Bitcoin Cash: What Is Going On With This Rally? (Cryptocurrency:BCH-USD)

Vasil Dimitrov/iStock by way of Getty Photographs

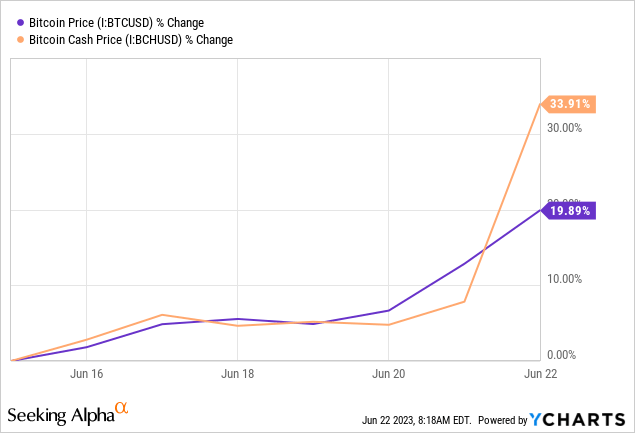

Within the rapid periods following BlackRock’s (BLK) software for a spot Bitcoin (BTC-USD) ETF, the main focus has rightfully been on BTC eclipsing $30k per coin for the primary time since April. The $3,000 spike within the worth of bitcoin over a 48-hour interval catapulted BTC dominance to about 50% – the very best degree in over two years. Nevertheless, at the same time as Bitcoin dominance has surged since BlackRock’s ETF software, it is really Bitcoin Cash (BCH-USD) that has outperformed the market to a bigger diploma.

Knowledge by YCharts

Knowledge by YCharts

Since June fifteenth, BCH is up 34% and is likely one of the higher performing belongings within the crypto market over that point. On this article, we’ll have a look at if there may be something basically driving this worth motion in BCH or if it is extra of a speculative frenzy.

What is Bitcoin Cash?

Bitcoin Cash is a tough fork of Bitcoin that permits quicker and cheaper transactions than the unique Bitcoin community. BCH is a product of the block measurement wars that occurred throughout the 2017 crypto bull run. Proponents of BCH, or “big blockers,” see the first operate of the cryptocurrency to be a peer-to-peer medium of alternate. Proponents of BTC, or “small blockers,” view the foreign money’s operate as extra of a retailer of worth on the base layer. This divide led to the fork. I’ve hypothesized that one other Bitcoin block house conflict could possibly be imminent in response to the Ordinals protocol. And we’re already seeing signs of battle enjoying out within the months since.

I final lined BCH for Searching for Alpha in June 2021. Whereas I see sure benefits in Bitcoin Cash’s base layer relative to different layer 1 fee networks, my prior considerations have been largely centered on lack of actual community adoption and alternate delisting headwinds. The latter of which has confirmed to not manifest to the diploma that I beforehand believed that it’d. That is the excellent news. BCH is accessible on all the main exchanges. Nevertheless, the query about adoption has seemingly been answered during the last two years. There hasn’t been a lot to talk of.

Key Community Metrics

I feel it is essential to grasp the motivation behind forking Bitcoin to really grasp why BCH hasn’t lived as much as its supposed objective. The purpose of the block wars was that the large blockers wished to have the ability to use BCH for peer-to-peer commerce. But, BTC nonetheless has a drastically bigger degree of every day utilization than BCH, each by every day energetic customers and by USD worth transferred over the community:

Yr To Date Day by day Averages Lively Customers USD Transferred Worth Bitcoin 930k $3.55 billion Bitcoin Cash 45k $21.2 million BTC/BCH Ratio 20.7 167.5 Click on to enlarge

Supply: CoinMetrics, as of 6/21/23

In 2023, Bitcoin Cash has averaged simply 45k every day energetic customers and $21 million in every day transacted worth. Even throughout giant day-to-day spikes in utilization, the every day energetic customers of BCH by no means sniff the DAUs of BTC. In truth, when the Ordinals transaction price spike occurred in Might and pushed customers to various chains, it was Litecoin (LTC-USD) that noticed the consumer movement, not Bitcoin Cash.

DAUs (CoinMetrics)

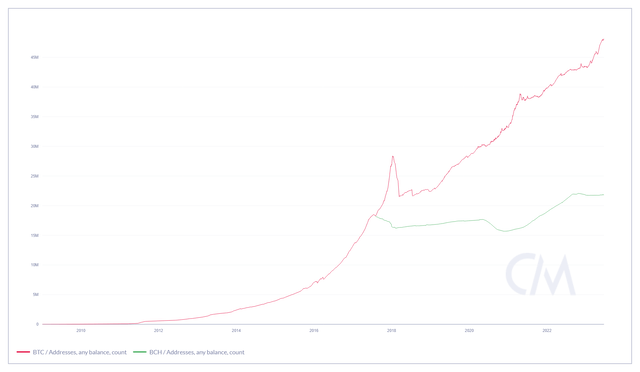

Recall that when a community is difficult forked, addresses on the brand new chain maintain the brand new coin when the brand new community goes stay. As an example, if somebody was holding 2 BTC earlier than the fork, their Bitcoin Cash pockets would additionally maintain 2 BCH on the brand new community. This means the fork is an efficient start line for assessing pockets deal with development:

Non-Zero Addresses (CoinMetrics)

Right here, we will see that regardless that non-zero pockets addresses on Bitcoin Cash have grown 20% because the fork, that development is dwarfed by the 164% development in non-zero pockets addresses on Bitcoin. how the holder focus breaks out additionally gives necessary context:

