Robinhood Outperforms Earnings Estimates Amid Increasing Cryptocurrency Trading Activity

Today’s late trading saw a bump of over 3% in the stock value of Robinhood Markets Inc. following an unexpectedly strong quarterly financial report, boosted by an uptick in user trading activities, especially in the realm of digital currencies.

Robinhood unveiled an increase in adjusted earnings per share to 21 cents for the second quarter, a rise from last year’s three cents during the same period, on a revenue of $682 million—a marked 40% enhancement compared to the prior year’s figure. These figures surpassed analysts’ expectations of 15 cents earnings per share on an identical revenue forecast.

In analyzing the quarter for Robinhood, the pivotal factor was the amplified use of its platform for trading. The company saw a 69% surge in transaction-based revenue, reaching $327 million. Revenue from options trading climbed by 43% to $182 million, while income from cryptocurrency transactions soared by 161% to $81 million, and equity revenue increased by 60% to $40 million. Revenue from net interest grew by 22% to $285 million, and other sources of revenue, including gold subscription services, went up by 19% to $70 million.

At quarter’s end, Robinhood’s total number of funded accounts stood at 24.2 million, a growth of 1 million from the previous year, while the count of investment accounts ascended by 1.4 million to 24.8 million. Moreover, the total assets under management experienced a 57% year-over-year rise, amounting to $139.7 billion, indicative of both increased net deposits as well as appreciation in the value of equities and cryptocurrencies.

Robinhood also demonstrated effective cost management in the face of increasing platform activity, with total operating expenses displaying a modest surge of just 6% from the year prior, totaling $493 million.

A key corporate milestone during the quarter was Robinhood’s declaration on June 6 of its plans to acquire Bitstamp Ltd., a cryptocurrency exchange, through a cash transaction valued at $200 million as stated in an announcement. Bitstamp, with over 50 operational licenses globally, paves the way for Robinhood’s cryptocurrency trading services to venture into additional international markets.

“We are heartened by our strides in business evolution,” proclaims Robinhood Chief Financial Officer Jason Warnick in the company’s financial briefing. “This second quarter has set new benchmarks for us in terms of revenue and earnings per share while we consistently endeavor to bring profitable growth throughout the year,” he adds.

Given the volatile nature of cryptocurrency, making definitive projections can be complex, and accordingly, Robinhood refrained. However, the firm did reiterate its initial full-year 2024 forecast for operating costs and stock-based compensation, maintaining it at $1.85 billion to $1.95 billion.

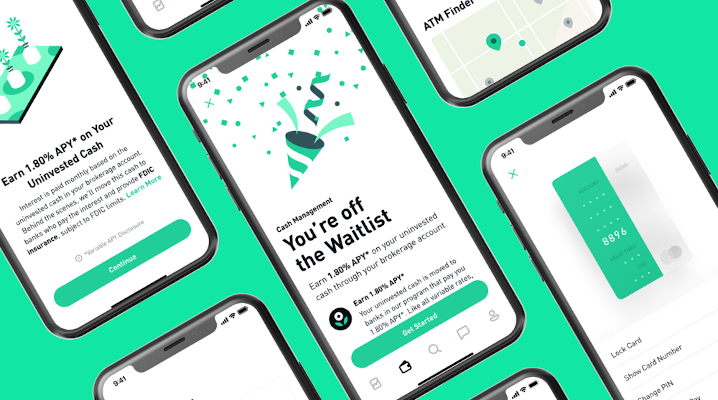

Image: Robinhood

Your participation is crucial for us and aids in maintaining our content free of charge.

A single click supports our ethos of offering deep, relevant content for free.

Engage with our YouTube community

Join over 15,000 #CubeAlumni experts, including leaders like Amazon.com’s Andy Jassy, Michael Dell of Dell Technologies, Intel’s Pat Gelsinger, alongside numerous celebrated industry specialists.

THANK YOU

Source link

#Surging #cryptocurrency #trading #sees #Robinhood #beat #earnings