How Bitcoin Reached the $100,000 Milestone – An Analysis by Vox

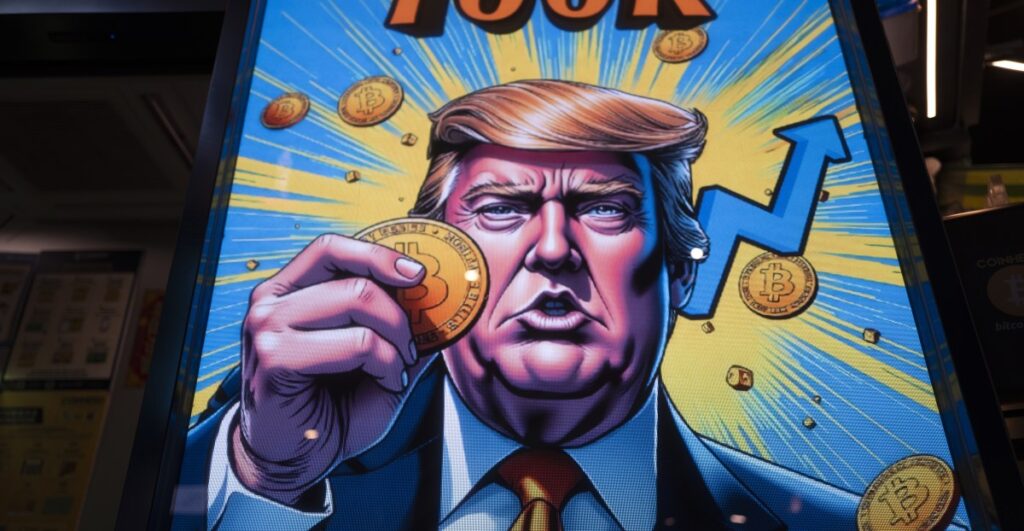

For the very first time, on Thursday, bitcoin’s value rocketed beyond the $100,000 milestone,

bolstered by momentum gained from the election and the pro-cryptocurrency stance

of the incoming Trump administration.

Election Day saw the renowned decentralized currency, bitcoin, priced at $69,374 as

listed on the digital currency exchange Coinbase. In under four weeks, its value leaped by an impressive 44 percent.

Additionally, alternative coins like ethereum and XRP experienced considerable gains during the same timeframe.

The dramatic upswing in the worth of cryptocurrencies indicates investor confidence in the future economic

policies of President-elect Donald Trump and his selections for vital regulatory body heads,

some of whom have openly advocated for the deregulation of the digital currency space.

“The fact that bitcoin has reached the landmark figure of $100,000 is a reflection of anticipations

for political endorsement and regulatory freedom with the new authority,” according to

Ramaa Vasudevan,

a Colorado State University economics professor critical of cryptocurrency.

“The appointment of figures with a strong inclination toward cryptocurrency to administrative roles

unmistakably demonstrates a welcoming attitude toward bitcoin and its counterparts,

igniting a surge of investment into these domains.”

The recent rally of bitcoin is also a testament to its growing legitimacy.

Trump’s victory might have kickstarted the surge, but the financial sector’s acknowledgment

of the currency in the past several months provided the required support.

Bitcoin has transitioned from a specialized novelty to a widely recognized digital asset,

now accessible to everyday Americans through credible retail investment platforms.

Despite arguments by some economists that bitcoin may represent a bubble,

as many have speculated,

these investment channels have ensured its enduring presence.

Incoming Trump administration policies driving positive sentiment

Throughout his most recent presidential campaign, Trump has exhibited unwavering support for cryptocurrencies,

and his selections for leading governmental regulatory bodies mirror this advocacy.

Following the nomination of Paul Atkins

as the Securities and Exchange Commission (SEC) head on Wednesday, BTC reached a record high valuation.

Previously, Atkins served as an SEC commissioner for six years during the administration of George W. Bush.

Atkins, who is known to be a staunch proponent of deregulation from his time in the SEC and beyond, has not been associated with

the Trump administration’s more radical nomination choices, explained cryptocurrency researcher Molly White to Vox. He is a seasoned

figure with deep SEC ties. Additionally, Atkins holds a co-chair position within the Chamber

of Digital Commerce’s Token Alliance, an advocacy group lobbying for relaxed regulations on cryptocurrencies.

