MicroStrategy And Other Whales Continue Bitcoin Accumulation

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

MicroStrategy’s Relentless Bitcoin Accumulation

Michael Saylor announced today over Twitter that MicroStrategy has purchased an additional 5,050 bitcoin for $242.9 million in cash at an average price of $48,099 per bitcoin, putting the company’s total holdings at 114,042 bitcoin.

With 114,042 bitcoin and approximately 8.58 million shares outstanding, investors now own 1.3 million sats per MicroStrategy share, with the bitcoin per share up 2%. As MicroStrategy issues more common stock to fund their bitcoin buying spree, investors give up some of their ownership through the increased equity dilution. In return, they get more bitcoin per share of MicroStrategy stock.

Over the last few weeks in their August 24 and September 13 announcements, MicroStrategy has sold an additional 793,232 shares for a total $577 million to buy more bitcoin. As previously announced in July, their Open Market Sale Agreement allows them to sell up to $1 billion in new stock. So far, Michael Saylor is following through with his original plan to buy as much bitcoin as possible through any and every financial vehicle at his disposal. And it doesn’t look like he’s stopping anytime soon.

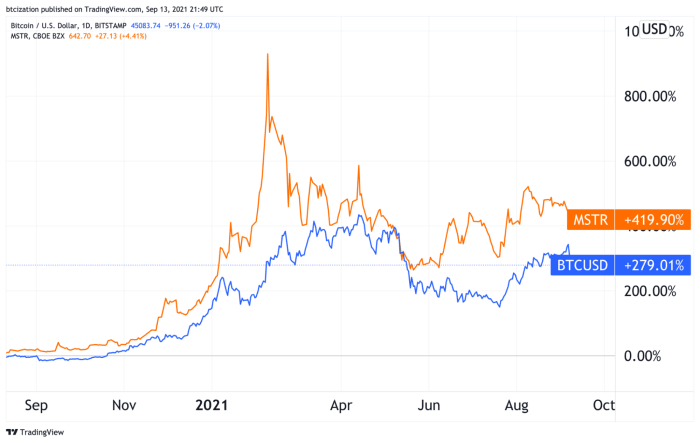

Since the company’s adoption of a bitcoin standard on August 11, 2020, MSTR shares have increased by 419.9%, outpacing the price of bitcoin, which returned 279.0% during the same period.

Source: TradingView

Whale Watching

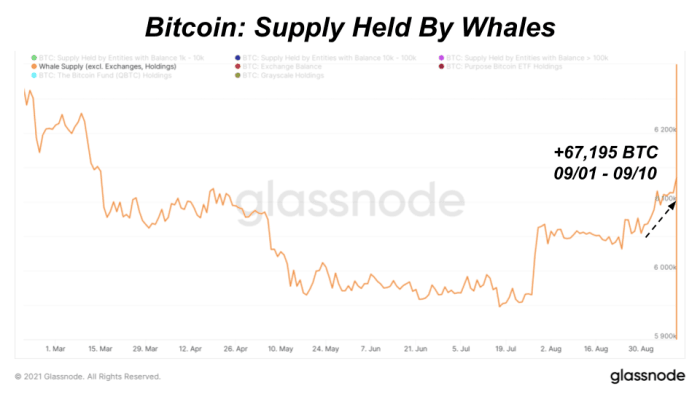

Bitcoin supply held by whales is trending up in the month of September – up 67,195 bitcoin totaling 6.13 million. That’s up 3.1% from this year’s low back in July indicating increased demand from larger institutional buyers over the last two months. Supply held by whales includes entities that hold over 1,000 bitcoin, excluding exchange balances and other known holdings like GBTC. MicroStrategy’s latest 5,050 bitcoin make up 7.5% of this move.

