Trading Behemoth Snaps Up $20 Million in Two Digital Currencies Amid Market Slide

As the workweek concluded on Friday, June 14, a significant downturn hit the cryptocurrency sector, sending the price of alternative coins to new lows not seen for several months. Concurrently, a certain company took a bullish stance amidst the price drop, injecting close to $20 million into two specific digital currencies.

Announcing significant market participation, Amber Group, a cryptocurrency trading enterprise, revealed that since 2017, it has processed over $1 trillion in transaction volume. The firm managed approximately $5 billion in digital assets (AUM) for 2022 and was valued at $3 billion during its most recent fundraising round, as highlighted in a Blockworks report.

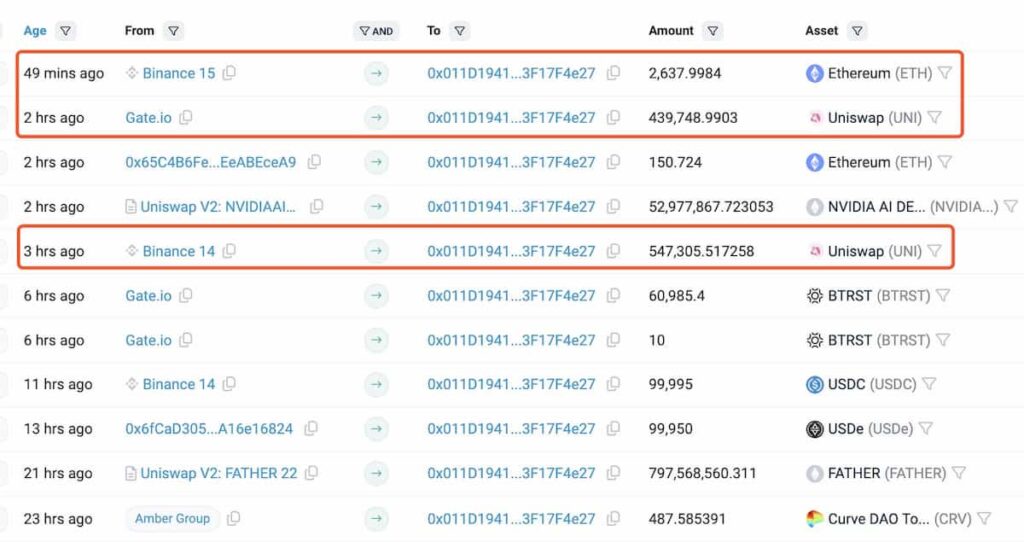

Monitoring firm Lookonchain noted and communicated that addresses associated with Amber Group were seen actively purchasing during the recent price fall. Of particular note, the wallet in question extracted almost $20 million worth of Ethereum (ETH) and Uniswap (UNI) from various currency exchanges, indicative of initiating significant trade positions.

Amber Group Exploits Market Decline, Bets Heavily on Ethereum and Uniswap

Significantly, the Amber Group-affiliated address ‘0x011d19410fc79f140c08ffa8301e4153f17f4e27‘ transferred a total of 2,638 ETH from Binance, valued at $9.2 million, as reported by Lookonchain.

The Uniswap tokens were acquired in two separate transactions, including 547,305 UNI from Binance and another 439,749 UNI from Gate.io, reaching an aggregate of 987,054 UNI, which equated to about $10.6 million at the time of transfer.

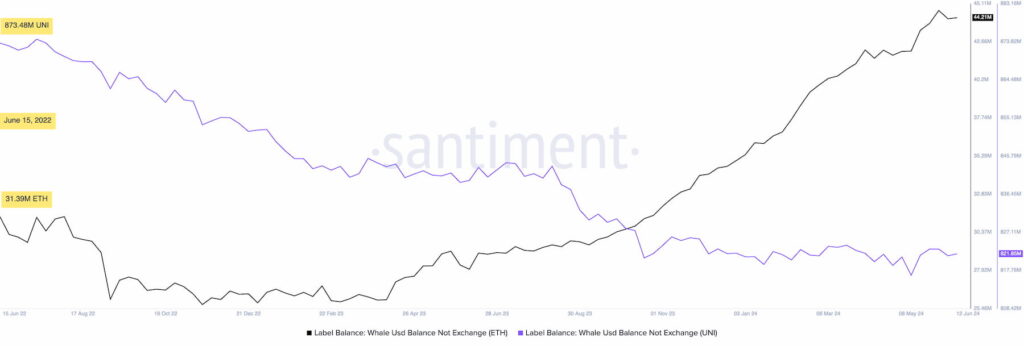

Data gathered from Santiment, as analyzed by Finbold, paints an intriguing pattern among large-scale investors (‘whales’) for Ethereum and Uniswap in the preceding years. An interesting trend emerges: Uniswap’s sizable holders have been offloading their assets, whereas those in Ethereum have been on a gathering spree.

From June 15, 2022, onward, these whales have collectively increased their Ethereum holdings by 12.82 million ETH while reducing Uniswap holdings by 51.63 million UNI.

As of the latest figures, Ethereum is trading at $3,534, bouncing back from a recent low of $3,376, while Uniswap is priced at $10.92, ascending from its earlier rate of $10.24 on June 14. This slump marked Ethereum’s lowest price entry point for the month, and Uniswap reached its own bottom at $8.84 on June 11.

Meanwhile, sentiment analysis among smaller investors points towards prevalent market fear, both from a technical and social perspective, creating a potential disconnect with market actions. Contrastingly, whales and institutional entities such as Amber Group are seizing what they view as an opportune moment to accumulate, possibly hinting at lucrative outcomes in the near future.

Disclaimer: The information provided here is not to be misconstrued as financial advice. Investment activities come with a risk, and past performance is not indicative of future returns. Each investor must perform their due diligence before making financial decisions.

Source link

#1Tvolume #trading #firm #buys #dip #20M #cryptocurrencies