Bitcoin And Gold Prices May Converge Again In 2023-24

brightstars

I’ve solely written one article on Looking for Alpha about cryptocurrencies, suggesting in August 2021 here buyers ought to keep away from Bitcoin (BTC-USD), when its worth was round $45,000. My story defined how Bitcoin was in a bubble that might ultimately burst. I’ve by no means owned cryptos, as a result of I’ve no clue tips on how to worth them with out concrete, verifiable math. Bitcoin could possibly be value $100 or $1,000 or $100,000. Who is aware of, it’s all guesswork and hoping a “greater fool” will present up keen to pay extra. Identical to each different tulip craze, in some unspecified time in the future you attain most possession and speculators change into internet sellers, as a substitute of patrons over time. Effectively, it seems we reached that stability in 2021, with a peak worth above $65,000 achieved.

Now worth is round $16,000, whereas crypto exchanges are blowing up and exposing severe accounting and fiduciary points beneath the floor of this go-go asset backed solely by proprietor over-enthusiasm and extreme liquidity within the international monetary system. A proof of final week’s FTX (FTT-USD) saga and chapter is linked here. Sadly, the U.S. Federal Reserve central financial institution has determined to mop up liquidity by elevating rates of interest and promoting bonds on its stability sheet. This motion has poked an entire within the increased “forever” hopes of crypto lovers. What if a decrease eternally pattern is the brand new actuality?

Conversely, gold has been efficiently used and valued as base cash for hundreds of years on each a part of the globe. Paper currencies have at all times been tied to it, whether or not achieved formally with a gold normal or not. Buying and selling treasured metals since 1986 and interesting in every kind of historic analysis, it stays fascinating to me that gold costs are clearly tethered to fiat cash printing and sovereign debt issuance in each nation on earth, even in 2022. I’ve written many articles explaining how gold and silver costs are a operate of paper financial ranges, alongside the relative pricing of other property and commodities. One such effort in August on silver’s present undervaluation is linked here.

My level is gold has been left for useless by Wall Road as “relic of the past” many occasions over my 36 years of buying and selling expertise. However, it has at all times come again into vogue when recession, financial uncertainty, and struggle present up. The precise rush of shopping for happens when buyers determine to show actually petrified of the longer term. 2023 might present one other setup the place buyers, merchants, establishments, and governments of every kind determine they need to personal it once more.

One bullish piece of knowledge in November: overseas central banks have added to their gold positions in 2022 on the highest consumption charge in 55 years! In response to an OilPrice.com article:

Central banks globally have been accumulating gold reserves at a livid tempo final seen 55 years in the past when the U.S. greenback was nonetheless backed by gold. In response to the World Gold Council (WGC), central banks bought a record 399 tonnes of gold value round $20 billion within the third quarter of 2022, with international demand for the valuable metallic again to pre-pandemic ranges. Retail demand by jewelers and patrons of gold bars and cash was additionally sturdy, the WGC mentioned in its newest quarterly report. WGC says that the world’s gold demand amounted to 1,181 tonnes within the September quarter, good for 28% Y/Y development.

So, right here’s my prediction: as cryptocurrencies proceed to deflate in 2023, and the explanations to purchase gold multiply in a deep international recession (forecast by October’s Treasury yield-curve inversion here), gold priced in U.S. {dollars} per ounce will ultimately converge with Bitcoin. Then, gold will surpass Bitcoin in worth and reclaim its place because the main base cash to worth all the things else in our fractional reserve banking world. It might occur shortly, or it might take a number of years, however I’m assured this convergence will probably be actuality quickly sufficient.

My Particular Forecast

What I’m visualizing subsequent 12 months is a huge soar in gold costs above US$2,500 per ounce, with Bitcoin sliding effectively below $10,000. It’s totally logical buyers and merchants ought to put together for each property to converge in worth between $3,000 and $4,000 on the finish of 2023 or someday in 2024.

