Why Long-Term Holders are Selling Bitcoin: The Next Major Crypto Trade

Bitcoin is still facing resistance at the crucial $100,000 mark, with investor focus shifting from BTC to altcoins. Particularly, tokens that surged during the 2021 bull run and metaverse tokens like Decentraland and Sandbox are seeing increased trade volume on centralized exchanges like Upbit.

Ethereum (ETH) has experienced a rise in open interest due to heightened demand from derivatives traders. This uptrend is supported by metrics showing a growing bullish sentiment among market participants. As institutional interest expands and traders diversify their portfolios to include tokens with potential gains, a rally in Ethereum price is expected in the near term.

Bitcoin struggles under $100,000, altcoins offer an opportunity for trade

Bitcoin fell just short of the $100,000 mark on Friday, November 20, and has since dropped nearly 5% to $95,719 as of Thursday, November 28.

This week, institutional investors have withdrawn capital from Bitcoin ETFs, with data from Farside Investors showing outflows of $435.30 million on Monday and $122.80 million on Tuesday.

With Bitcoin consolidating and altcoins from previous bull markets seeing rallies, institutional investors are turning their attention to Ethereum and other alternatives that could potentially offer higher returns in the weeks ahead.

Bitcoin ETF Flows | Source: Farside Investors

Altcoins such as Cardano (ADA), Ripple (XRP), Stellar (XLM), and metaverse tokens like Decentraland (MANA) and Sandbox (SAND) have experienced an increase in trade volume on centralized exchanges this week. South Korean exchange Upbit has seen consecutive days of volume growth across these tokens and altcoins from the 2021 bull run.

Data from 10xResearch has identified the altcoins driving this surge, as shown in the chart below.

Tokens with spike in trade volume and rising trade volume on Upbit | Source: 10xResearch.co

Trade activity on South Korean exchanges often foreshadows spot trading across global centralized exchanges. Altcoins like Sei, Polkadot (DOT), and Dogecoin (DOGE) are gaining attention among traders.

Ethereum derivatives traders turn bullish on ETH

Among the altcoins that have made gains in the past week while Bitcoin consolidates, Ethereum stands out. Derivatives traders are increasingly bullish on Ether, reflecting a shift in institutional investor sentiment.

Farside Investor data shows a gradual recovery of institutional interest in Ethereum ETFs, with moderate inflows of $133.60 million recorded this week. The open interest in Ethereum derivatives has reached a four-month peak of over $24 billion.

Despite the Ethereum spot price lagging behind open interest, derivatives traders anticipate a climb in ETH price.

