Bitcoin And Ethereum Are Parting Ways (ETH-USD)

Dennis Diatel Images

Produced by Ryan Wilday with Avi Gilburt and Jason Appel.

Incessant Decline

In my article “Red Flag In Crypto Miners,” apart from airing warning relating to the long-term prospects for Bitcoin (BTC-USD) mining, I acknowledged how crucial $16K is to my Bitcoin outlook. Whereas we have already got witnessed a one-year and 73% decline in Bitcoin costs from its 2021 excessive to its June low, breaking and sustaining under $16K may usher in a deeper bear market.

Weak Reversal

To date, Bitcoin has stayed above its $17,100 June low. On Aug. 14 it traded at $25,185, roughly 47% off the June low. However does this robust transfer point out the underside holds? Sadly, I can’t say that is the case as your complete transfer off the June low is corrective in construction. Additional, if a low goes to carry, we don’t need the worth to interrupt under the .764 retrace of the transfer off of that low. That stage is $19,100 and it was breached on September 6. And as of writing, Bitcoin has continued decrease on the hourly chart.

Which means that the June low may be very more likely to break and the crucial $16K stage is in danger.

Ether Power

Whereas Bitcoin and Ether are usually extremely correlated, Ethereum (ETH-USD) has fared a lot better. After dropping to $879 in June, it rallied again to $2026, or 131% off the low. What’s extra vital is that the rally to $2026 is just too excessive to be a fourth wave of the C wave that began down from Ether’s all-time highs. A excessive fourth wave ought to have held beneath $1780. And, lastly, the construction off of the June low may be known as a number one diagonal. This all signifies that the June low probably holds.

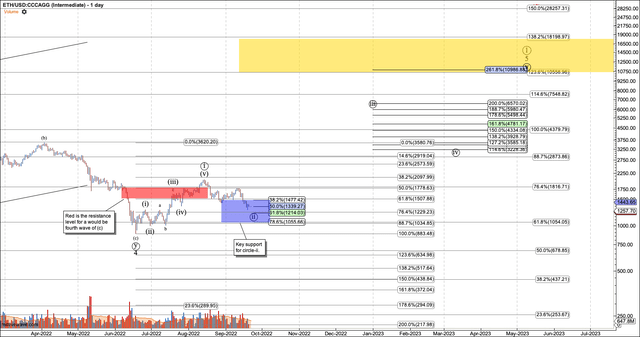

This construction leaves us with help for a wave 2 off the June low of $1000. So long as that stage shouldn’t be breached, each the long-term chart and the transfer off the June low recommend $10,500 is within the playing cards.

Ethereum Each day Chart (Produced by the creator utilizing Motivewave software program.)

Ether’s Frothy Bulls

If you realize the crypto area effectively, you realize it may be tribal. Many crypto buyers give attention to a favourite mission, leaving diversification to extra mature buyers. They present their help through the use of social media to cheerlead their favourite mission and bash the remainder. No tribal battle in crypto is extra fierce than that between the Bitcoin maximalists, or maxis, as they’re known as, and the Ether Maxis.

Ethereum went by means of what was known as “the Merge” on Sept. 15. This was an improve of the blockchain from Proof of work (POW), to proof of stake (POS). This modification has been heralded by Ether Maxis as making Ethereum superior to Bitcoin as a result of proof of stake consensus takes much less vitality. And different modifications enabled within the Merge make the availability of Ethereum extra deflationary.

The joy surrounding this improve often is the purpose for the robust push off the June low. However as all the time, euphoria results in frothy markets, and as an alternative of pushing increased, Ether has up to now dropped over 20% because the Merge triggered. Ether maxi social media heralded its arrival but it triggered a drop

Ryan Sean Adams co-costs the Bankless Podcast, a pod that may be known as very pro-Ethereum (Twitter)

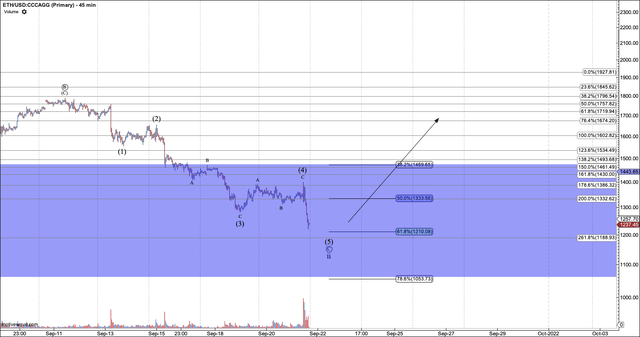

We noticed the potential of the B wave high forming on my chart under every week earlier than it lastly did, as Ether bulls seemed up with pleasure. Now that the smoke has cleared, we’re beginning to accumulate in our help zone, which ranges from the present worth all the way down to $1,000.

Ethereum 45 min. Chart (Produced by the creator utilizing Motivewave software program. )

As I’ve stated emphatically up to now, there’s by no means a assure that our help zones will maintain. Nevertheless, by patiently ready for the proper construction, we will take a commerce with a stable risk-to-reward ratio. And we will measurement our place such that breaking help causes us little ache. If we begin to see the market react to the help area we will construct on a profitable commerce.

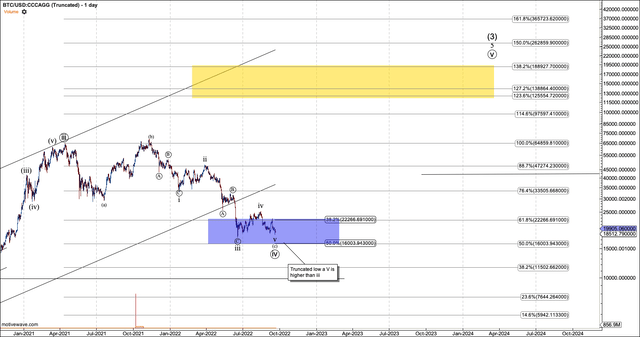

Bitcoin’s Slim Likelihood

The one manner that Bitcoin can go from right here to our $100K goal with out a new low is by way of a truncated low. A truncated low is the place the fifth wave of the C wave doesn’t breach the earlier third wave’s backside. That is proven within the chart under. Nevertheless, it is a very uncommon sample and all the time requires a market to show it out.

For Bitcoin, breaking above $23,000 would assist the case for truncation. Nevertheless, Bitcoin has by no means sustained over the resistance for a fourth wave, not like Ether. That resistance is at $25K, and it could possibly all the time ship Bitcoin again for one more strive at a full and full fifth wave. Bitcoin clearly has numerous work to do to reverse itself out of a bear pattern.

Bitcoin’s every day chart exhibiting what a truncated low seems to be like. (Produced by creator with Motivewave Software program.)

Conclusion

So, right here we have now the recipe for Ether and Bitcoin to half methods. Ether is poised very bullishly, whereas Bitcoin has been unable to maneuver over any key ranges of resistance in a sustained method. Which means that the monies you’re allocating to swing buying and selling cryptocurrencies are higher spent on Ether than Bitcoin.

Ether’s help stage for the next low is just under the present worth, which is $1350, as of writing. Bitcoin, alternatively, may flip right into a scorching knife, able to pierce its June low. And as soon as it falls under $16K, it may fall additional.

Source link

#Bitcoin #Ethereum #Parting #Ways #ETHUSD