Bank of America Market Strategist Says ‘Summer Rally Is Over’ as Crypto and Stocks Slide Ahead of Fed Rate Hike This Week – Economics Bitcoin News

Digital forex markets, valuable metals, and shares dropped one other leg down on Monday following the drop markets noticed final Tuesday. Final week’s fall was one of many worst weeks in additional than three months as market strategists imagine a large Fed price hike is coming this week. Bank of America’s analysts led by Savita Subramanian believes the U.S. Federal Reserve “has more work to do,” and an aggressive central financial institution could also be “anathema for stocks that have benefited from low rates and disinflation.”

Crypto, Treasured Metals, Equities Present Volatility Ahead of Fed Rate Hike — Pseudonymous Analyst Plan B Says Bitcoin and the S&P 500 Are Correlated however Are ‘Completely Different Worlds’

A hawkish Fed could also be like repellent or kryptonite to property that profited from simpler financial coverage and stimulus, Bank of America’s market strategists led by Savita Subramanian said in a word this previous weekend. World property are having a tough begin on Monday as all 4 main inventory indexes on Wall Road began the day (9:30 a.m.) decrease following a ugly week of buying and selling exercise final week. By 3:00 p.m. (ET), benchmark shares noticed a slight rebound showcasing extreme market volatility and uncertainty.

Subramanian and his workforce predict the S&P 500 will lose one other 8% this 12 months, and he additional pressured that the “summer rally is over.” On Monday, digital forex markets slid 1.61% within the final 24 hours, and the crypto economic system is now simply above the $900 billion mark at $933.17 billion. Bitcoin (BTC) has misplaced 1.67% and ethereum (ETH) shed 1.79% in opposition to the U.S. greenback throughout the previous 24 hours.

Treasured metals like gold and silver noticed losses as effectively on Monday, as gold shed 0.12% and silver dipped by 0.74% in opposition to the dollar. Bitcoin markets have been extraordinarily correlated with U.S. equities, however some BTC market analysts imagine bitcoin is a really totally different animal.

