Bitcoin Surges as Harris Vows to Support Regulatory Framework

(Bloomberg) — Bitcoin reached its highest level in two weeks as Vice President Kamala Harris vowed to support a regulatory framework for cryptocurrencies.

Most Read from Bloomberg

This promise added to the optimism seen during Asian trading hours that a mixed response to China’s latest stimulus will encourage speculators to invest in cryptocurrencies rather than the country’s stocks.

The largest digital asset rose up to 5.6% on Monday before slightly decreasing to $65,585 at 2:04 p.m. in New York. Other smaller tokens like Ether and Solana also saw gains.

Harris’ commitment to a regulatory framework comes after years of criticism from crypto industry officials regarding the lack of clarity in U.S. regulations. Former President Donald Trump has actively courted crypto voters during the current presidential campaign and has been involved in several crypto-related ventures.

“The recent increase is largely due to the election, initially from Trump’s lead in predictions and polls, followed by somewhat supportive statements about crypto markets from the Harris campaign,” said Noelle Acheson, author of the Crypto Is Macro Now newsletter.

Prediction markets have recently shifted, giving Trump better odds of winning than Harris.

Bitcoin-related companies also saw a surge in shares, with Coinbase rising around 9% and MARA Holdings gaining 5%. MicroStrategy, a Bitcoin proxy, remained stable after a 16% surge on Friday.

Meanwhile, the bankrupt Mt. Gox crypto exchange extended the creditor repayment deadline to Oct. 31, 2025, alleviating concerns about an oversupply of Bitcoin in the market.

“The recent improvement in Trump polling will enhance the market’s response to positive news such as the Mt. Gox repayment delay,” said Benjamin Celermajer, co-chief investment officer at Magnet Capital.

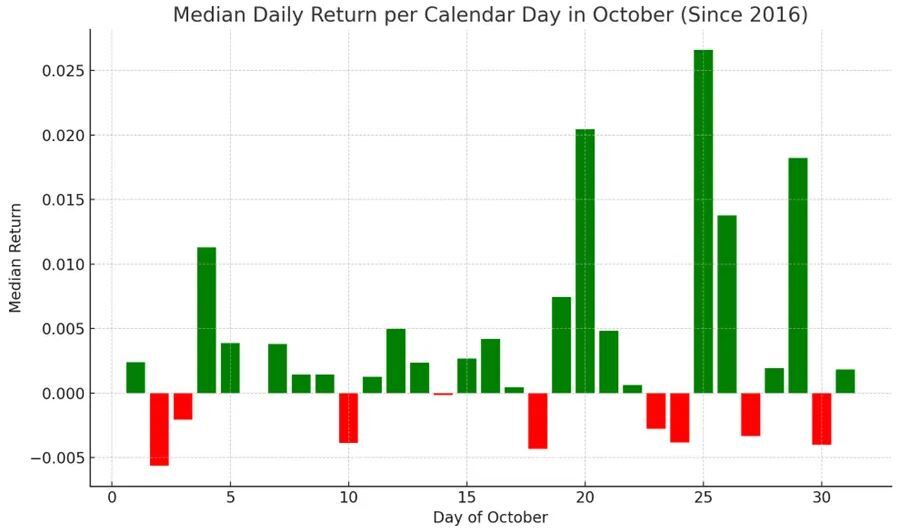

Bitcoin is now higher for October after a sluggish start, which typically sees an average 20% increase in the past decade.

“Historical data shows that October’s seasonal strength in crypto markets usually occurs in the later part of the month,” noted Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC.

China is working to boost its economy, but a highly anticipated weekend policy update failed to outline the exact amount of fiscal stimulus the government plans to provide. Some economists are skeptical that officials are taking enough measures to combat deflation.

“The disappointing China stimulus is likely seen as positive news for Bitcoin, as the shift of capital from Bitcoin to Chinese equities was believed to have weighed on crypto prices,” said Caroline Mauron, co-founder of Orbit Markets.

–With assistance from Sunil Jagtiani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

#Bitcoin #Climbs #Harris #Pledging #Regulatory #Framework #Support