Amid vanishing Bitcoin whales, these BTC traders appear prepared to carry the fort

Retail traders present curiosity in Bitcoin, whereas whales appeared disinterested

Exercise on Bitcoin declines, nevertheless, BTC’s market cap dominance grows

In keeping with information supplied by Glassnode, it was noticed that the variety of addresses holding greater than 0.01 Bitcoin [BTC] had reached an all-time excessive. This was indicative of huge curiosity in Bitcoin coming from retail traders.

Are your BTC holdings flashing green? Check the profit calculator

David vs Goliath

The curiosity from retail traders can be noticed via Santiment’s information. In keeping with Santiment, Bitcoin addresses that have been holding anyplace from 0.01 BTC to 1000 BTC, began shopping for extra Bitcoin.

This shopping for spree occurred proper after Bitcoin’s costs dropped on the 15 December. It appeared that after the mentioned date, a number of retail traders determined to purchase BTC at a reduction.

Nevertheless, throughout the identical interval, addresses that holding 1,000 to 10,000 Bitcoins, began lowering. This meant that BTC whales had began to exit their positions and have been promoting their BTC.

Supply: Santiment

Glass half empty

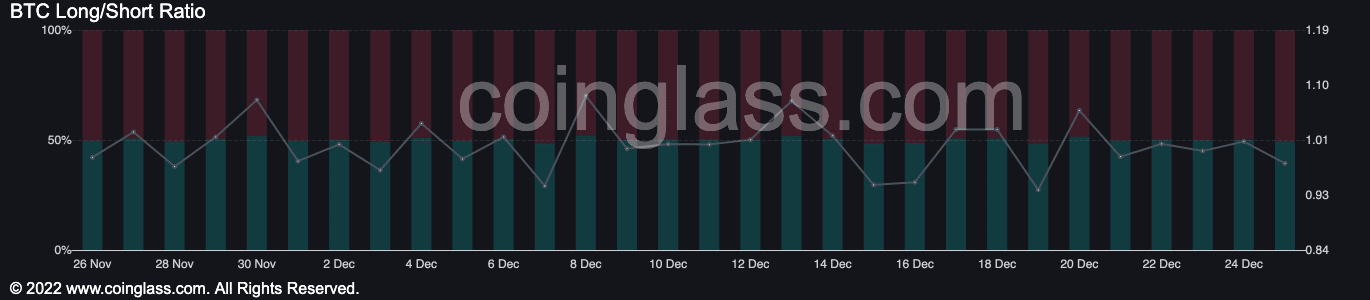

It appeared that giant addresses have been shedding religion in BTC. This sentiment was additionally shared by merchants. In keeping with information from Coinglass, the variety of brief positions taken in opposition to Bitcoin had elevated over the previous few days. At press time, 51% of merchants had taken brief positions in opposition to Bitcoin.

One of many causes for the rising variety of brief positions being taken in opposition to BTC may very well be the rising alternate reserve. In keeping with CryptoQuant, the alternate reserve had continued to rise, which indicated that the promoting stress on BTC might enhance.

Supply: coinglass

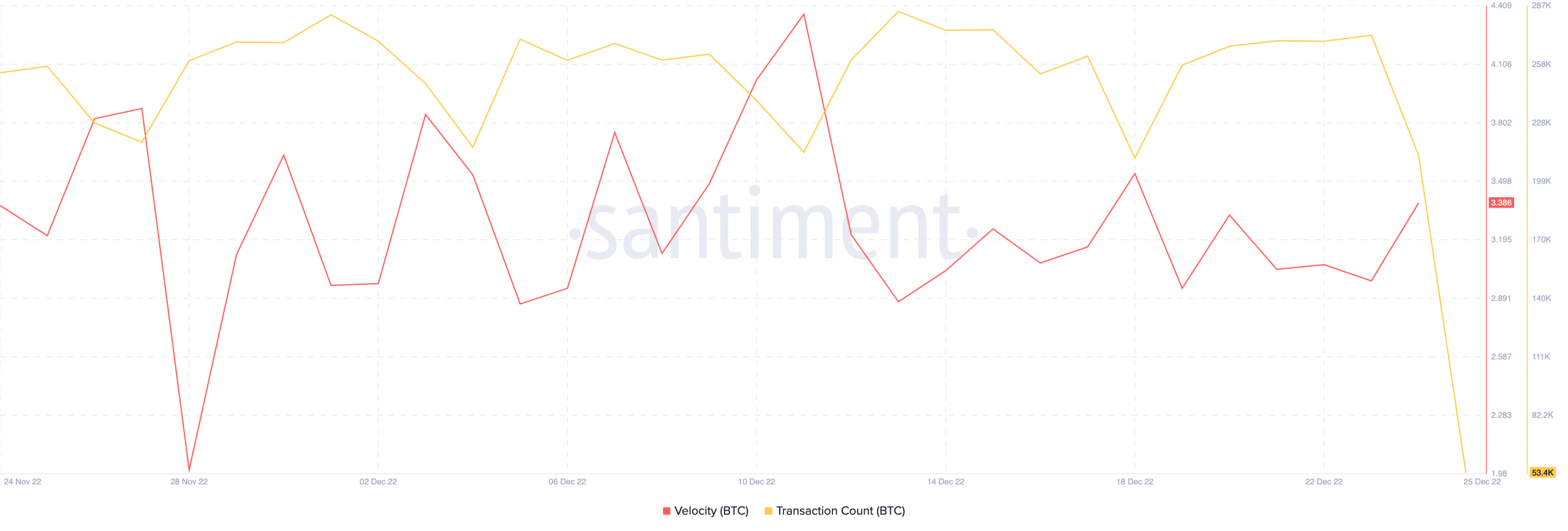

One other trigger for the pessimistic view that merchants have been protecting may very well be because of the declining exercise on Bitcoin’s community. In keeping with information supplied by Santiment, Bitcoin’s velocity fell considerably over the previous few days.