Ethereum futures open interest in USD | Source: Coinglass

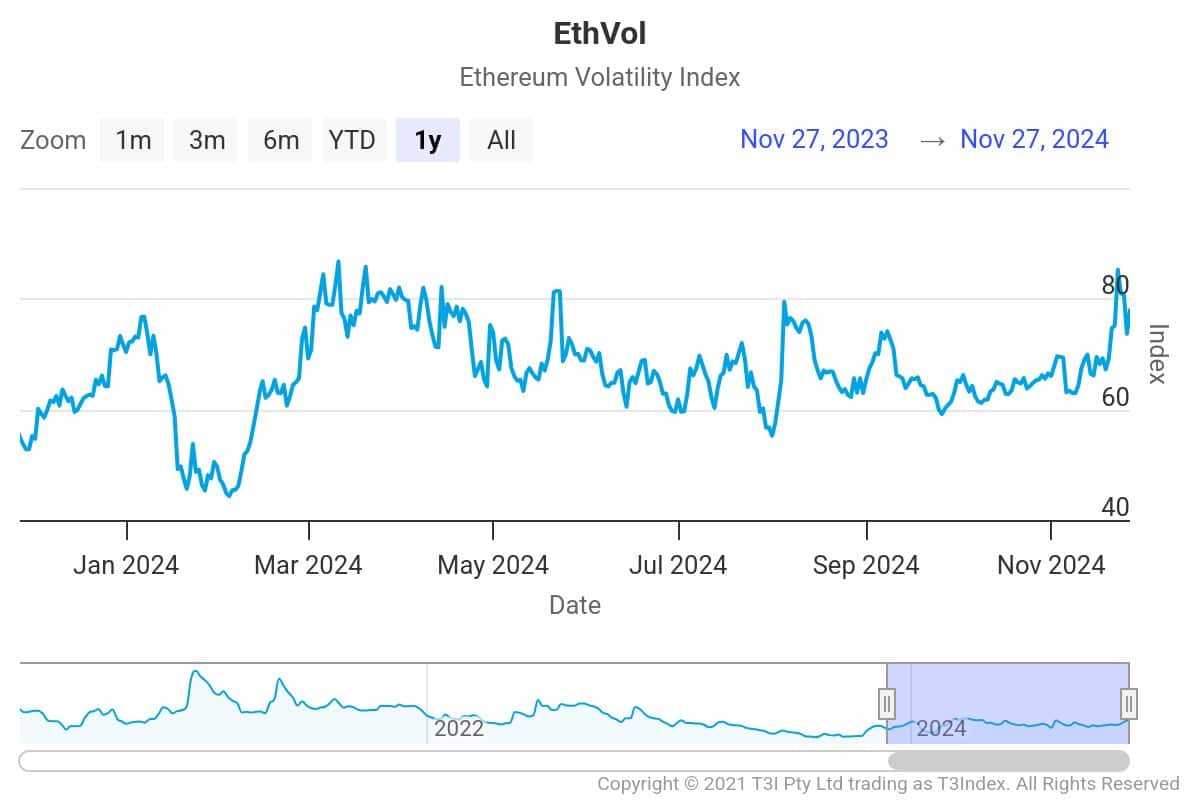

Ethereum has seen a spike in implied volatility between November 14 and 27, contrasting with Bitcoin’s relatively stable volatility. This suggests a potential price movement in Ethereum while Bitcoin consolidates, reinforcing the bullish outlook for the altcoin.

