Bitcoin’s drop below $60K contributes to over $150 million in crypto liquidations

Market liquidations climbed to over $150 million.

The market cap also declined by over 1%.

Bitcoin [BTC] recently dipped below the $60,000 price range again, triggering significant market liquidations. While Bitcoin managed these liquidations, the total market volume exceeded $100 million.

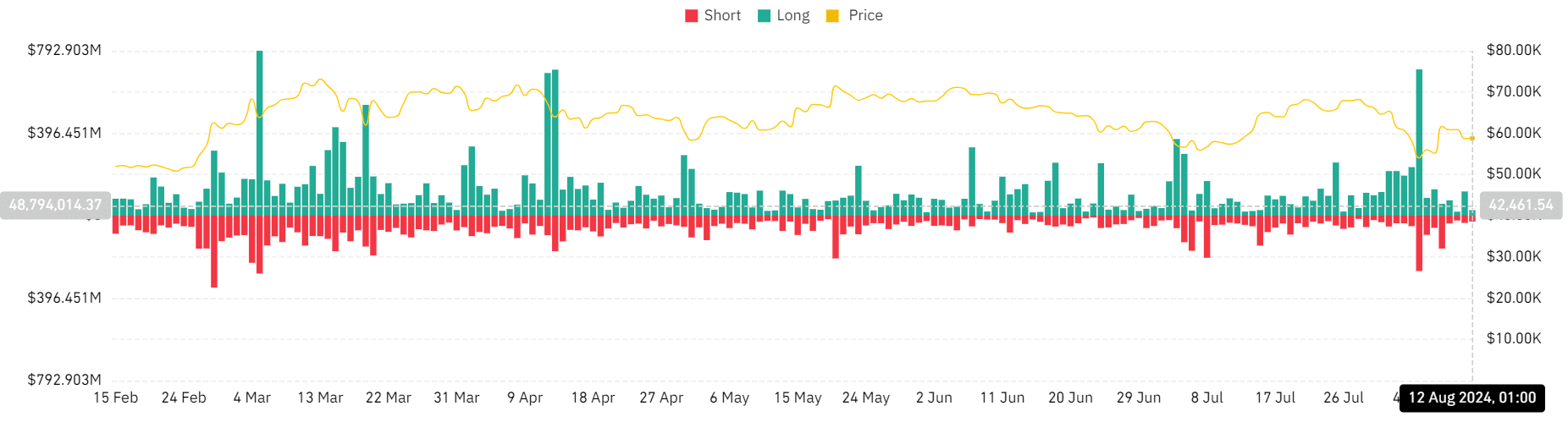

Liquidations spike

The crypto market experienced a downturn in the previous trading session, with assets such as Bitcoin undergoing significant declines. This downward trend triggered substantial market liquidations.

According to Coinglass, the total liquidation volume reached over $151 million. This volume, while not the highest recently, occurred when the market appeared to be on a recovery path.

Source: Coinglass

A further breakdown revealed that long positions bore the brunt of these liquidations. The record showed over $116.3 million for long positions, whereas short positions accounted for over $23.3 million.

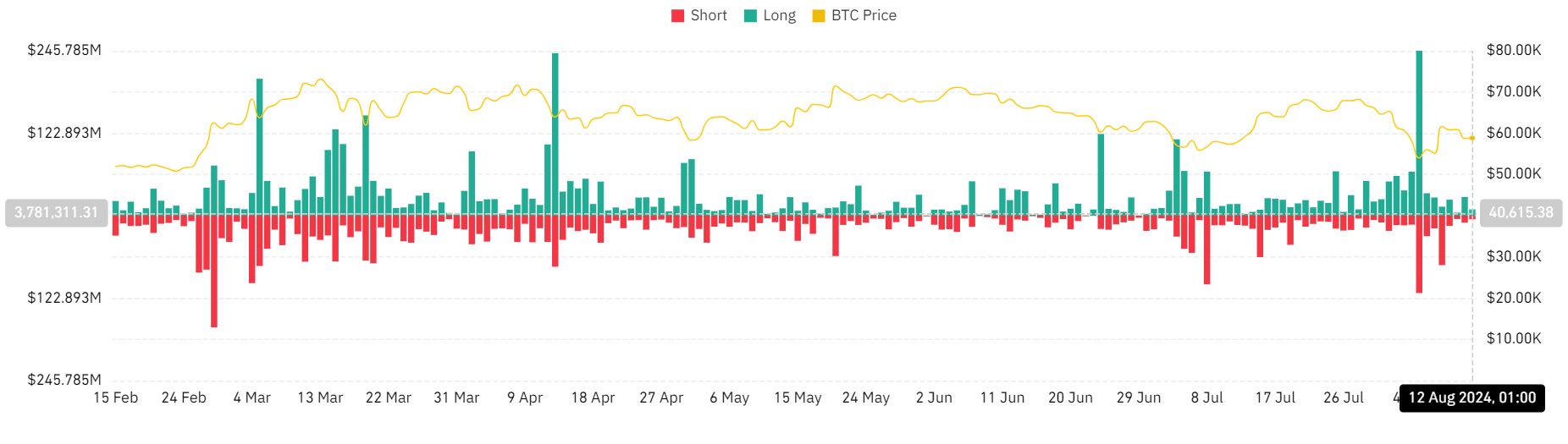

The role of Bitcoin in liquidations

AMBCrypto’s look at Bitcoin’s liquidation trends on Coinglass revealed that Bitcoin accounted for approximately $38 million in liquidations. The data was less than half of the overall market liquidations.

Source: Coinglass

Furthermore, long positions experienced most of these liquidations, totaling over $27.8 million, while short positions accounted for around $10.37 million.

As of the latest data, the volume had already surpassed $13 million, indicating continued activity and market adjustments.

Bitcoin slips up

AMBCrypto’s examination of Bitcoin on a daily time frame revealed a significant 3.63% decline in the last trading session. The decline dropped its price from around $60,935 to approximately $58,722.

This downturn occurred just after it had regained the $60,000 price range, which it had been below for several weeks, highlighting the significance of this recent drop.

As of this writing, it had risen to about $59,500, reflecting a recovery of over 1%.

However, the decline from the previous session continued to influence the bearish market trend, as indicated by the Relative Strength Index (RSI), which remains below the neutral threshold.

Recent analysis of the overall cryptocurrency market capitalization indicated a decline of over 1.5% in the last 24 hours. The market cap was around $2.1 trillion, according to CoinMarketCap.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite this downturn, there was a significant increase in trading volume, which rose by over 60% to approximately $67 billion.

This surge in volume suggests that the recent market liquidations have stimulated heightened trading activity as investors react to the fluctuations.

Next: Why is crypto down today? Bitcoin’s 6% loss, unpacked

Source link

#Crypto #liquidations #cross #mln #Bitcoins #slip #60K #played #part