A Bitcoiner’s Guide To Proof-Of-Stake

That is an opinion editorial by Scott Sullivan.

Usually Bitcoiners don’t care an excessive amount of about what goes on in Shitcoin-land, however now that Ethereum has merged to proof-of-stake (PoS), there’s been fairly the thrill on Bitcoin Twitter. Of course, the Bitcoin community itself will stay unaffected, however I feel this “upgrade” remains to be price paying some consideration to. Now that Ethereum has cleansed itself of the “dirty” and “wasteful” externalities related to proof-of-work (PoW), we will anticipate the gloves to return off within the narrative warfare, and I feel Bitcoiners needs to be able to punch again.

Studying how PoS works is a very good method to internalize the variations and trade-offs between PoW and PoS. Despite the fact that I had seen all of the high-level arguments in opposition to PoS earlier than — that PoS is extra permissioned, centralizing, and oligarchical — I’ll admit that with out trying into the small print, all of it felt form of hand-wavy. By really diving into the PoS algorithm, we will start to see how all these properties naturally emerge from first rules. So for those who’re inquisitive about how the PoS algorithm works, and why it results in these sorts of properties, then learn on!

Fixing The Double-Spend Downside

Let’s begin with a fast recap of the issue we’re attempting to unravel. Suppose now we have a big group of individuals in a cryptocurrency community attempting to take care of a decentralized ledger. Right here’s the issue: How can new transactions be added to everybody’s ledger, such that everybody agrees on which new transactions are “correct”? PoW solves this drawback fairly elegantly: Transactions are grouped collectively in blocks, whereby every block takes a considerable amount of computational work to provide. The quantity of labor required can transfer up or down to make sure blocks are produced each ten minutes on common, giving every new block loads of time to propagate all through the community earlier than the subsequent one is created. Any ambiguity is resolved by choosing the chain with essentially the most work, and double-spending is prevented on account of requiring at the least 51% of the worldwide hashpower for a double-spend block to catch up.

However suppose now we need to throw away Satoshi Nakamoto’s key perception that made all of this attainable within the first place. In spite of everything, these pesky ASICs are loud and annoying, they usually eat extra power than all of George Soros, Invoice Gates and Hillary Clinton’s personal jets mixed. Is there a way we will unambiguously agree on which transactions are true simply by speaking it out?

Ethereum’s proof-of-stake proposes to unravel this drawback utilizing two key elements. The primary is to make particular “checkpoint blocks” now and again, whose objective is to present assurance to everybody within the community in regards to the “truth” of the system at numerous time limits. Making a checkpoint requires a two-thirds majority vote by stake, so there may be some assurance that almost all of validators agreed on what the reality really was at that time limit. The second ingredient is to punish customers for including ambiguity to the community, a course of referred to as “slashing.” For instance, if a validator had been to create a fork, or vote on an older sidechain (much like a 51% assault), then their stake would get slashed. Validators may also be slashed for inactivity, however not as a lot.

This leads us to our first precept behind PoS, which is that PoS relies on a unfavourable (penalty-based) incentive system.

This contrasts closely with Bitcoin and proof-of-work, which is a optimistic (reward-based) incentive system. In Bitcoin, miners can try to interrupt the foundations — badly formatted blocks, invalid transactions, and so forth — however these blocks will simply get ignored by full nodes. The worst-case situation is a little bit of wasted power. Miners are additionally free to construct on older blocks, however with out 51% of the hashpower, these chains won’t ever catch up, once more simply losing power. Any miner who participates in these actions, whether or not deliberately or not, needn’t fear about shedding their collected bitcoin or mining machines, however they gained’t get new rewards. Quite than reside in concern, bitcoin miners can err on the facet of taking motion and danger.

The world is a really totally different place for validators dwelling in Ethereum-land. As a substitute of working onerous and being rewarded for including safety to the community, validators do no precise work, however have to be cautious that their node by no means misbehaves, lest they watch their financial savings go up in flames. If any proposed modifications had been made to the community, a validator’s first intuition could be to adjust to no matter everybody else was doing, or else danger getting slashed. To be a validator is like strolling on eggshells on a regular basis.