Ethereum volatility index | Source: T3index

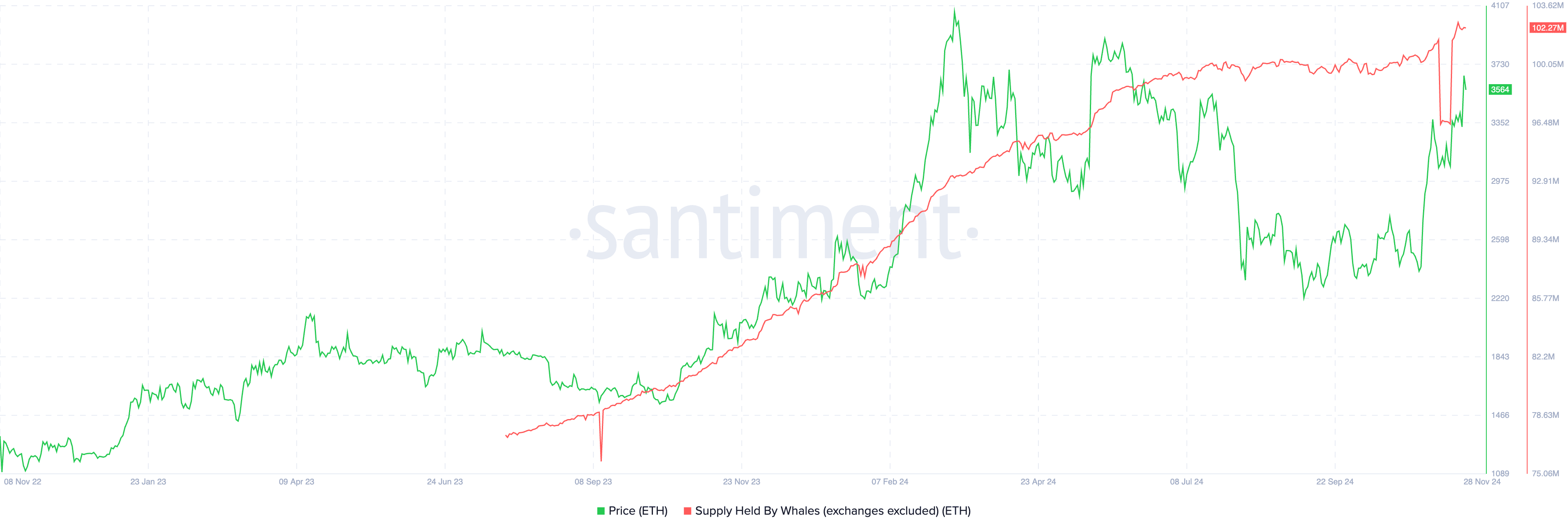

Over the past eight days, Ethereum whales have increased their holdings by 6%, totaling $102.27 million. This accumulation by whales is typically seen as a bullish signal, as large holders anticipate price gains in the token.

Data from Santiment shows historical price spikes in Ethereum following whale accumulation, illustrating the positive impact of this trend.

Ethereum supply held by whales (excluding exchanges) vs. ETH price | Source: Santiment

Recent events point at major win for the Ethereum ecosystem

A U.S. court of appeals overturned sanctions against Tornado Cash, a crypto mixer on the Ethereum blockchain. In 2022, the firm was accused of laundering over $7 billion for North Korean hackers and malicious entities.

Chief Legal Officer of Coinbase, Paul Grewal, announced that Tornado Cash’s smart contracts are no longer subject to sanctions, allowing U.S.-based individuals to use the privacy-protecting protocol.

Privacy wins. Today the Fifth Circuit held that @USTreasury’s sanctions against Tornado Cash smart contracts are unlawful. This is a historic win for crypto and all who cares about defending liberty. @coinbase is proud to have helped lead this important challenge. 1/6

— paulgrewal.eth (@iampaulgrewal) November 26, 2024

Following Donald Trump’s victory in the recent Presidential elections, U.S.-based traders are optimistic about potential changes in regulatory policies and crypto-related decisions in 2025. These developments could serve as a catalyst for Ethereum’s price.