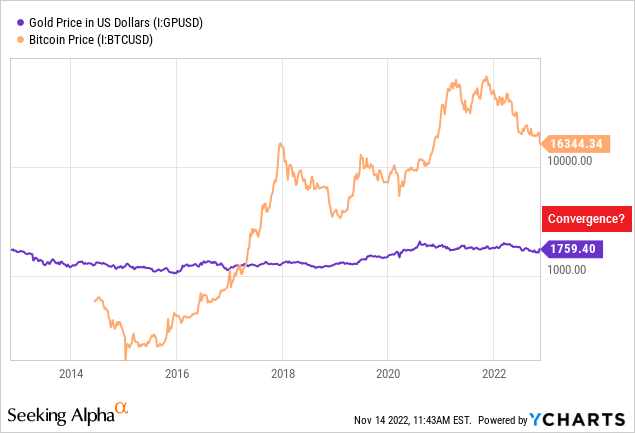

Beneath is a log-scale chart of pricing over the previous decade for each property, one bodily, easy, comprehensible and accepted for hundreds of years, the opposite a new-age laptop code asset that has not been severely examined in a chronic recession and liquidity disaster. The final time the 2 decentralized cash concepts converged in worth was early 2017. I’ve marked with a pink field my “convergence” space to look at in 2023 or 2024.

YCharts – Gold vs. Bitcoin, Value Modifications with Creator Convergence Level Estimate, 10 Years

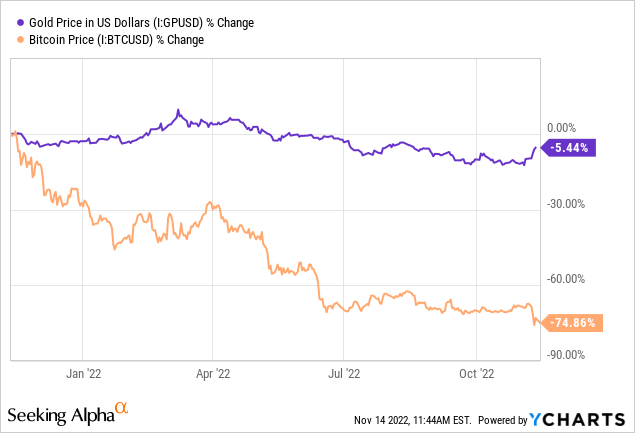

Since November 2021, the depraved -75% collapse in Bitcoin has achieved wonders to quickly carry costs for each into nearer proximity. One other -75% Bitcoin decline matched in opposition to a +70% to +120% enhance in gold costs would get us to equal pricing within the $3,000 to $4,000 vary.

YCharts – Gold vs. Bitcoin, Share Value Modifications, 1 Yr

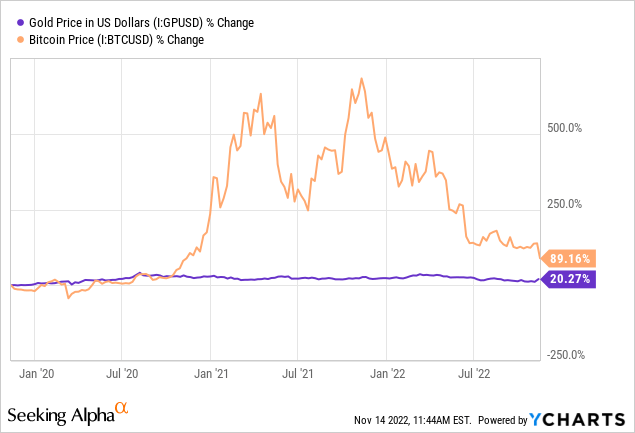

On a 3-year chart, we are able to evaluate how Bitcoin’s monster advance into final 12 months’s peak is deflating at superb pace. Another concentrated promote wave will put Bitcoin (and lots of different cryptocurrencies) again to 2019 pre-COVID ranges.

YCharts – Gold vs. Bitcoin, Share Value Modifications, 3 Years

How To Play The Convergence

Avoiding or promoting your Bitcoin now could be the simplest option to sidestep the subsequent wave of liquidation in cryptos. Fairly primary rationale.

To arrange for a large gold advance, you may straight purchase bullion and cash effectively above the spot pricing of COMEX futures or the official London repair. Truthfully, one thing of a scarcity globally in bodily metals has existed because the begin of the COVID-19 pandemic.

Nevertheless, the most suitable choice for brokerage portfolios stays ETFs tied to bullion, in case you are searching for straightforward low-cost methods to realize possession and publicity. My two favorites are additionally the 2 largest on this area, the SPDR Gold Shares ETF (NYSEARCA:GLD) and iShares Gold Belief ETF (IAU). I personal these names and others personally.