Rumors suggest that Perianne Boring,

CEO of the Chamber of Digital Commerce, is among Trump’s preferred choices to head the Commodity Futures Trading Commission (CFTC) which oversees

futures and commodities trading. Currently, the SEC has jurisdiction over cryptocurrency, but there is speculation from the Trump administration about

potentially classifying it as a commodity instead. If reclassified, the regulation of cryptocurrency would fall within the CFTC’s less rigorous oversight.

Appointed as his crypto and AI czar on Thursday, billionaire crypto advocate David Sacks was tasked by Trump

with crafting policies on crypto and AI. In his announcement on Truth Social, Trump said that Sacks would collaborate

with both the SEC and CFTC to establish a framework for crypto regulation.

Additionally, Trump has personal connections to the cryptocurrency world via his family’s business endeavor,

World Liberty Financial, pertaining to cryptocurrencies and trading. Notably, pro-cryptocurrency factions

disbursed $245 million in the year’s elections, surpassing all other industries, in support of candidates

across the nation perceived as pro-cryptocurrency.

This all hints at a regulatory environment under a Trump leadership that could be significantly more accommodating

to the crypto sector following a time of stricter regulation and numerous legal confrontations with crypto firms

under the guidance of the current SEC chair, Gary Gensler.

The fresh surge of capital into the crypto arena is largely fueled by the widespread perception that years

of regulatory vagueness and confrontations may finally be resolved, offering a clearer path ahead,

according to Christian Catalini of the MIT Cryptoeconomics Lab.

Under the stern Gensler-led SEC, stringent measures were implemented against trading platforms such as Coinbase,

Binance, and Kraken. The argument was that cryptocurrency transactions necessitate similar oversight as traditional

securities like stocks or bonds, and that investors deserve equivalent levels of information about crypto firms

as they would for a publicly traded company. However, opponents from the crypto trading platforms and associated

entities argue that crypto tokens are distinct from stocks and should thus not be subjected to identical regulatory measures.

Under Trump’s governance, there’s the potential for ongoing lawsuits against eminent crypto platforms such as Coinbase

to be discontinued, and the regulatory framework for bitcoin and other digital currencies to be substantially revised.

A Trump regulatory regime could mean crypto exchanges like Binance and Coinbase might face fewer legal challenges,

which would make it simpler for individuals to trade on these platforms. Industry supporters believe this could

catalyze innovation, but it may also leave individual traders more susceptible to fraud, theft, and the

innately erratic nature of the currency.

Bitcoin is now an established digital asset

Particularly since the collapse of the FTX trading platform in 2022,

the conversation around cryptocurrency functionality has pivoted. The focus has shifted toward presenting

cryptocurrency predominantly as an investment tool instead of an alternative to traditional currency.

This shift has also been contributory to the asset’s valuation appreciation, as stated by White.

In the U.S., the first bitcoin exchange-traded funds (ETFs) were sanctioned in January by the SEC.

ETFs, which are collections of financial instruments traded on a regulated stock exchange, could consist

of stocks, bonds, commodities, or cryptocurrencies such as bitcoin or ethereum.

ETFs permit investors to have indirect access to cryptocurrencies. If the price of bitcoin rises,

the value of these ETFs increases correspondingly. Thanks to the conglomerate structure of ETFs and

their placement in a regulated exchange, investors can navigate with more security against potential

losses if bitcoin’s value declines. Finance giants such as BlackRock, Invesco, Fidelity, Grayscale,

and Ark Invest have introduced bitcoin funds that offer investors, including the more conservative ones,

alternative means of acquiring or getting exposure to cryptocurrency.

Previously, bitcoin investors were confined to purchasing directly from crypto exchanges or relying on

prolonged storage solutions. Investors could also take chances on unpredictable bitcoin futures.

Now, ETFs offer a solid and regulated trading option.

Catalini remarked, “The root driver of bitcoin’s ascension lies in its development – not only as a digital

synonym to gold but as a foundational component of the global financial system,

although predicting its future stability and value remains uncertain.”

Nevertheless, Vasudevan pointed out that the relentless increase in the cryptocurrency market may not be sustainable.

Past instances have seen bitcoin’s value shoot up only to collapse steeply later. For instance, following the FTX debacle,

bitcoin’s worth plummeted by 20 percent, dropping under $16,000 within a brief period. The skepticism concerning crypto prices

continues, with many believing that its valuation is more speculation-driven than based on intrinsic worth.

Source link

#bitcoin #hit #100k #Vox