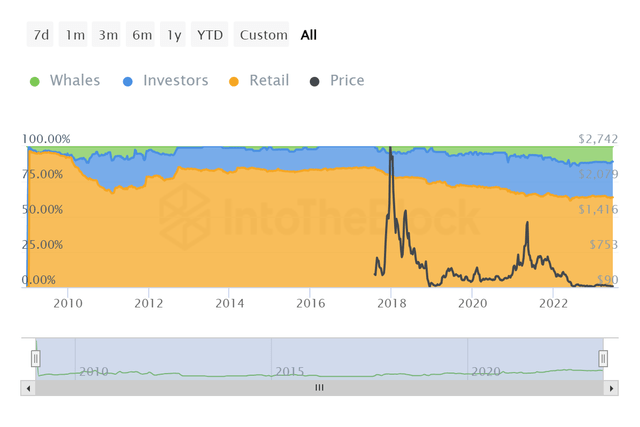

BCH Holder Focus (IntoTheBlock)

Because the fork, BCH has seen a bigger transfer towards whale possession than retail possession. This signifies that BCH has turn into extra concentrated over time. This is usually not what BCH bulls or proponents of peer-to-peer fee cash would need to see. Lastly, the community safety story for Bitcoin Cash just isn’t ideally suited.

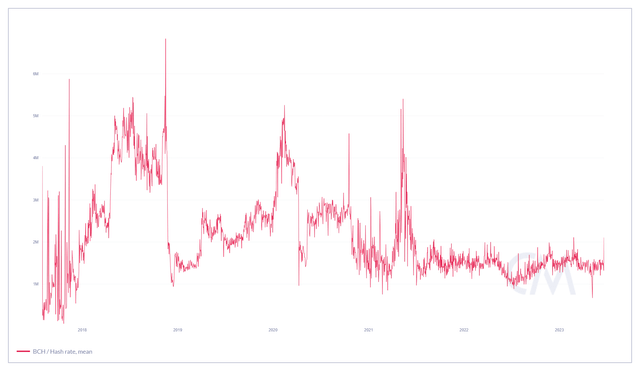

BCH Hash Fee (CoinMetrics)

Whereas Bitcoin continues to see world exahash grind increased, Bitcoin Cash hash charge peaked in 2018. This decline in mining problem has allowed miners to stay modestly worthwhile via the years, but it surely does diminish the theoretical safety of Bitcoin Cash, as it might be simpler to 51% assault BCH than it’s to assault BTC. A 51% assault was really orchestrated on Bitcoin Cash again in 2019 although that “attack” was stated to be a pre-emptive measure to thwart the doubtless malicious efforts of one other entity.

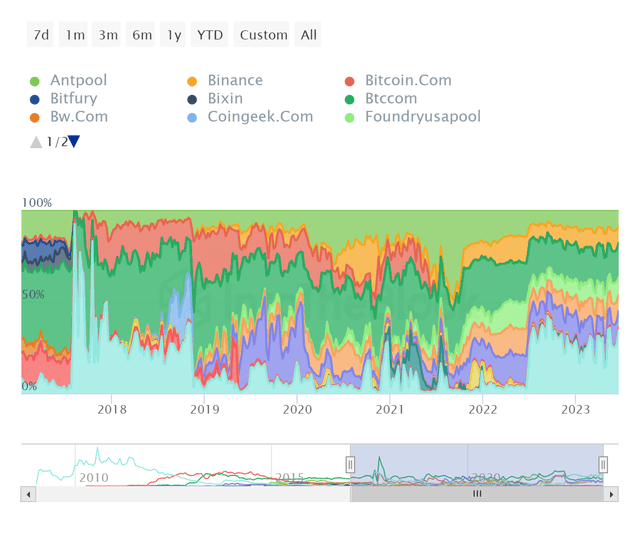

BCH Hash Distribution (IntoTheBlock)

In the present day, we observe a fairly effectively distributed mining pool, with no identified particular person pool accounting for greater than 19%. By comparability, Poolin at present accounts for greater than 22% of Bitcoin’s mining pool hash.

Important Takeaways

Bitcoin Cash merely hasn’t benefitted from the adoption as a medium of alternate the way in which early proponents of the fork possible would have wished. There are a couple of totally different causes for the shortage of actual community development for my part. First, there have been competing factions throughout the BCH neighborhood that finally led to yet one more fork and the creation of Bitcoin Satoshi’s Imaginative and prescient (BSV-USD). This additional fragmented the large blocker neighborhood.

And there is extra competitors elsewhere. In my opinion, Litecoin is a viable various to Bitcoin. The Lightning Community is definitely one thing that challenges the necessity for Bitcoin Cash, although it’s admittedly cumbersome to make use of. And admittedly, using stablecoins for funds on low-cost sensible contract chains like Solana (SOL-USD) or Algorand (ALGO-USD) is smart for retailers and peer to see funds. Although there are clearly dangers with fiat-collateralized stables, they do supply crypto funds in a unit of account that the lots perceive.

Finally, although, I do not see a basic catalyst that might to be driving the latest rip increased in BCH. I do not consider BCH is a promote. It is nonetheless worthwhile to mine even at present coin costs, and there are at the very least some people who find themselves utilizing it. It might by no means really problem the dominance of BTC as a real peer to see fee instrument, however I do not suppose it is a horrible method to speculate on a broader crypto rally. Strictly from a consumer expertise standpoint, it is a stable blockchain community.

Source link

#Bitcoin #Cash #Rally #CryptocurrencyBCHUSD