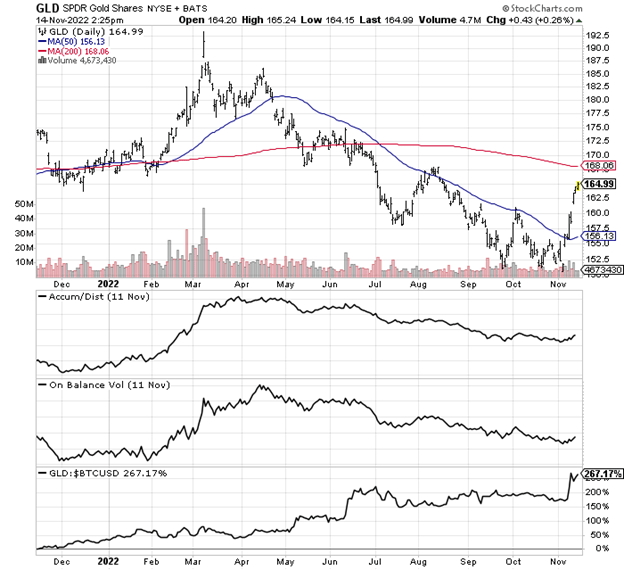

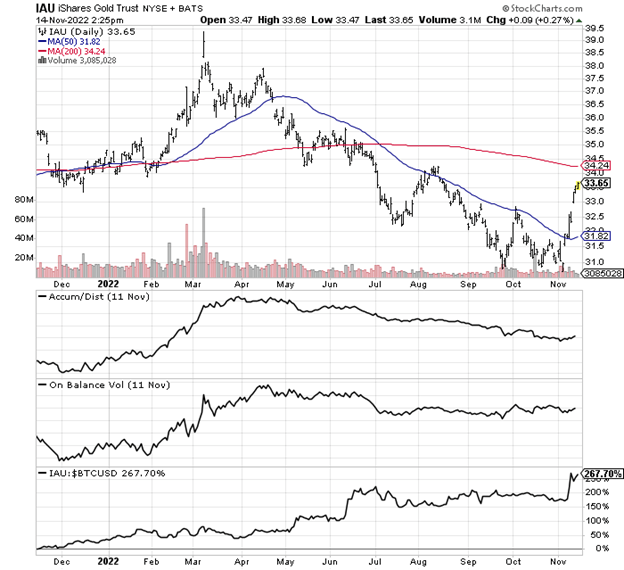

On the 1-year graphs under you may evaluate respectable developments within the Accumulation/Distribution Line and On Steadiness Quantity readings for each gold bullion ETFs. Additionally, I’ve drawn a comparability line vs. Bitcoin pricing. The 2 gold selections have “outperformed” Bitcoin by +267% during the last 12 months!

StockCharts.com – GLD, Day by day Modifications in Value/Quantity, Since November 2021

StockCharts.com – IAU, Day by day Modifications in Value/Quantity, Since November 2021

Last Ideas

Might my forecast show fallacious? To a level, it might. It’s doable neither Bitcoin nor gold declines/rises a lot in 2023, if a recession fails to materialize. In this case, the convergence in worth might not happen for an additional two or three years. Nevertheless, booms in issues/property with little underlying worth or utility have inevitably busted all the best way again nearer to zero for worth (after you flip your laptop off, cryptos are degraded to an thought in your head). That’s the clear historical past of fads and manias all through all of human time, relating to rampant hypothesis in beanie infants, or tulips, or dotcom shares with no earnings/gross sales, or as we speak’s cryptocurrency experiments backed solely by fantastical laptop code and blind religion.

I might fairly go together with a confirmed winner by means of historical past. Gold has been accepted as a type of wealth and forex lengthy earlier than Jesus or Muhammad or Buddha. You should use gold in jewellery. It is essential for electronics and industrial functions. So, if monitor data and philosophical logic are essential in your funding choice making, gold simply trounces Bitcoin for long-term holding worth and value.

With a world awash in report money owed and fiat cash creations, gold ought to once more stand out as a beacon of funding honesty. Gold/silver bullion are a few of my largest monetary holdings as hedges in opposition to greenback devaluations in a extreme recession situation. Bankers and authorities officers appear OK with inflation creeping increased. What if stagflation morphs into hyperinflation? How do you put together?

I firmly consider $5,000 and even $10,000 gold quotes are a certainty over time. The one query is when will these numbers play out. Bear in mind, gold traded at $50 an oz in 1970 and $275 in 2001. $1759 gold as we speak is only a short-term steppingstone to but increased numbers within the not-too-distant future. My argument is to depend on gold for future wealth hedging in opposition to greenback devaluations, not risky/controversial Bitcoin or associated crypto innovations. Meals for thought anyway.

Thanks for studying. Please contemplate this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is advisable earlier than making any commerce.

Source link

#Bitcoin #Gold #Prices #Converge