The price of Bitcoin, the leading cryptocurrency, continues to be a hot topic with analysts offering a spectrum of predictions....

With the 2024 Bitcoin halving event behind us, it's time to embrace the wealth of opportunities it presents! Bitcoin halving...

NodeMonkes surged to the top of the non-fungible token (NFT) market, recording over US$1.05 million in sales on Thursday, CryptoSlam...

Last updated: April 25, 2024 06:36 EDT | 2 min read The European Union (EU) has formally passed a new...

An enigmatic digital currency investor known as Cyclop has become the center of attention. This investor boasts an impressive financial...

Bitcoin's price reached above $66,000 for a brief period and even attempted to surpass $67,000 on multiple occasions without success....

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of...

Last updated: April 25, 2024 01:27 EDT | 9 min read The text below is a promotional article not affiliated...

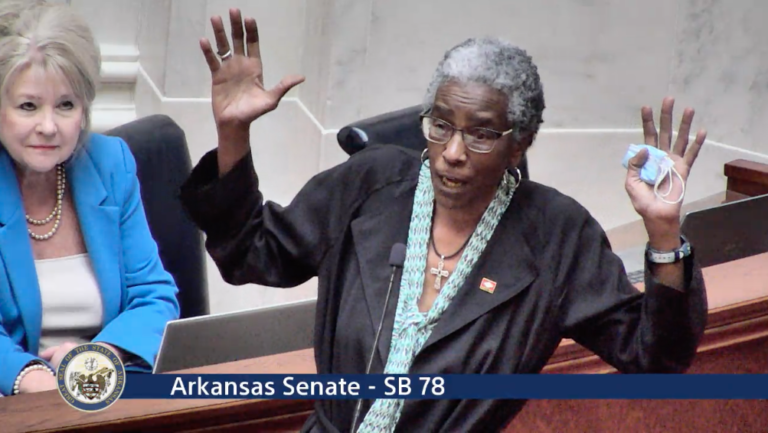

Two bills that would regulate cryptocurrency mining operations in Arkansas passed the state Senate Wednesday and will be considered by...

```html CoinW Exchange, a leading crypto exchange based in Dubai, marked its milestone anniversary with the debut of an innovative...