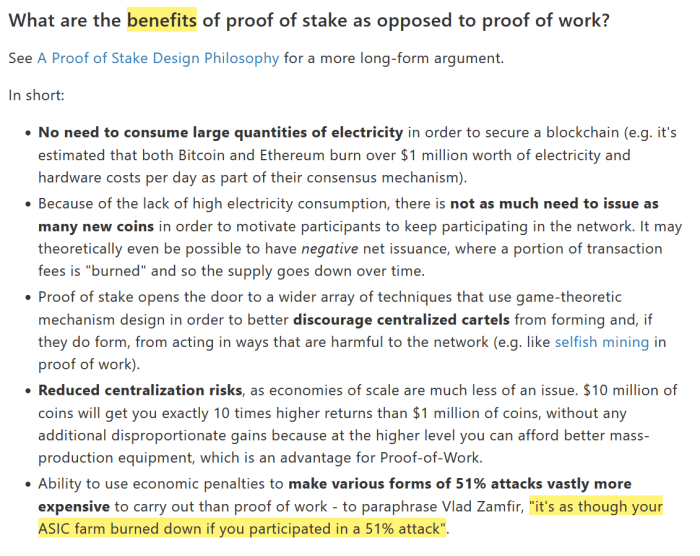

(Source)

By the best way, dwelling underneath a unfavourable incentive system is likely one of the, ahem, “benefits” of proof-of-stake, in line with the Ethereum community’s co-founder Vitalik Buterin’s FAQ:

(Source)

So how would slashing really work on a technical stage? Wouldn’t we have to first create a listing of all of the validators, with a purpose to have one thing to slash within the first place? The reply is sure. To turn out to be a validator in Ethereum, one should first transfer ETH right into a particular “staking” tackle. Not solely is that this checklist wanted for slashing, but in addition for voting since a two-thirds majority vote is required for checkpoint blocks.

There are some attention-grabbing implications to sustaining a listing of all validators always. How onerous is it to hitch? How onerous is it to go away? Do validators get to vote on the standing of different validators?

This brings us to our second precept behind PoS, which is that PoS is a permissioned system.

Step one in turning into a validator is to deposit some ETH right into a particular staking tackle. How a lot ETH? The minimal required is 32 ETH, or about $50,000 on the time of this writing. For context, an honest bitcoin mining rig sometimes runs within the single-digit 1000’s of {dollars}, and a house miner can begin with a single S9 for a couple of hundred bucks. To be truthful, ETH’s excessive entry charge has a technical justification, since a better stake means fewer validators, which lowers bandwidth.

So the deposit charge is excessive, however at the least anybody who owns 32 ETH is free to hitch or depart at any time, proper? Not fairly. There are security risks if massive coalitions of validators had been to all enter or exit on the identical time. For instance, if a majority of the community all left without delay, then they may double-spend a finalized block by replaying a fork during which they by no means left, with out getting slashed on both chain. To mitigate this danger, the on- and off-ramps have a built-in throughput restrict. At the moment this limit is about to max(4,|V|/65536) validators per epoch (each 6.4 minutes), and is similar for each coming into and leaving. This interprets roughly to 1 full validator set each ten months.

By the best way, although it’s at present attainable for validators to publish an “exit” transaction and cease validating, the code to really withdraw funds hasn’t even been written but. Sounds a bit like “Hotel California” …

(Source)

There’s one final level in regards to the incentives behind approving new validators. Suppose you had been a shareholder in a big and secure firm paying common dividends each quarter. Would it not make sense to present new shares away totally free? Of course not, since doing so would dilute the dividends of all present shareholders. The same incentive construction exists in PoS, since every new validator dilutes the income of all present validators.

In idea, validators may merely censor each single transaction that provides a brand new validator; nonetheless, in apply, I feel such a blunt strategy could be unlikely. This may be very noticeable and would destroy Ethereum’s picture of “decentralization” in a single day, doubtlessly crashing the worth. I feel a extra refined strategy could be used as an alternative. For instance, the foundations may slowly change over time making it more durable to turn out to be a validator, with excuses being supplied comparable to “security” or “efficiency.” Any insurance policies that enrich present validators on the expense of recent validators would have monetary tailwinds, whether or not spoken out loud or not. We are able to begin to see why PoS would have a tendency in direction of oligarchy.

(Source)

Overview Of The Casper Algorithm

Now that we all know the high-level technique behind PoS, how does the algorithm really work? The principle concepts behind checkpoints and slashing had been put ahead in an algorithm referred to as Casper, so we’ll begin there. Casper itself doesn’t really specify something about easy methods to produce blocks, however somewhat supplies a framework for easy methods to superimpose a checkpoint/slashing technique on prime of some already-existing blockchain tree.