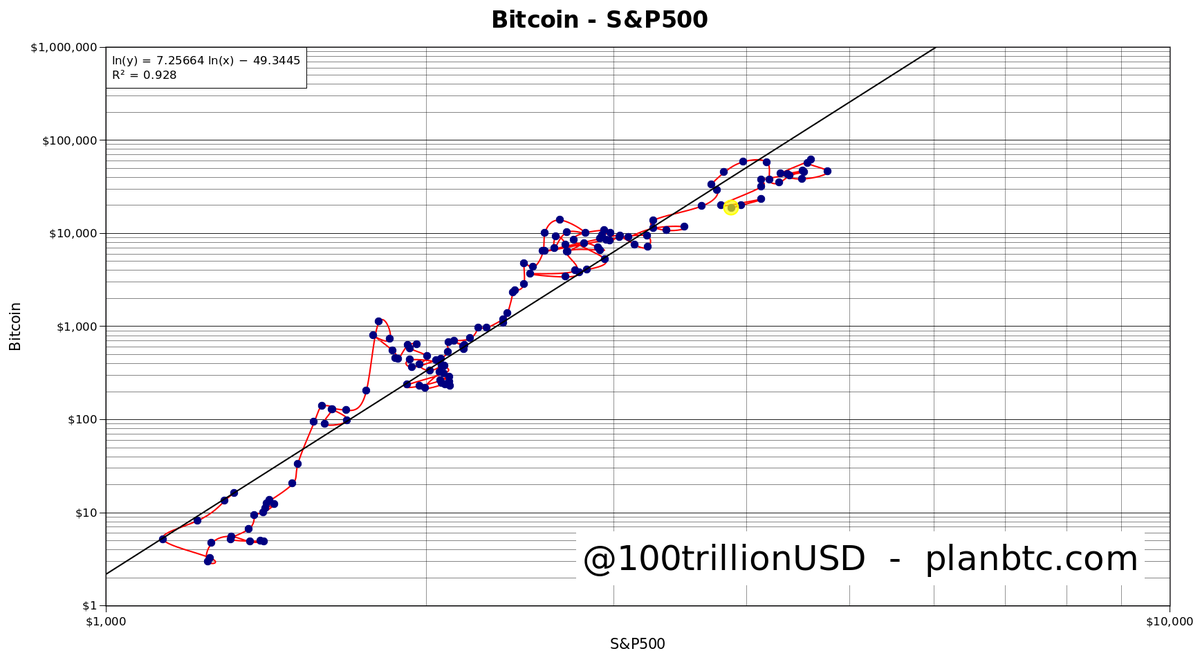

“[Bitcoin] and S&P 500 are correlated,” the pseudonymous analyst Plan B tweeted on Monday. “However, in the same period that S&P increased from ~$1K to ~$4K, [bitcoin] jumped from ~$10 to ~$20K. 4x versus 2000x … completely different worlds. Short-term moves are noise, long term trends are the signal.”

Chart shared by Plan B on September 19, 2022.

Chart shared by Plan B on September 19, 2022.

Bank of America Market strategists: ‘The Fed Has More Work to Do’ — Dollar Jumps Increased, 10-12 months Treasury Notes Faucet an 11-12 months Excessive

Within the meantime, economists and analysts suspect the U.S. Federal Reserve will increase the goal federal funds price by 75 foundation factors this week. Bank of America’s Subramanian detailed that “the Fed has more work to do” and classes from greater than 4 many years in the past can inform us so much about combating inflation.

“A hawkish Fed may be anathema for stocks that have benefited from low rates and disinflation (i.e. most of the S&P 500), but lessons from the ’70s tell us that premature easing could result in a fresh wave of inflation—and that market volatility in the short-run may be a smaller price to pay,” the Bank of America strategist’s word explains. Subramanian’s opinion follows the report Bank of America economists revealed in mid-July.

If the Fed’s not cautious one thing goes to interrupt. pic.twitter.com/inTtO7CZaP

— Sven Henrich (@NorthmanTrader) September 16, 2022

On the time, the financial institution’s economists mentioned it beforehand anticipated a “growth recession,” however the summer time forecast recommended a “mild recession in the U.S. economy this year.” On Monday, market analyst Sven Henrich quoted Fed chair Jerome Powell’s assertion throughout a press convention final June, when Powell said: “Clearly, today’s 75 basis point (bps) increase is an unusually large one, and I do not expect moves of this size to be common.” Henrich then mocked the Fed chair by noting the central financial institution is continuing to execute the third 75bps price hike in a row.

Whereas practically each asset class underneath the solar is exhibiting a robust connection to inflationary pressures and the Fed’s financial coverage, the U.S. greenback has continued to skyrocket in opposition to different fiat currencies. The U.S. Dollar Currency Index (DYX) tapped 109.756 on Monday afternoon (ET) and the euro has met parity with the greenback as soon as once more. A single Japanese yen equals $0.0070 per yen, and 10-year U.S. Treasury notes tapped an 11-year excessive at 3.518% on September 19.

Tags on this story

10-year T notes, 75 foundation level, 75 foundation factors, 75bps, Bank of America, Bank of America economists, Bank of America strategist, Bearish, Bears, benchmark, Central Bank, Crypto, crypto property, Greenback, DYX), economics, Fed, World Property, gold, Hiked Rate, jerome powell, Gentle recession, Plan B, Treasured Metals, Treasured metals (PMs), Rate Hike, Recession, S&P 500, Savita Subramanian, silver, shares, Sven Henrich, treasury notes

What do you consider the Bank of America market strategist’s opinion about an aggressive Fed and the S&P 500 shedding one other 8% by the 12 months’s finish? Tell us what you consider this topic within the feedback part under.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

Extra Well-liked News

In Case You Missed It

Source link

#Bank #America #Market #Strategist #Summer #Rally #Crypto #Stocks #Slide #Ahead #Fed #Rate #Hike #Week #Economics #Bitcoin #News