Source: Glassnode

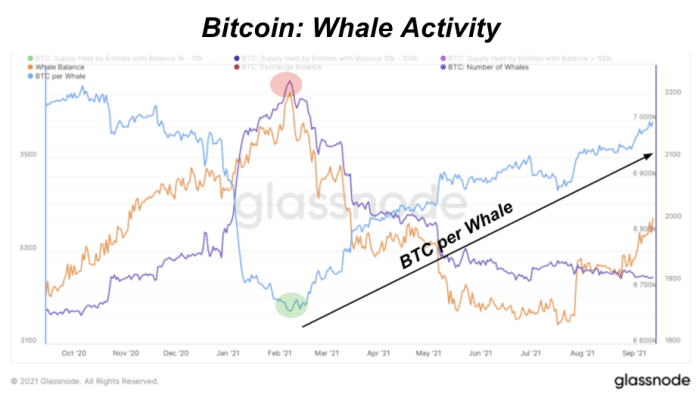

When adding up the bitcoin supply held by entities with a balance of 1,000-10,000, 10,000-100,000, or over 100,000 BTC, and subtracting exchange balances from the metric, a clear picture emerges. Since February, both the total whale balance started to decline as well as the number of whale entities (entities being a heuristic labeling of a cluster of addresses associated with one another on the blockchain); however the BTC per whale began to increase quite significantly.

In simple terms this means that a number of convicted whales continued to accumulate despite the upside and downside volatility since the month of February, and following the summer price drawdown of over 50%, aggregate BTC balance held by whales has resumed its uptrend.

TLDR: Both total BTC holdings by whale entities as well as the average BTC holding per whale are increasing. The big money is buying right now. The numbers don’t lie.

Source: Glassnode

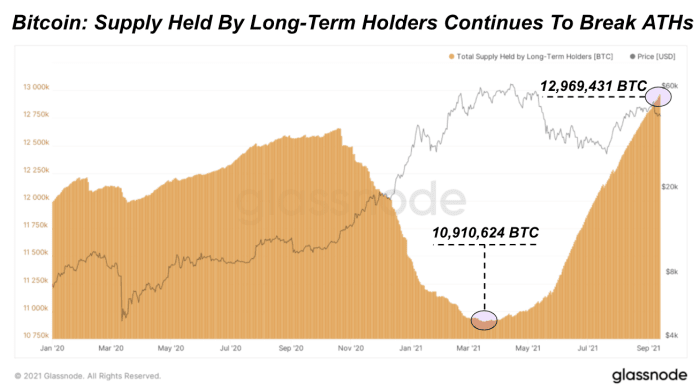

Long-Term Holder Supply Continues To Break All-Time Highs

Source: Glassnode

The supply of bitcoin that is held by long-term holders continues to break all-time highs on a daily basis, with the total bitcoin held by the cohort being over 2 million more than it was on March 17, which was the low figure for 2021. This is without a doubt a bullish catalyst and shows how strong-handed HODLers have been accumulating through the volatility of 2021.

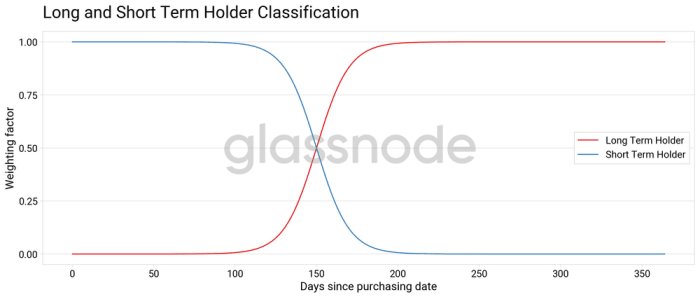

With the classification of long-term holders being 155 days (for reasons explained below), the current date for a UTXO to be considered a “long-term” holder is April 11, 2021, just three days before the local top of the bitcoin market. Despite this, there have never been more bitcoin held by long-term investors. Incredibly bullish.

Source: Glassnode

The time threshold for a bitcoin balance to be considered “long-term” is 155 days, and this is because of the statistical significance of the data when backtesting UTXO spend probabilities. For more information on the quantification of long-term versus short-term holders, read here.

Source link

#MicroStrategy #Whales #Continue #Bitcoin #Accumulation