Aave DAO Approves the Launch of a Collateral-Backed Stablecoin Called GHO – Bitcoin News

4 min read

On Sunday, the non-custodial market convention Aave reported that the Aave DAO has endorsed a new stablecoin for the environment called “GHO.” Aave Companies proposed the stablecoin during the principal seven day stretch of July and the guarantee upheld stablecoin will be fixed to the U.S. dollar’s value.

A New security Backed Stablecoin Crafted by Aave Companies Is Due to Launch After the Aave DAO Votes on Genesis Parameters

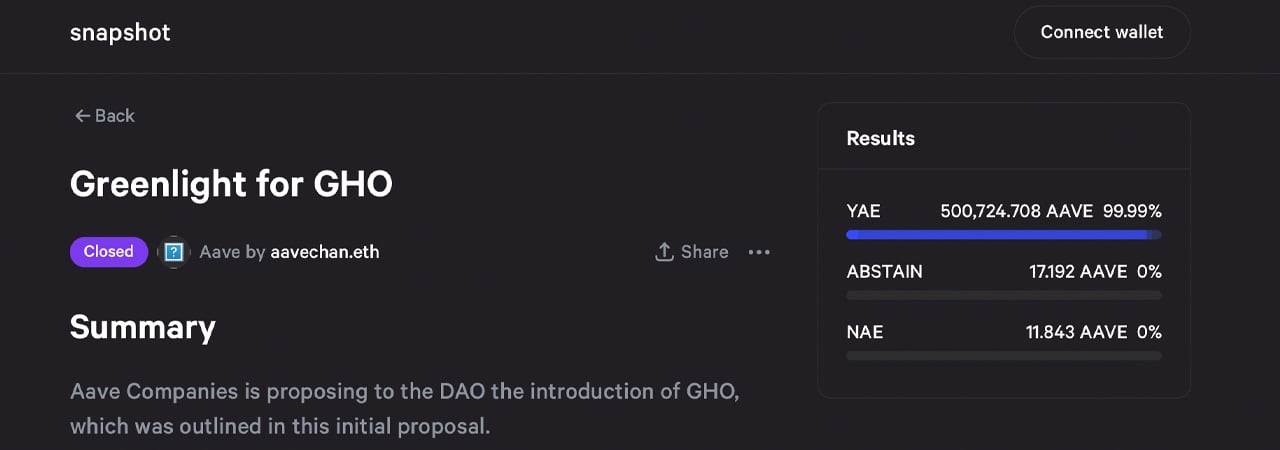

Aave explained on Sunday that the Aave decentralized independent association (DAO) endorsed a proposition to make a stablecoin token called “GHO.” “The community has given the green light for GHO,” the authority Aave Twitter account detailed. “The next step is voting on the genesis parameters of GHO, look out for a proposal next week on the governance forum.”

The GHO starting blog post, distributed on July 7, 2022, says the stablecoin will be “backed by a diversified set of crypto-assets chosen at the users’ discretion, while borrowers continue earning interest on their underlying collateral.” The administration proposition was endorsed by an extraordinary greater part of Aave DAO citizens, as over the vast majority of casting a ballot members casted a ballot for sending off GHO.

The administration proposition’s approval snapshot says GHO will “provide benefits for the community via the Aave DAO by sending 100% of interest payments on GHO borrows to the DAO” and GHO will be “administered by Aave governance.” Aave’s stablecoin will join the stablecoin economy, which is at present esteemed at $153 billion. Tether (USDT) drives the stablecoin pack and usd coin (USDC) follows behind USDT, as far as generally speaking business sector capitalization.

GHO will likewise join stablecoin crypto resources that influence guarantee resources and some that influence the strategy for over-collateralization. Makerdao’s DAI stablecoin is over-collateralized and Tron’s USDD is likewise over-collateralized, and that implies there’s more security than needed to cover the stablecoin’s supporting during seasons of outrageous market volatility.

“As a decentralized stablecoin on the Ethereum mainnet, GHO will be created by users (or borrowers),” Aave Companies’ blog entry about the subject makes sense of. The blog entry further adds:

Correspondingly, when a client reimburses a get position (or is exchanged), the GHO convention consumes that client’s GHO. All the premium installments gathered by minters of GHO would be straightforwardly moved to the Aave DAO depository; as opposed to the standard save factor gathered when clients get other assets.

Aave Companies Says Community Was Very Engaged With GHO Governance Proposal

Aave likewise has a local symbolic which is positioned 45 out of more than 13,000 crypto resources today. The computerized resource has a market valuation of around $1.46 billion and aave (AAVE) has expanded 84.7% during the last month. The open source decentralized loaning convention is the third biggest decentralized finance (defi) convention as far as complete worth locked. Data from defillama.com demonstrates that Aave has $6.59 billion locked on July 31. In mid-May, Aave sent off a Web3, brilliant agreements based web-based entertainment stage called the Lens Protocol. The Lens stage has in excess of 50 applications based on top of the Polygon (MATIC) network.

As far as the GHO stablecoin is concerned, Aave Companies said that the local area was “very engaged with the GHO proposal, providing incredibly helpful and informative feedback.” Aave itemized a portion of the things referenced by the local area the group will zero in on which incorporates DAO-set financing cost weaknesses, supply covers, a stake security module, and the “necessity for properly vetting potential facilitators.” For now, the local area should take part in deciding on the stablecoin’s beginning boundaries before the crypto token is issued.

Labels in this story

Aave, Aave DAO, insurance supported, security upheld stablecoin, local area vote, crypto token, decentralized independent association, decentralized finance, DeFi, Defi convention, GHO, GHO convention, GHO Stablecoin, Governance proposition, Lens Protocol, new stablecoin, Stablecoin, stablecoin issuance, Token, USD upheld token, Voting

What is your take on the impending Aave stablecoin project called GHO? Tell us your opinion regarding this matter in the remarks area underneath.

![]()

Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for enlightening purposes as it were. It’s anything but an immediate deal or requesting of a proposal to trade, or a suggestion or underwriting of any items, administrations, or organizations. Bitcoin.com doesn’t give speculation, charge, legitimate, or bookkeeping counsel. Neither the organization nor the writer is dependable, straightforwardly or in a roundabout way, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any happy, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Aave #DAO #Approves #Launch #CollateralBacked #Stablecoin #Called #GHO #Bitcoin #News