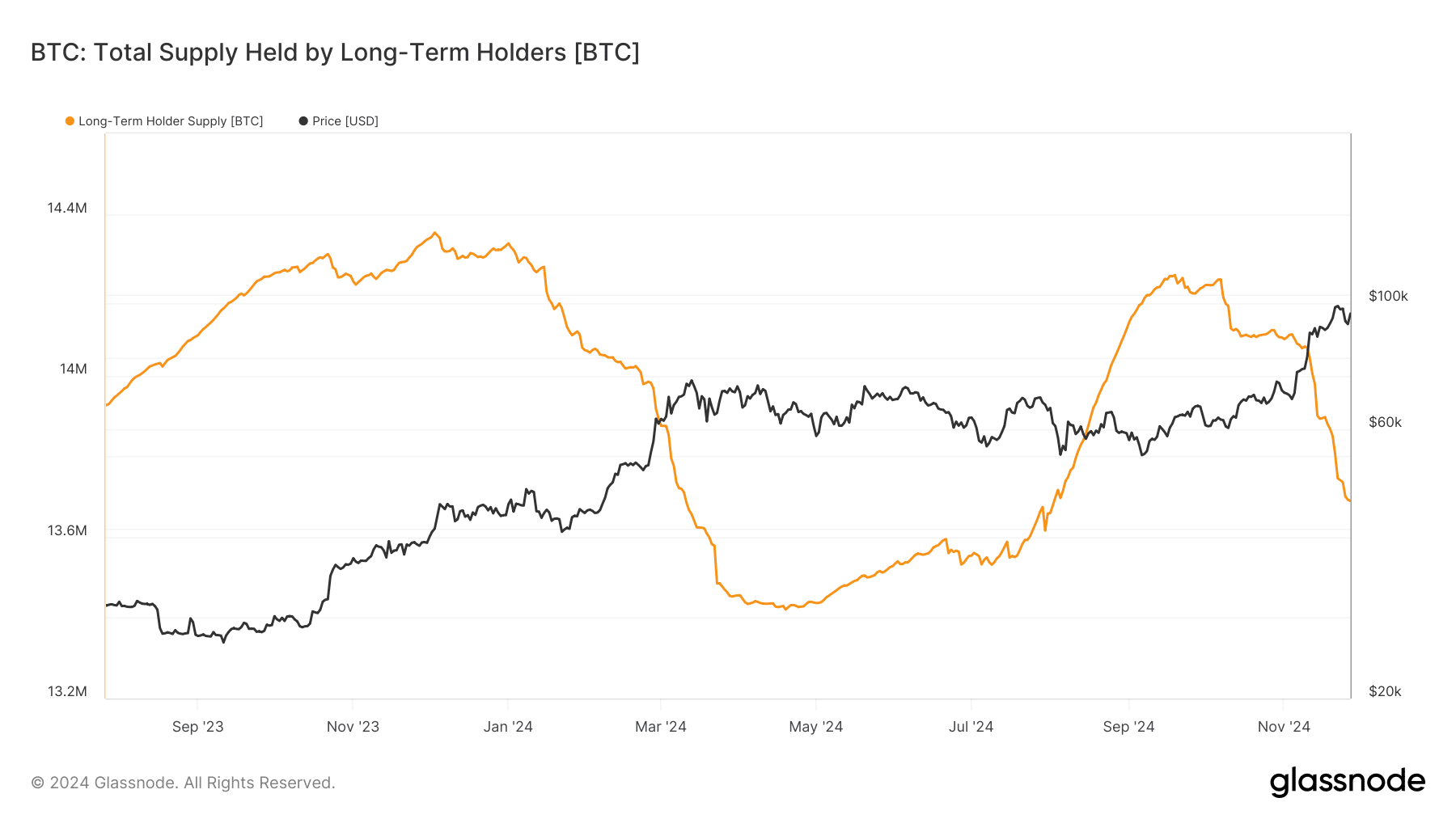

Long-term Bitcoin holders are selling their BTC

In November, long-term Bitcoin holders reduced their BTC holdings by almost 3%, dropping from 14.09 million to 13.69 million BTC. The decline in Bitcoin supply held by these holders raises concerns about potential selling pressure on the asset.

Despite the profit-taking by long-term holders, Bitcoin price has not been significantly affected, with demand absorbing the supply of BTC being sold by these holders.

Traders should monitor the decline in BTC holdings by long-term holders for further insights into potential selling pressure and a prolonged correction in Bitcoin price.