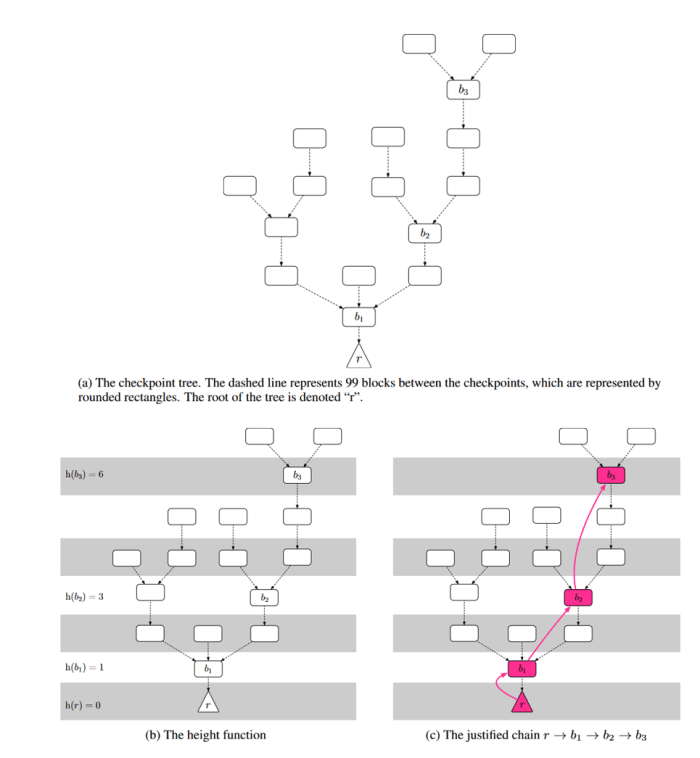

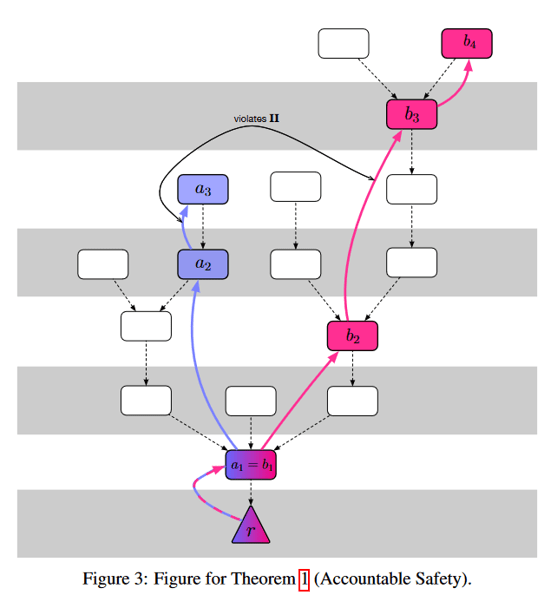

First, some arbitrary fixed (C) is chosen to be the “checkpoint spacing” quantity, which determines what number of blocks happen between checkpoints; for instance, if C=100 then checkpoints would happen at blocks 0, 100, 200, and so forth. Then the nodes all vote on which checkpoint block needs to be the subsequent “justified” checkpoint. Quite than vote on single blocks in isolation, validators really vote on (s,t) checkpoint pairs, which hyperlink some beforehand justified checkpoint supply “s” to some new goal checkpoint “t.” As soon as a checkpoint hyperlink (s,t) will get a two-thirds majority vote by stake, then “t” turns into a brand new justified checkpoint. The diagram beneath reveals an instance tree of checkpoints:

(Source)

On this diagram, the h(b) operate is referring to the “checkpoint height,” e.g., the block’s a number of of 100. You will have observed that not each hundredth block is essentially justified, which might occur if the vote failed at a sure peak. For instance, suppose at peak 200 two separate checkpoints every acquired 50% of the vote. Since voting twice is a slashable offense, the system would get “stuck” except some validators willingly slashed their very own stake to attain a two-thirds vote. The answer could be for everybody to “skip” checkpoint 200 and “try again” at block 300.

Simply because a checkpoint is justified, doesn’t imply it’s finalized. To ensure that a checkpoint to rely as finalized, it have to be instantly adopted by one other justified checkpoint on the subsequent attainable peak. For instance, if checkpoints 0, 200, 400, 500 and 700 had been all justified and linked collectively, solely checkpoint 400 would rely as “finalized,” since it’s the just one instantly adopted by one other justified checkpoint.

As a result of the terminology may be very exact, let’s recap our three classes. A “checkpoint” is any block which happens at peak C*n, so if C=100, each block with peak 0, 100, 200, 300, and so forth would all be checkpoints. Even when a number of blocks had been created at peak 200, they might each be “checkpoints.” A checkpoint is then “justified” if it’s both the foundation block at peak 0, or if two-thirds of the validators voted to create a hyperlink between some beforehand justified checkpoint and the present checkpoint. A justified checkpoint is then “finalized” if it then hyperlinks to a different justified checkpoint on the subsequent attainable peak. Not each checkpoint essentially turns into justified and never each justified checkpoint essentially turns into finalized, even within the closing chain.

Casper Slashing Guidelines

The slashing guidelines in Casper are designed such that it’s inconceivable for 2 finalized checkpoints to exist in two separate forks, except at the least one-third of the validators broke the slashing guidelines.

