Bitcoin, ether slipping even with inventory market greater (Cryptocurrency:BTC-USD)

MicroStockHub/E+ through Getty Photographs

Bitcoin (BTC-USD) and ethereum (ETH-USD) traded in adverse territory in Friday morning buying and selling and look to shut out the week with losses, whereas equities pushed greater and on monitor for per week of features, in an rare relationship that has speculators pondering.

Some buyers have been paying attention to bitcoin (BTC-USD) and ether’s (ETH-USD) falling volatility in latest weeks, in contrast with the jumpy inventory market, as the worth of the 2 largest cryptocurrencies by market cap proceed to commerce rangebound after massive drops seen originally of the yr.

intraday worth motion, bitcoin (BTC-USD) slipped 1.6% to $19.01K at 10:34 a.m. ET in contrast with its $68.9K November 2021 peak, and ether (ETH-USD) drifted down 2% to $1.28K versus its $4.64K all-time excessive in November a yr in the past. All three main inventory indices every rose lower than 1%, with Dow Jones (DJI) +0.7%, S&P 500 (SP500) +0.5%, and Nasdaq (COMP.IND) +0.2%.

Jim Bianco, the president of Bianco Analysis, identified that the previous Wall Avenue adage, “never short a dell market,” now applies to bitcoin (BTC-USD) because the token’s 30-day realized volatility (vol for brief) fell to its lowest in additional than two years, he wrote in a collection of Twitter posts. Which may be much more of the case for ether (ETH-USD), which has seen its realized vol plunge to its lowest level in over 5 years. These vol drops could possibly be seen as a adverse as a result of it implies that speculative demand is slowing down.

Nonetheless, “this is an unquestionably good thing as it means that more people are holding Bitcoin as an investment, and fewer people are holding it as a speculative hot potato,” stated Searching for Alpha contributor Logan Kane, who views BTC as a Buy. “Should volatility continue to decline, this means that investors can expect a smoother ride and likely a higher fair value as more people get comfortable allocating.”

The inventory market, although, is protecting market members on their toes because the S&P 500’s (SP500) realized vol modifications fingers at one of many highest marks previously decade towards a backdrop of the Federal Reserve’s aggressive financial tightening marketing campaign in addition to rising recession dangers.

“Markets bottom on apathy, not excitement. BTC and ETH have apathy. The S&P 500 is nearly the opposite, as prices move around like a video game. This might also be another sign of the TradFi/Crypto tight relationship breaking. If so, this is long-run bullish for crypto,” Bianco contended.

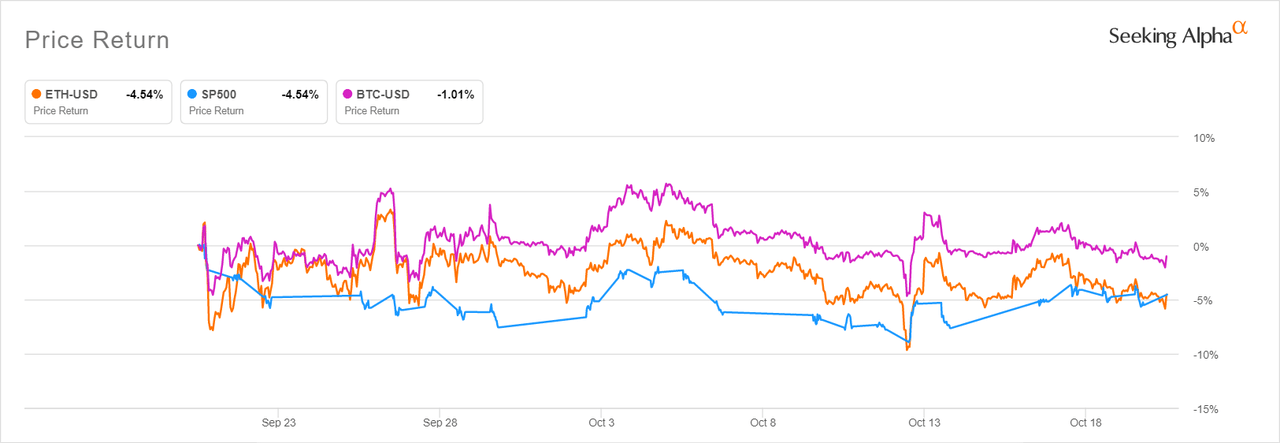

Be aware that the S&P (SP500) has dipped extra previously month (-4.9%), though by a small margin, than ether (ETH-USD) (-4.8%) and bitcoin (BTC-USD) (-1.1%), as seen within the chart under. That is a comparatively uncommon dynamic because the tokens, that are seen as a gauge for danger tolerance and total sentiment, simply noticed over 5% swings in a single session, traditionally talking.

Fellow SA contributor The Digital Development believes bitcoin is about to flee its month-long quiet interval and return to its typical volatile state.

Source link

#Bitcoin #ether #slipping #inventory #market #greater #CryptocurrencyBTCUSD