Bitcoin: Total supply held by long-term holders | Source: Glassnode

Strategic considerations: Bitcoin and Ethereum

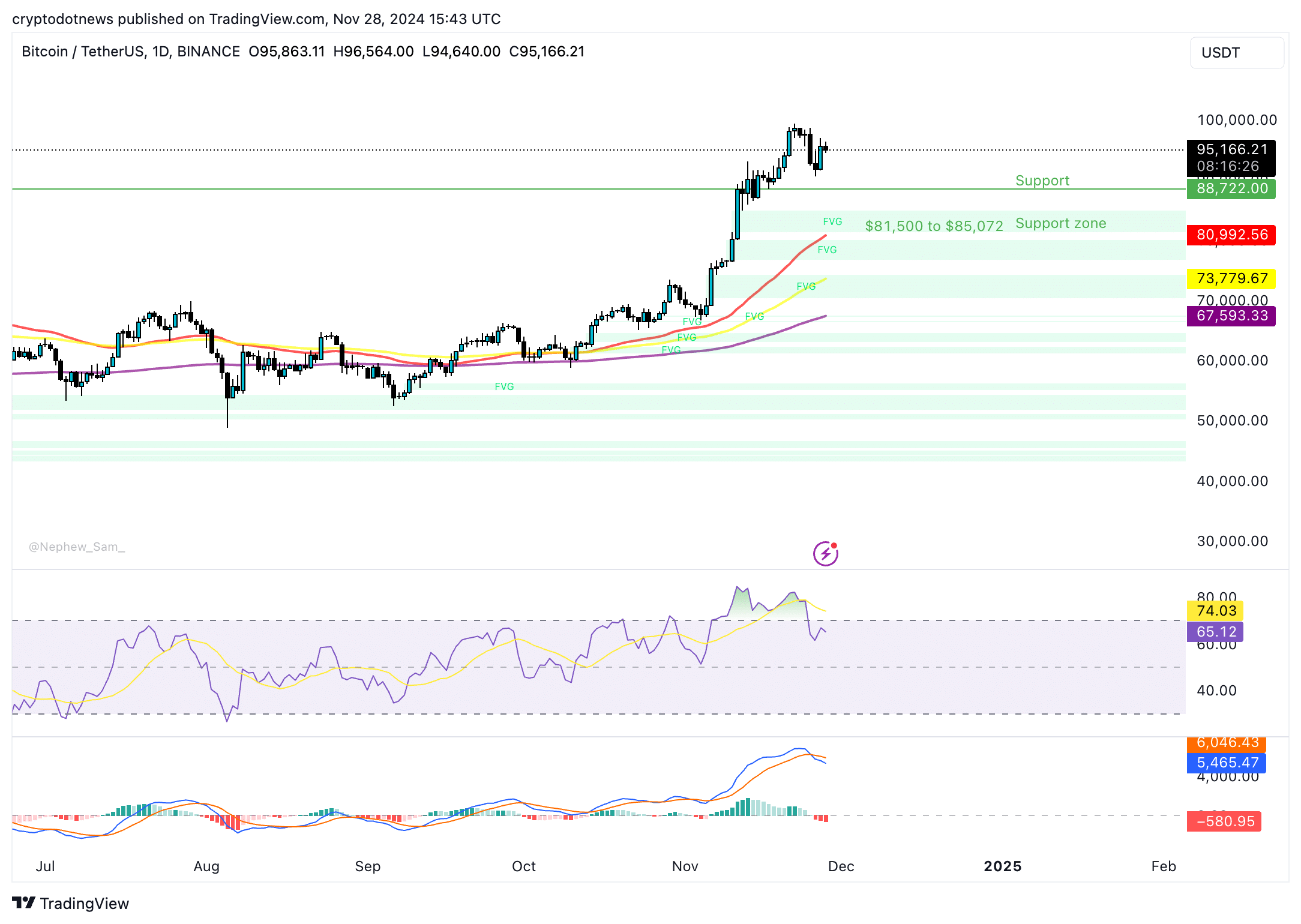

Bitcoin is currently consolidating after its attempt to reach the $100,000 mark. The nearest support for BTC is at $88,722, which was the low on November 17. BTC could find support in the zone between $81,500 to $85,072.

The relative strength index momentum indicator is sloping downwards and stands at 65. The moving average convergence divergence shows red histogram bars below the neutral line, indicating a negative momentum underlying the Bitcoin price trend.

BTC/USDT daily price chart | Source: Crypto.news

Traders should closely monitor the Bitcoin price chart and technical indicators for signs of a potential reversal in the coming weeks.