In different phrases, solely finalized checkpoints ought to ever be counted as unambiguous “truth” blocks. It’s even attainable for 2 justified checkpoints to happen on each side of a fork, simply not two finalized checkpoints. There’s additionally no assure about when or the place the subsequent finalized checkpoint will happen, simply that if a series break up had been to happen, then it’s best to sit again and wait till a finalized block reveals up someplace, and as soon as it does then you realize that’s the “correct” chain.

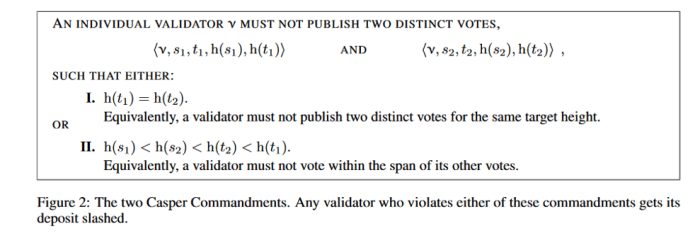

There are two slashing guidelines in Casper which implement this property:

(Source)

The primary rule forbids anybody from double-voting on checkpoints with the identical goal peak, so if a validator voted for 2 totally different checkpoint blocks with goal peak 200, that might be a slashable offense. The aim of this rule is to forestall the chain from splitting into two totally different justified checkpoints with the identical peak, since this may require 2/3 + 2/3 = 4/3 of the overall validator votes, implying that at the least one-third of the validators broke the slashing guidelines. Nevertheless, as we noticed beforehand, it’s attainable for justified checkpoints to “skip” sure block heights. What prevents a series from splitting into totally different goal heights? For instance, couldn’t checkpoint 200 fork into justified checkpoints at 300 and 400 with out anybody getting slashed?

That’s the place the second rule is available in, which principally prevents validators from “sandwiching” votes inside different votes. For instance, if a validator voted for each 300→500 and 200→700, that might be a slashable offense. Within the case of a series break up, as soon as one department sees a finalized checkpoint, it turns into inconceivable for the opposite department to see a justified checkpoint afterwards except at the least one-third of the validators broke rule #2.

To see why, suppose the blockchain forked into justified checkpoints 500→800 and 500→900, then in some unspecified time in the future the primary chain noticed a finalized checkpoint with hyperlink 1700→1800. Since each 1700 and 1800 can solely be justified on fork #1 (assuming no one broke the primary slashing rule), the one means fork #2 may see a justified checkpoint after 1800 is that if there was some voted-in hyperlink between heights H<1700 and H>1800. However since this vote would “sandwich” the 1700→1800 hyperlink and require a two-thirds vote, and the 1700→1800 already handed with a two-thirds vote, then at the least one-third of the validators would want to interrupt rule #2. The Casper paper has a pleasant diagram demonstrating this property:

(Source)

And that’s it, simply comply with the Casper guidelines and also you’re good!

(Source)

Appears fairly easy, proper? I’m certain PoS would solely ever use slashing as an absolute final resort to take care of consensus, and never as an extortionary mechanism to stress validators into behaving a sure means … proper?

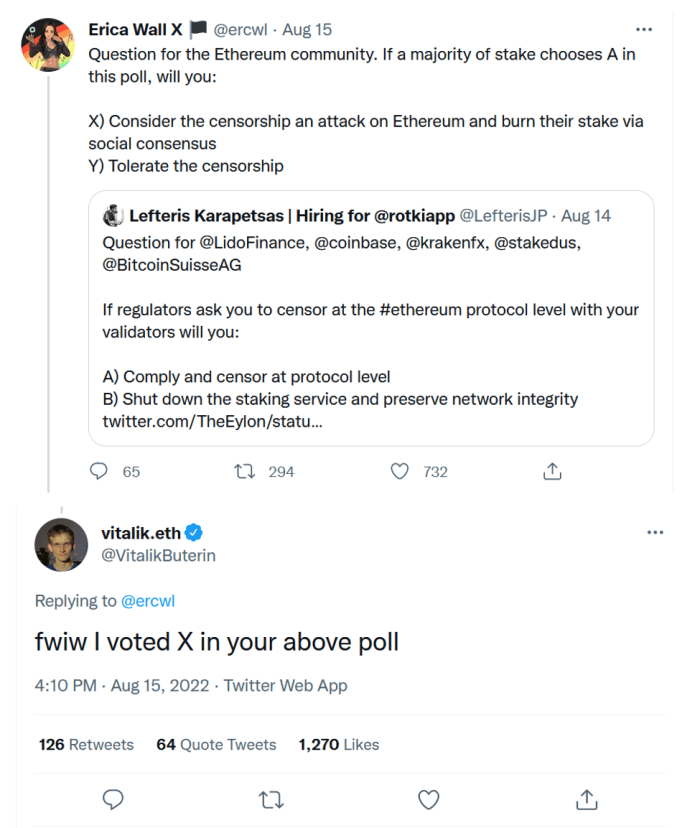

(Source)

This brings us to our third precept behind PoS: There aren’t any guidelines. The “rules” are no matter everybody else says they’re.

