Michael Barr Resigns as Fed Vice Chair, Prompting Crypto Community’s Speculation on Policy Changes – Brave New Coin

Michael Barr, the Federal Reserve’s Vice Chair for Supervision, has announced his resignation, effective February 28, 2025.

This decision, made over a year before his term was set to expire in mid-2026, marks a significant shift in U.S. financial regulation. Barr will remain a member of the Federal Reserve Board of Governors.

His resignation comes amidst speculation about potential legal challenges with the incoming Trump administration. Reports suggest that Trump’s advisers considered removing Barr from his supervisory role, which could have led to legal disputes and raised questions about the Fed’s independence. In his statement, Barr cited the need to avoid distractions as the reason for his early departure, stating, “The risk of a dispute over the position could be a distraction from our mission.”

Implications for Crypto Regulation

Barr’s tenure was marked by his firm stance on cryptocurrency oversight, which many in the crypto community viewed as a hindrance to industry growth. He pushed for stricter regulations on stablecoins and warned banks against holding crypto assets directly, labeling such practices as “unsafe and unsound.” This approach drew criticism from crypto advocates and some lawmakers who argued it stifled innovation.

Source: Federal Reserve

Senator Cynthia Lummis, a staunch crypto supporter, openly criticized Barr, accusing him of enabling “Operation Chokepoint 2.0,” a term used by industry leaders to describe a perceived coordinated effort to debank crypto firms. In a recent statement, Lummis remarked, “Barr completely failed to fulfill his duties, enabling illegal overreach at the expense of Wyoming’s digital asset industry.”

A Changing Regulatory Landscape

Barr’s departure paves the way for the Trump administration to appoint new financial regulators, potentially ushering in more crypto-friendly policies. Pro-crypto figures have welcomed the shift, with Nic Carter, a partner at Castle Island Ventures, noting that several leaders associated with restrictive crypto policies have either stepped down or announced plans to leave their roles.

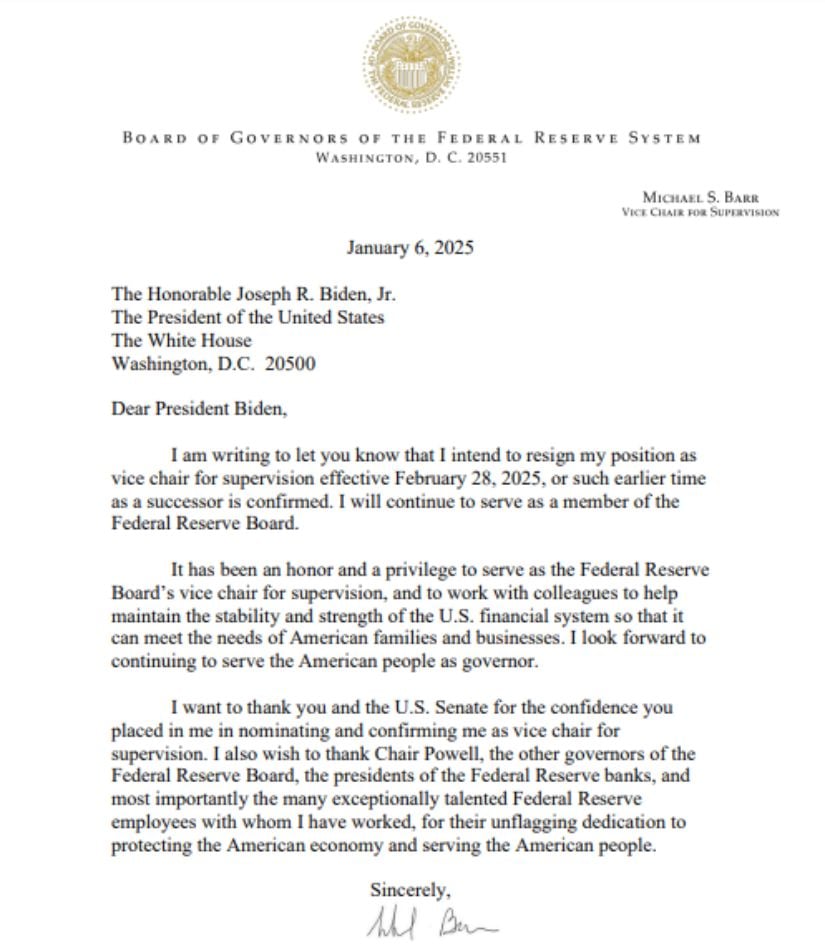

Michael Barr’s resignation letter addressed to President Joe Biden. Source: Federal Reserve

Despite the criticism, Barr advocated for responsible stablecoin regulation and supervised research into central bank digital currencies (CBDCs), initiatives some industry experts acknowledge as crucial for fostering crypto adoption in the U.S. His balanced approach to innovation and risk management drew both praise and opposition during his time in office.

Industry Reactions

Barr’s resignation has sparked optimism among crypto industry stakeholders, who hope for a regulatory environment more conducive to innovation. Brian Gardner, a policy strategist at Stifel, called the move “positive for banks,” predicting a potential easing of regulatory pressures and a shift in supervisory priorities.

Source: Eleanor Terrett via X

Custodia Bank CEO Caitlin Long referred to Barr as “the Fed’s debanker-in-chief,” underscoring the crypto community’s frustrations with his policies. Meanwhile, former U.S. prosecutor and crypto advocate John Deaton emphasized the need to investigate alleged efforts to suppress the crypto sector, stating, “If these actions go unchallenged, it creates a dangerous precedent.”

Future Outlook

As the Trump administration prepares to take office, the Federal Reserve’s regulatory stance remains under scrutiny. Fed Governor Michelle Bowman and Christopher Waller, both considered critics of Barr’s policies, are potential candidates for the vice chair role. Their appointments could signal a significant shift in the Fed’s approach to digital assets.

For now, the crypto industry is watching closely, hopeful that new leadership will strike a balance between safeguarding the financial system and fostering innovation in the digital economy. Just as importantly, crypto investors are hoping the current 2025 bull market will continue to gather steam under President Trump’s leadership. This is looking increasingly likely and frankly, we are here for it. Bring on the Trump Pump in 2025. Stack Sats, folks.

Source link

#Michael #Barr #Steps #Fed #Vice #Chair #Role #Sparking #Crypto #Worlds #Anticipation #Policy #Shifts #Brave #Coin