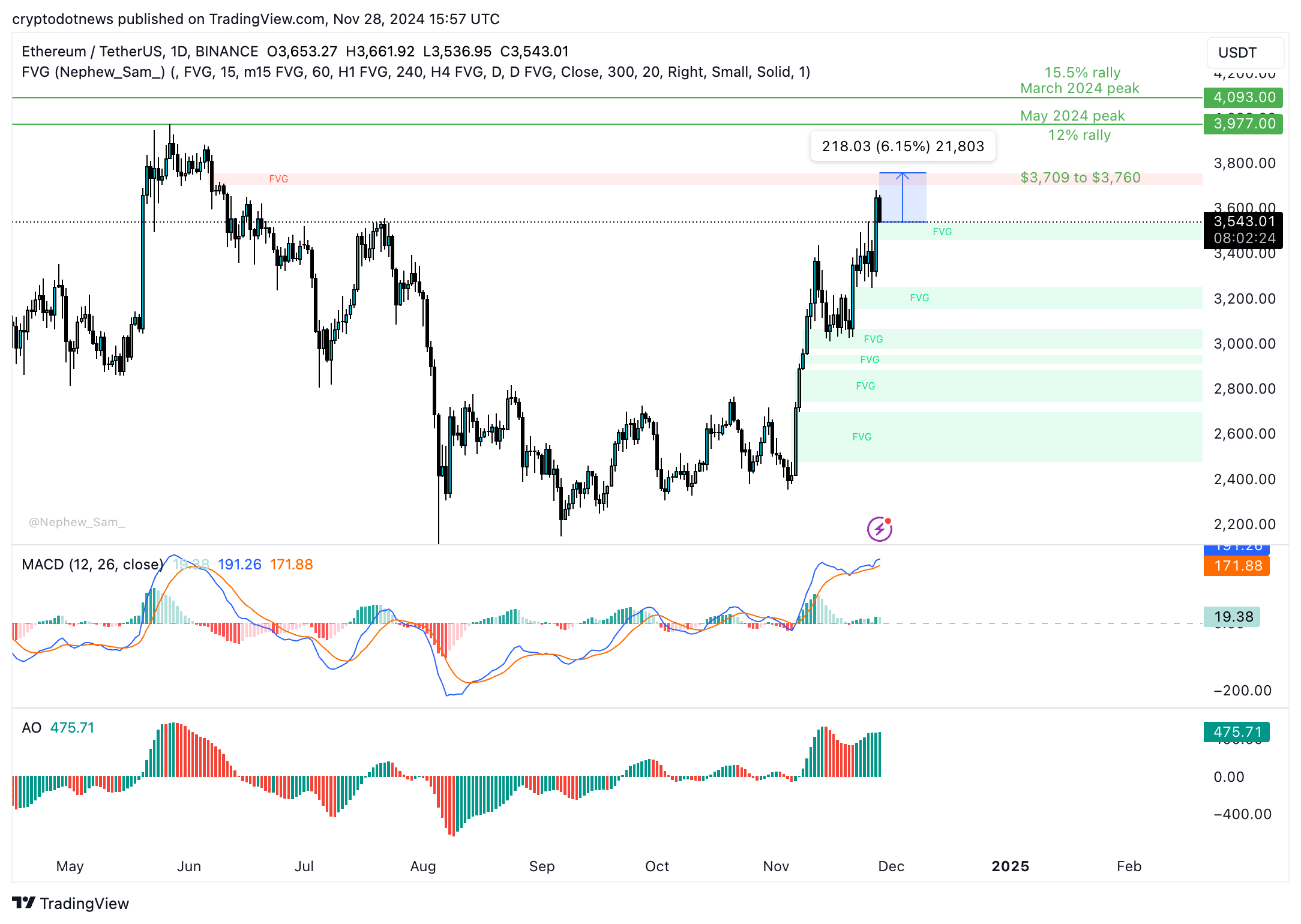

Ethereum could rally towards the imbalance zone between $3,709 and $3,760, representing a 6% increase from the current price. If ETH surpasses this level, the two key resistance levels to watch are the May 2024 peak of $3,977 and the March 2024 peak of $4,093.

The MACD and awesome oscillator indicators support a positive momentum for Ethereum price. ETH could continue its upward trajectory while Bitcoin consolidates, presenting an opportunity for sidelined buyers before the end of 2024.

ETH/USDT daily price chart | Source: Crypto.news

The three-month correlation between Bitcoin and Ethereum stands at 0.95, indicating the need for traders to watch for potential sharp corrections in BTC. Any sudden changes in Bitcoin’s price trend could impact Ethereum traders and long positions in ETH, necessitating strategic considerations.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

#Big #Crypto #Trade #Long #Holders #Sell #Bitcoin