(Source)

Someday your node may very well be technically following each Casper commandment to the letter, and the subsequent day your financial savings may very well be slashed since you had been doing one thing everybody else didn’t like. Authorised a “team red” transaction that one time? Tomorrow the “team blue” majority may slash you. Or perhaps you probably did the alternative and omitted too many “team red” transactions? Tomorrow the “team red” majority may slash you for censorship. The flexibility to slash goes far past the restricted scope of OFAC (Office of Overseas Property Management) censorship. PoS is sort of a nonstop Mexican standoff, the place the implicit menace of slashing is ever-present always.

(Source)

I wouldn’t be stunned if in a contentious onerous fork, each side hard-coded the validation guidelines of the opposite fork, simply in case they wished to punish anybody who joined the “wrong” facet. Of course, this may be a nuclear possibility, and like nukes, either side may solely select to strike in retaliation. I might guess that the majority particular person validators are impartial in that they might prioritize monetary self-preservation over political self-sacrifice, however may outwardly take a facet in the event that they sensed that was the right transfer to keep away from getting slashed.

What Time Is It?

Now that we all know the fundamentals of checkpoints and slashing, we will transfer onto the precise algorithm utilized in Ethereum, referred to as Gasper. It is a portmanteau of Casper, which we’ve already lined, and GHOST, a method for choosing the “best” chain of blocks in between checkpoints.

The very first thing to grasp about Gasper is that point itself is the principle unbiased variable. Actual-world time is split into twelve-second models referred to as “slots,” the place every slot comprises at most one block. These slots then type bigger teams referred to as “epochs,” the place every epoch refers to 1 checkpoint. Every epoch comprises 32 slots, making them 6.4 minutes lengthy.

It’s price noting that this paradigm flips the causal relation between time and block manufacturing when in comparison with PoW. In PoW, blocks are produced as a result of a legitimate hash was discovered, not as a result of sufficient time had handed. However in Gasper, blocks are produced as a result of sufficient real-world time has handed to get to the subsequent slot. I can solely think about the tough timing bugs such a system might encounter, particularly when it’s not only one program working on one laptop, however tens of 1000’s of computer systems attempting to run in sync everywhere in the world. Hopefully, the Ethereum builders are conversant in the falsehoods programmers believe about time.

Now suppose you had been beginning up a validator node, and also you had been syncing the blockchain for the primary time. Simply since you noticed that sure blocks referenced sure timestamps, how may you ensure that these blocks had been actually produced at these instances? Since block manufacturing doesn’t require any work, couldn’t a malicious group of validators simulate a wholly pretend blockchain from day one? And for those who noticed two competing blockchains, how would you realize which is true?

This brings us to our fourth precept behind PoS, which is that PoS depends on subjective reality.

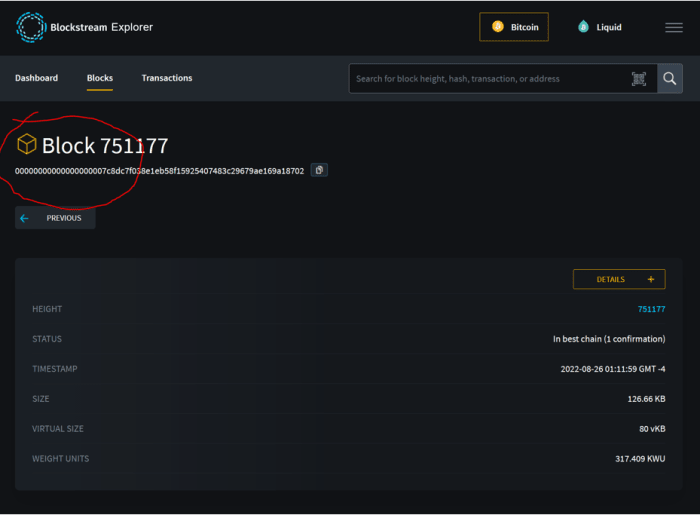

There’s merely no goal method to decide between two competing blockchains, and any new nodes to the community should in the end belief some present supply of reality to resolve any ambiguity. This contrasts considerably with Bitcoin, the place the “true” chain is at all times the one with essentially the most work. It doesn’t matter if a thousand nodes are telling you chain X, if a single node broadcasts chain Y and it comprises extra work, then Y is the right blockchain. A block’s header can show its personal price, fully eradicating the necessity for belief.

(Source)

By counting on subjective reality, PoS reintroduces the necessity for belief. Now I’ll admit, I’m maybe barely biased, so if you wish to learn the opposite facet, Buterin wrote an essay containing his views here. I’ll admit that in apply, a series break up doesn’t appear all that doubtless given the Casper guidelines, however regardless, I do get some peace of thoughts figuring out that this isn’t even a chance in Bitcoin.

