30% of Today’s Staked Ethereum Is Tied to Lido’s Liquid Staking, 8 ETH 2.0 Pools Command $8.1 Billion in Value – Blockchain Bitcoin News

In roughly three days Ethereum is predicted to transition from a proof-of-work (PoW) blockchain community to a proof-of-stake (PoS) model by way of The Merge. Forward of the transition, the liquid staking undertaking Lido has seen much more exercise as the worth locked within the protocol elevated by greater than 13% this week. Furthermore, the undertaking’s lido dao governance token has elevated 25.4% in opposition to the U.S. greenback through the previous seven days.

Lido TVL Jumps 13% Greater This Week, Mission’s Wrapped Ether Represents Extra Than 30% of Staked Ethereum

Final week, Bitcoin.com News reported on the decentralized finance (defi) undertaking Lido because the undertaking began seeing extra demand forward of The Merge. Lido Finance is a liquid staking undertaking that enables folks to wrap their crypto belongings with the intention to collect a staking yield, however the course of additionally permits house owners to carry the belongings in a non-custodial vogue and be capable of commerce them as effectively.

Lido affords liquid staking options for blockchains like Ethereum, Solana, Polygon, Polkadot, and Kusama. Nonetheless, many of the worth locked in Lido derives from locked ether, as ETH represents $7.61 billion of Lido’s $7.81 billion complete worth locked (TVL).

Through the previous seven days, metrics from defillama.com signifies that Lido’s TVL swelled by 13.08%, and the TVL has risen by 2.43% through the previous 24 hours. Whereas Makerdao is the biggest defi protocol immediately, by way of TVL stats, Lido is the second largest defi protocol on September 11.

The ether locked in Lido’s utility alone represents 12.60% of the $60.38 billion TVL in defi immediately. Lido’s wrapped ether spinoff token, STETH, is the thirteenth largest market capitalization out of the 12,907 tokens value $1.1 trillion. Lido’s governance token lido dao (LDO) has elevated 25.4% through the previous two weeks.

Three Larges Exchanges and eight Ethereum 2.0 Pools

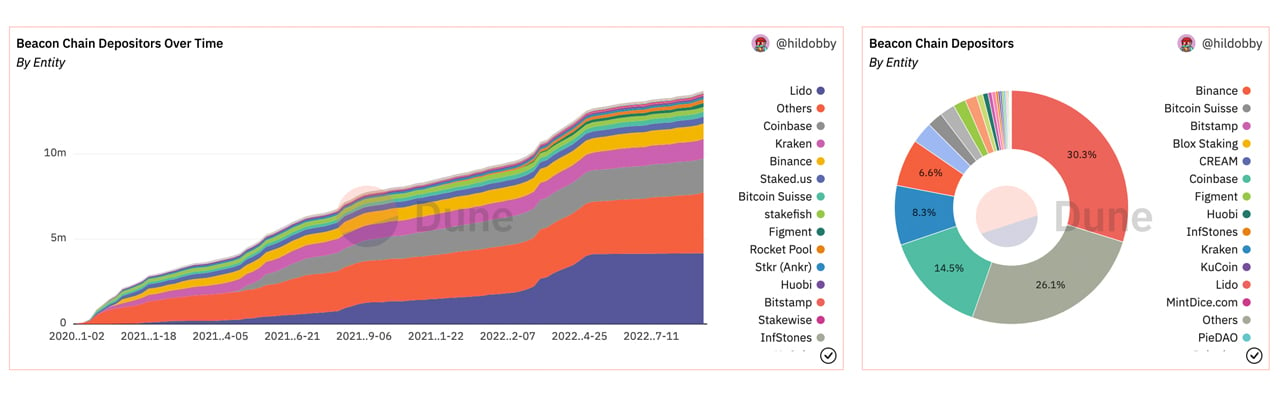

Information from Dune Analytics exhibits Lido is the biggest Beacon chain depositor with 30.3% of the deposits stemming from Lido Finance. Coinbase is second to Lido with 14.5% of the Beacon chain deposits and Kraken instructions 8.3%.

Coinbase just lately launched a liquid staking token known as coinbase wrapped ethereum (CBETH), and in mid-August a JPMorgan market analyst stated Coinbase could possibly be a cloth beneficiary of Ethereum’s Merge transition. At press time, there’s 13,638,351 ether locked into the ETH 2.0 contract and there are 426,198 validators. 30.49% of the 13.6 million ETH staked is staked by way of Lido Finance.

Moreover huge exchanges like Coinbase, Kraken, and Binance, Lido competes with Stkr, Sharedstake, Stafi, Stakewise, Cream, Stakehound, and Rocketpool. Between Lido, Rocketpool, Stakehound, Stakewise, Stafi, Sharedstake, and Stkr, there’s roughly $8.11 billion in worth.

Whereas Lido instructions 30.49% of the ETH staked, the aforementioned ETH 2.0 swimming pools signify 33.11% of the staked ether immediately. There’s 4,585,038 locked ether held between the eight ETH 2.0 swimming pools immediately.

Tags on this story

13 million ether, Binance, CBETH, Coinbase, coinbase wrapped ether, ETH 2.0, ETH 2.0 Contract, ETH liquid staking, ETH staked, Kraken, LDO, Lido, Lido Finance, Lido wrapped ether, Liquid Staking, liquid staking ETH, Rocketpool, Sharedstake, Stafi, Staked ETH, Stakehound, Stakewise, staking, STETH, Stkr, Validators

What do you consider the latest Lido Finance motion and the quantity of ether eight swimming pools have held? Tell us what you consider this topic within the feedback part under.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

Extra Well-liked News

In Case You Missed It

Source link

#Todays #Staked #Ethereum #Tied #Lidos #Liquid #Staking #ETH #Pools #Command #Billion #Blockchain #Bitcoin #News