Bitcoin Bull Flag Suggests Potential 5.58% Price Increase to $67,380 with Positive Outlook for Q4

The resilience of Bitcoin was put to the test during a significant crash weeks ago, but the asset has demonstrated its strength by staying above the $60,000 mark.

Investors are now eagerly anticipating the next major rally, with some analysts predicting that a new high is on the horizon. Milkybull Crypto, among others, remains positive, highlighting a bullish technical pattern that suggests further upward movement. Bitcoin seems ready to target $67,380, driven by positive technical indicators.

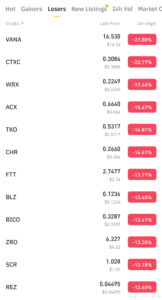

Bull Flag Signals Potential Upside

A key signal is the bull flag pattern recently identified in Bitcoin’s price action. This pattern often appears after an upward trend and signals further bullish movement. Bitcoin’s consolidation within this pattern suggests a brief pause before another upward surge. Once the price breaks above the upper boundary of the flag, Bitcoin could see additional gains.

Moving averages support this outlook, adding to the bullish momentum. The golden cross, where the short-term moving average is above the long-term moving average, remains in place. This signal provides strong support at lower levels, increasing the likelihood of more gains.

Bitcoin needs to increase by approximately 5.58% from its current level of $63,817 to reach the $67,380 target. Traders are closely monitoring this projection, with many optimistic that the bullish pattern will unfold in the coming days or weeks.

Historical Trends Point to Bullish Q4

Looking ahead, historical trends offer more optimism for a strong rally. Quinten François, co-founder of WeRate, points to Bitcoin’s impressive performance in the fourth quarter across previous years.

BTC Historical Trends Quinten François

BTC Historical Trends Quinten François

October, November, and December have historically been months of significant gains, with Bitcoin recording an average increase of 22.9% in October alone. Notably, in 2017 and 2020, Bitcoin saw rises of 47.81% and 27.7% in October, respectively, solidifying this month as a period of recovery after Q3 volatility.

November consistently shows even stronger results, with an average gain of 46.81%, making it historically one of Bitcoin’s best months. December also contributes to the bullish reputation of Q4, with an average gain of 5.45%, continuing the upward trend from November.

Updated Forecasts from Leading Analyst

Henrik Zeberg, Head Macro Economist at Swissblock AG, maintains an optimistic outlook for Bitcoin despite current market fluctuations. According to a recent report, Zeberg has adjusted his forecasts, projecting Bitcoin to reach a new high between $115,000 and $120,000. These predictions are part of a broader outlook that includes gains for other major indices like the S&P 500 and Nasdaq.

Zeberg’s forecasts reflect confidence in a scenario of rapid market growth, where exuberant market conditions could push Bitcoin and other assets to unsustainable levels before a substantial correction occurs.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may be personal and do not necessarily reflect The Crypto Basic’s views. Readers are advised to conduct thorough research before making any investment decisions. The Crypto Basic is not liable for any financial losses incurred.

Source link

#Bitcoin #Bull #Flag #Hints #Surge #Optimism