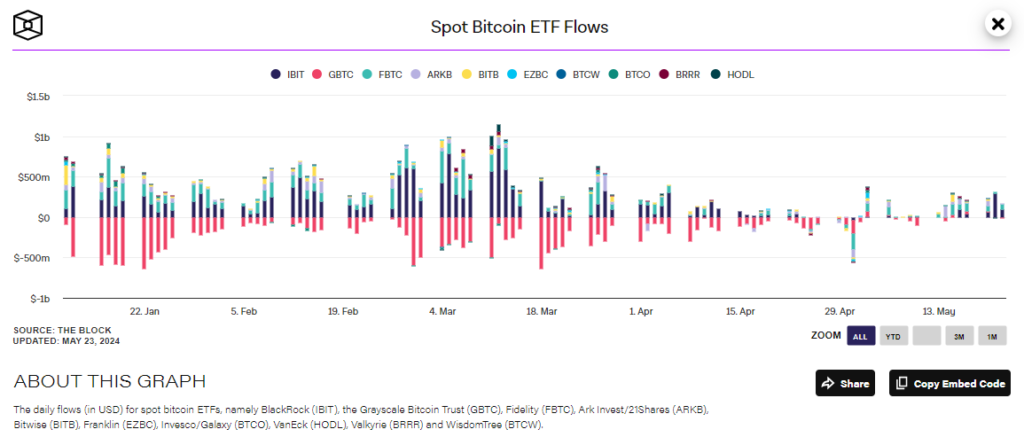

The excitement around spot-traded Bitcoin funds in the United States has not escaped our watchful eye for some time now. Indeed, spot ETFs recorded their ninth consecutive day of net inflows, attracting a whopping $107.91 million just on Thursday, according to The Block. A series of positive flows unprecedented since mid-March, a blessed time when they had ten straight days of financial inflows.

Inflow and Outflow for Bitcoin Spot ETFs – Source: The Block

Leading the pack, BlackRock’s IBIT took the lead with $89 million, followed by Fidelity’s FBTC which attracted $19 million. VanEck, meanwhile, accrued $10 million, according to SoSoValue. The smaller players in the lot, Ark Invest with 21Shares, and Invesco with Galaxy Digital, were not left behind with $2 million each.

However, Grayscale was downbeat with its converted GBTC, recording a net outflow of $14 million. Meanwhile, funds from Bitwise, Valkyrie, Franklin Templeton, WisdomTree, and Hashdex remained stoic, with no inflows or outflows.

Since January, the 11 Bitcoin ETFs have accrued over $13.43 billion. However, overall flows remain well below the peaks reached in March, The Block reminds us.

The ETF Dance: Bitcoin and Ether on the Track

Bitcoin is on a roller coaster ride! Although its price dropped by 2.61% in the last 24 hours, reaching $67,642, analysts remain confident. The US SEC has sparked a flame by approving the 19b-4 forms for eight Ethereum spot ETFs, notably from BlackRock, Fidelity, Grayscale, and company. But the merry folks will still have to wait for the approval of S-1 registration statements before they can start trading.

Despite this dip in Bitcoin, some crypto gurus, like BitQuant, predict a meteoric rise. According to him, Bitcoin could reach $80,000 in May and peak at $95,000 the following month. This “world peak” could, according to his predictions, be reached by the third quarter, followed by an equally spectacular fall.

“Yes, $95,000 will extend into June, but the sharp drop from this local peak will also occur in June, so the overall timetable for this local peak has not changed,” he states without flinching.

So, the temporarily lower price of Bitcoin does not overly worry the optimists. The SEC’s approval of Ethereum ETFs is seen as a strong signal, likely to reinvigorate the crypto market.

One thing is certain, the ETF dance is just beginning, and spectators are ready to battle it out on the trading and investment floor for 2024.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Source link

#Spot #Bitcoin #ETFs #recording #uninterrupted #success #days