This indicated that the variety of occasions $BTC had been transferred amongst addresses had decreased. Coupled with a declining velocity, the variety of BTC transfers witnessed a drop as properly.

Supply: Santiment

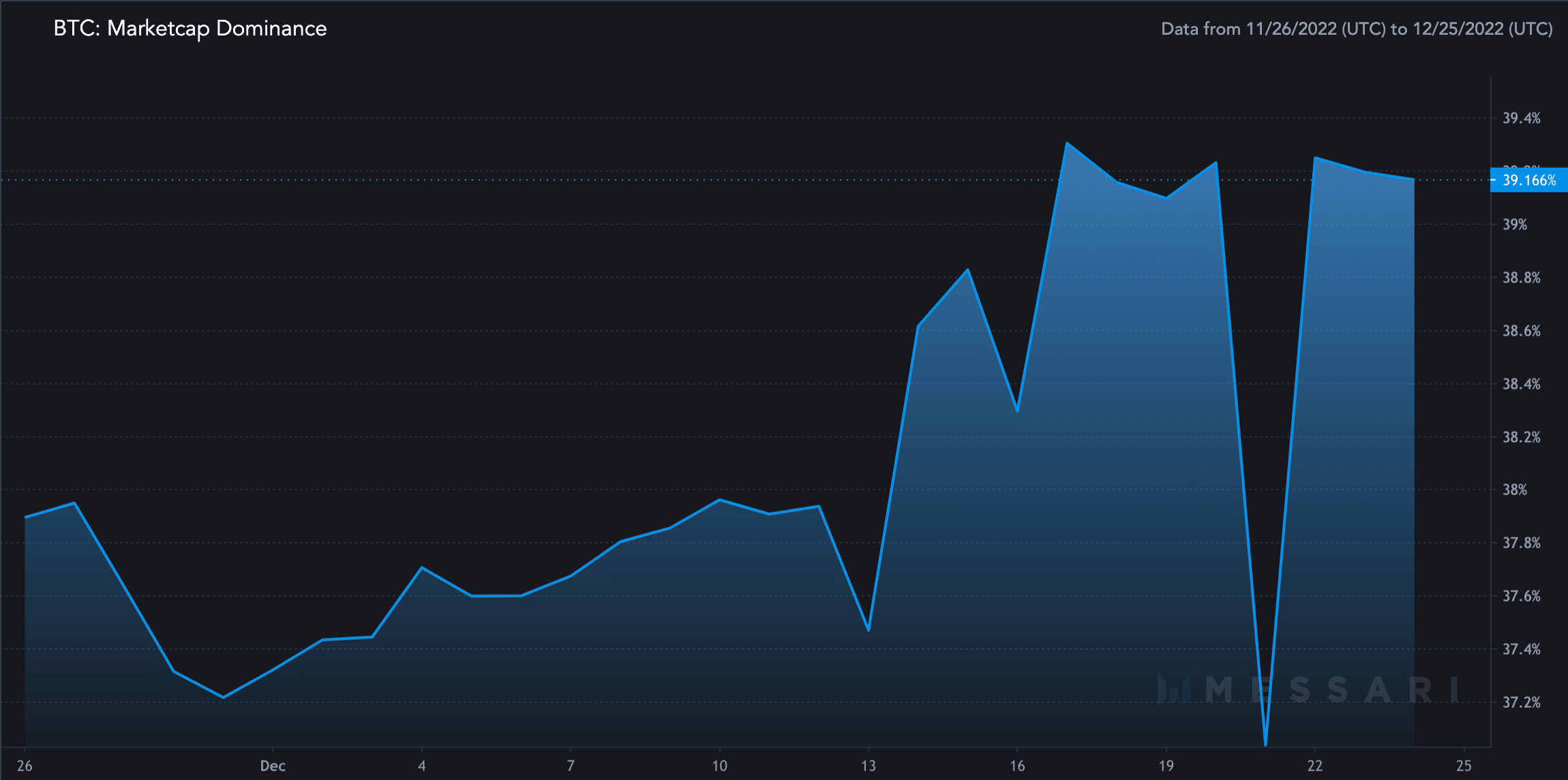

Bitcoin’s market cap dominance, nevertheless, was not affected by the shortage of exercise or dealer sentiment. Over the past month, Bitcoin’s market cap dominance grew immensely. In keeping with Messari’s information, Bitcoin had captured 39.16% of the general crypto market.

How a lot Bitcoin can you get for $1?

Coupled with a rising market cap dominance, the volatility surrounding BTC fell by 59.51% in keeping with Messari. This made shopping for BTC much less dangerous for traders.

Supply: Messari

It’s but to be decided whether or not retail traders’ religion trumps the pessimistic view whales and merchants are sharing.

On the time of writing, BTC was buying and selling at $16,840.85 and its value had fallen by 0.03%.

Source link

#vanishing #Bitcoin #whales #BTC #traders #prepared #maintain #fort