Block Manufacturing And Voting

Now that we’re conversant in slots and epochs, how are particular person blocks produced and voted on? In the beginning of every epoch, the complete validator set is “randomly” partitioned into 32 teams, one for every slot. Throughout every slot, one validator is “randomly” chosen to be the block producer, whereas the others are chosen to be the voters (or “attestors”). I’m placing “randomly” in quotes as a result of the method have to be deterministic, since everybody should unambiguously agree on the identical validator units. Nevertheless this course of should even be non-exploitable, since being the block producer is a extremely privileged place because of the further rewards obtainable from miner extractable worth (MEV), or because it’s being renamed, “maximum extractable value.” “Ethereum Is A Dark Forest” is a superb learn on this.

As soon as a block is produced, how do the opposite validators vote or “attest” to it? Block proposal is meant to occur throughout the first half (six seconds) of a slot, and testifying throughout the second half, so in idea there needs to be sufficient time for the attestors to vote on their slot’s block. However what occurs if the block proposer is offline or fails to speak or builds on a nasty block? The job of an attestor isn’t essentially to vote on that slot’s block, however somewhat whichever block “looks the best” from their view at that time limit. Underneath regular circumstances it will often be the block from that slot, however is also an older block if one thing went fallacious. However what does “look the best” imply, technically? That is the place the GHOST algorithm is available in.

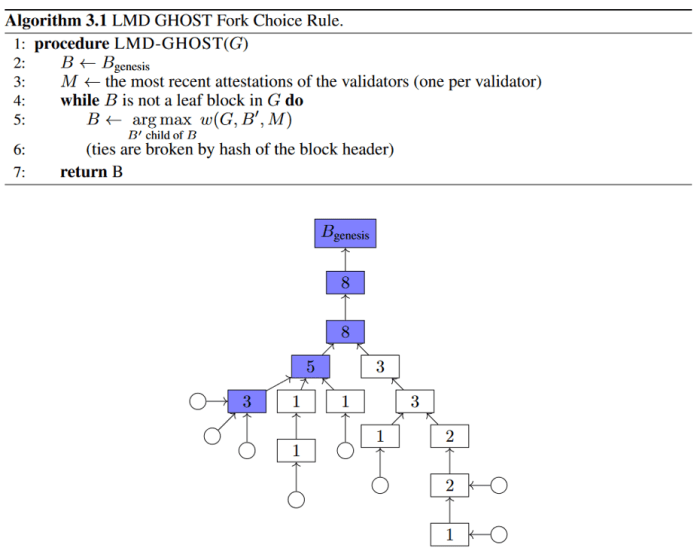

GHOST stands for “Greediest Heaviest Observed SubTree” and is a grasping recursive algorithm for locating the block with essentially the most “recent activity.” Mainly, this algorithm appears in any respect the current blocks within the type of a tree, and walks down the tree by greedily choosing the department with essentially the most cumulative attestations on that total subbranch. Solely the latest attestation of every validator counts in direction of this sum, and ultimately this course of lands on some leaf block.

(Source)

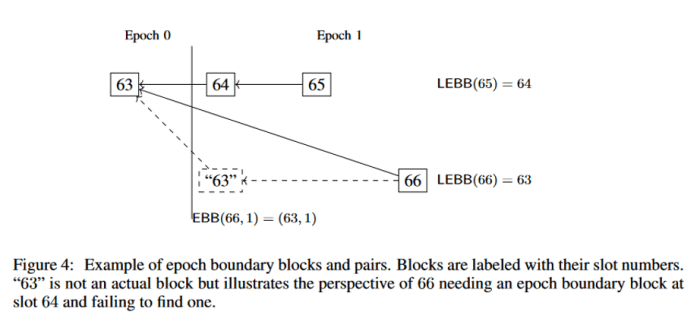

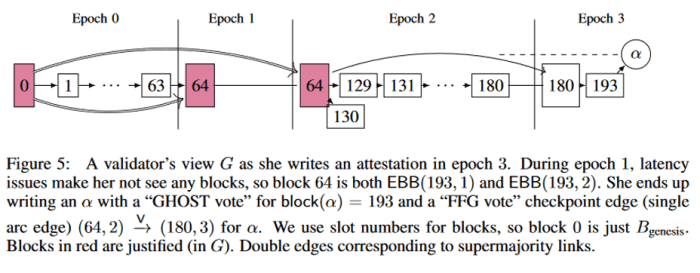

Attestations usually are not simply votes for the present greatest block, but in addition the for the latest checkpoint which result in that block. It’s price noting in Gasper, checkpoints are based mostly on epochs somewhat than block heights. Every epoch refers to precisely one checkpoint block, which is both the block in that epoch’s first slot, or if that slot was skipped, then the latest block earlier than that slot. The identical block can theoretically be a checkpoint in two totally different epochs if an epoch someway skipped each single slot, so checkpoints are represented utilizing (epoch, block) pairs. Within the diagram beneath, EBB stands for “epoch boundary block” and represents the checkpoint for a particular epoch, whereas “LEBB” stands for “last epoch boundary block” and represents the latest checkpoint total.

