Exploring CryptoSlate Alpha Unlock exclusive content and enhance your web3 experience with CryptoSlate Alpha, provided via Access Protocol. Discover more...

Last updated: April 16, 2024 17:27 EDT | 2 min read Grant Martin, the former Chief Compliance and Ethics Officer...

```html Trading in cryptocurrencies has seen the South Korean won outpace the U.S. dollar as the primary currency globally. A...

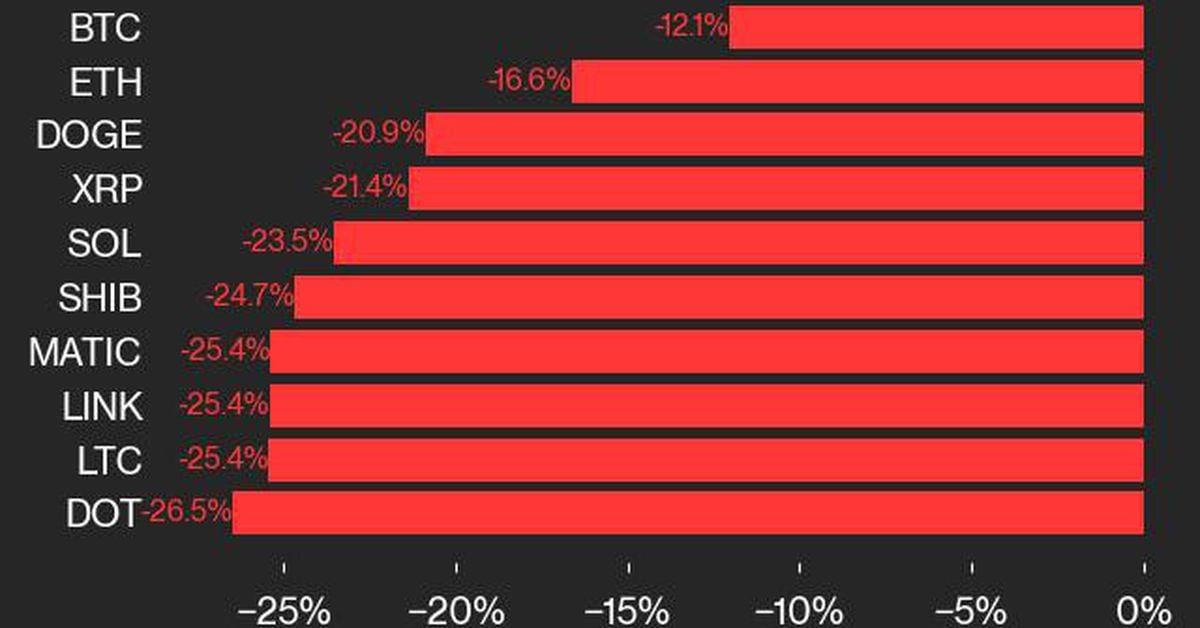

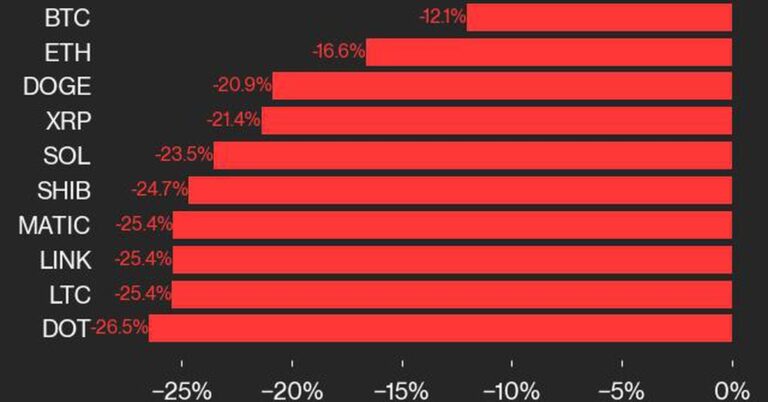

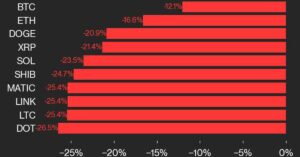

The CoinDesk Indices (CDI) provides a bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk...

Dubai, UAE, April 16, 2024 (GLOBE NEWSWIRE) -- CoinW, the world's pioneering cryptocurrency trading platform, will list MARU, an NFT...

Summary: NFTs ExplainedNFTs, or Non-Fungible Tokens, are digital assets that became popular in 2021. They represent ownership of digital assets...

```html Cryptocurrency represents a digital or virtual currency that operates via an automated payment network. It lacks physical representation, being...

Senate Majority Leader Chuck Schumer (D-NY) surprised and pleased longtime critics of his frequent role as Wall Street’s man in...

```html OKX, the fourth-ranking cryptocurrency exchange , announced the launch of its new layer-2 blockchain network, X Layer, now operational...

Improbable CEO and co-founder Herman Narula is the featured guest on this week's UKTN Podcast. Narula believes that the metaverse...