(Source)

Just like Casper, a checkpoint turns into justified as soon as the overall variety of attestations passes the two-thirds threshold, and finalized if it was instantly adopted by one other justified checkpoint within the subsequent epoch. An instance of how this voting works is proven beneath:

(Source)

There are two slashing circumstances in Gasper, that are analogous to the slashing guidelines in Casper:

No voting twice in the identical epoch.No vote can comprise epoch checkpoints which “sandwich” one other vote’s epoch checkpoints.

Regardless of being based mostly on epochs as an alternative of block heights, the Casper guidelines nonetheless be sure that no two finalized checkpoints can happen on totally different chains except one-third of the validators may very well be slashed.

It’s additionally price noting that attestations are included within the blocks themselves. Just like how a block in PoW justifies itself utilizing its hash, a finalized checkpoint in PoS justifies itself utilizing all of its previous attestations. When somebody does break the slashing guidelines, these unhealthy attestations are included in a block which proves the violation. There’s additionally a small reward for the block producer who included the violation, with a purpose to present an incentive to punish rulebreakers.

Forks

It’s attention-grabbing to consider what would occur within the case of a fork. To rapidly recap, a fork refers to a change within the consensus guidelines, they usually are available in two varieties: onerous forks and gentle forks. In a tough fork, the brand new guidelines usually are not backwards-compatible, doubtlessly leading to two competing blockchains if not everybody switches over. In a gentle fork, the brand new guidelines are extra restrictive than the outdated guidelines, whereas preserving them backwards-compatible. As soon as over 50% of the miners or validators begin implementing the brand new guidelines, the consensus mechanism switches over with out splitting the chain. Smooth forks are typically related to upgrades and new transaction varieties, however additionally they technically embrace any kind of censorship enforced by a 51% majority. PoS additionally has a 3rd kind of “fork” not current in PoW: a series break up with none modifications to the foundations. However since we’ve already lined this, we’ll deal with onerous and gentle forks.

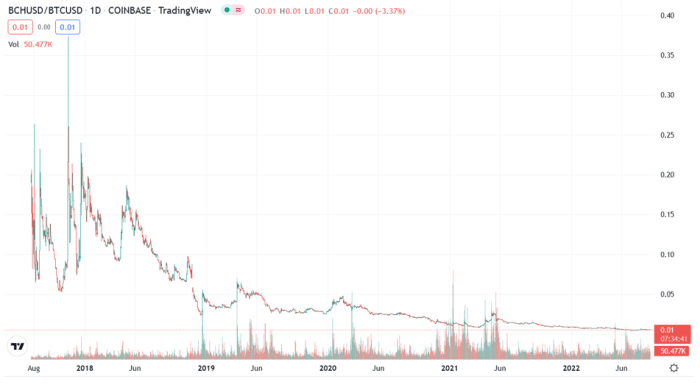

Let’s begin with the only case: a standalone contentious onerous fork. By contentious, I imply a rule change that divides the customers politically. A bug repair or minor technical change doubtless wouldn’t be contentious, however one thing like altering the validation reward in all probability could be. If a tough fork was contentious sufficient, it may end in a series break up and would get resolved economically by customers promoting one chain and shopping for the opposite. This may be much like the Bitcoin Money break up in 2017, which appears to have a transparent winner:

(Source)

Now suppose the validators had been sitting round in the future and determined they weren’t getting paid sufficient, and determined they need to elevate their rewards from 5% per 12 months to 10% per 12 months. This may be a transparent trade-off in favor of the validators on the expense of non-validators who would now be getting extra diluted. Within the occasion of a series break up, which chain would win?

This results in our fifth precept of PoS, which is that cash is energy.

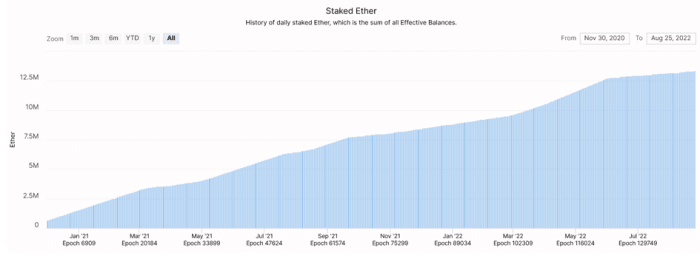

Out of the 120M ETH in existence, over 10% of that’s at present being staked, as seen within the chart beneath:

(Source)

Given a contentious onerous fork between the validators and non-validators, assuming that every one the non-validators market-sold the brand new chain and all of the validators market-sold the outdated chain, then in idea the outdated chain would win, for the reason that majority of ETH would nonetheless held by non-validators (90% versus 10%). However there’s a couple of extra issues to think about. First, after any chain break up, the validators would nonetheless be “in control” of each blockchains. If the validators had been in a position to affect the opposite chain, they could be incentivized to make it fail. Second, there’s additionally the nuclear possibility mentioned earlier, whereby the brand new chain may slash anybody nonetheless validating the outdated chain to stress them into becoming a member of. Lastly, the validators would doubtless carry vital social and political affect over everybody else within the community. If Buterin, the Ethereum Basis and the exchanges all determined in unison they had been going to boost the staking reward, I discover it tough to consider that common Ethereum customers and validators may preserve the outdated fork going whereas additionally making it extra invaluable by way of shopping for stress.

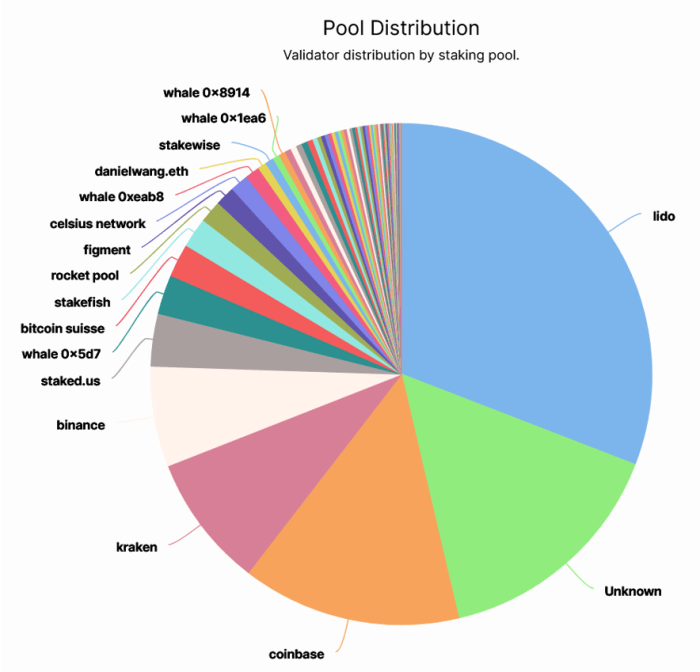

Transferring on to gentle forks, what would occur in a contentious gentle fork, comparable to OFAC censorship? The validators are pretty centralized, as we will see within the chart beneath:

(Source)

In contrast to PoW the place miners can change swimming pools on the press of a button, validators in Ethereum are locked right into a staking tackle till they course of an exit transaction. If Lido and the highest exchanges had been made to censor sure transactions, they may simply cross the two-thirds majority wanted for deciding checkpoints. Earlier, we noticed how Buterin and the opposite ETH validators may attempt to counter a censorship gentle fork with their very own counter-censorship onerous fork, whereas slashing the censors within the course of. Even when they succeeded in making a fork, a number of worth could be destroyed within the course of, each from the slashing and from a lack of belief.

Closing Ideas

On this essay, we checked out how PoS solves the double-spend drawback with Gasper, a mix of checkpoint/slashing guidelines referred to as Casper, and a “best block” voting rule referred to as GHOST. To recap, Gasper divides time into models referred to as slots, the place every slot can have at most one block, and the slots are grouped into epochs, the place every epoch refers to 1 checkpoint. If a two-thirds majority votes on a checkpoint, it turns into justified, and if two justified checkpoints happen in a row, the primary of these two checkpoints turns into finalized. As soon as a checkpoint turns into finalized, it turns into inconceivable for a parallel chain to be finalized, except one-third of the validators may get slashed.

On this course of we uncovered 5 rules of PoS:

PoS makes use of a unfavourable (penalty-based) incentive construction.PoS is a permissioned system.PoS has no guidelines.PoS depends on subjective reality.In PoS, cash is energy.

Every of those rules has reverse habits in PoW:

PoW makes use of a optimistic (reward-based) incentive system.PoW is a permissionless system (anybody can begin or cease mining at any time).In PoW, forks which change the foundations get ignored.PoW depends on goal reality.In PoW, miners serve the customers and have little energy themselves.

I consider everybody ought to attempt to create the form of world that they need to reside in. If, like me, you need to reside in a permissionless world the place you possibly can have management over your cash, the place onerous work is rewarded and passive possession is a legal responsibility and the place your cash will retailer its worth far into the longer term with out altering on a whim, then chances are you’ll need to consider carefully in regards to the trade-offs between PoW and PoS, and combat in favor of the rules you need to reside by.

It is a visitor submit by Scott Sullivan. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.

Source link

#Bitcoiners #Guide #ProofOfStake