Bitcoin Exchange Balance Hits Three-Year Low

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

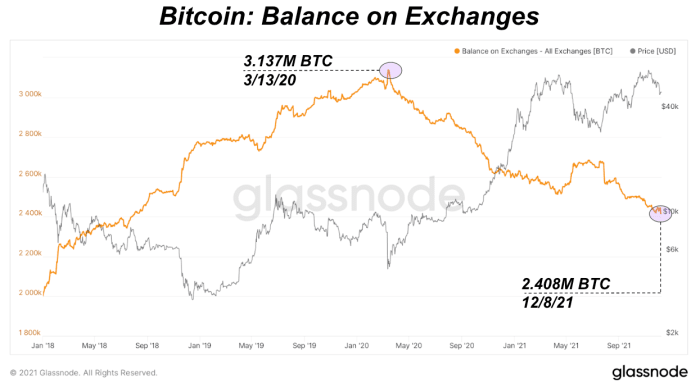

Bitcoin balance on cryptocurrency exchanges.

Total bitcoin on exchanges has hit another three-year low today, with 2,408,237 BTC across all reported exchanges.

Total bitcoin balance on cryptocurrency exchanges peak versus now.

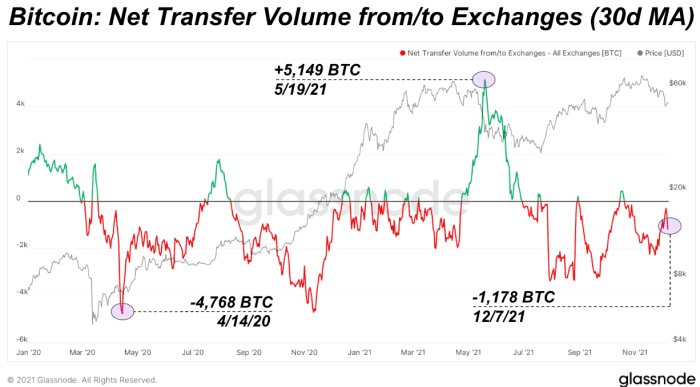

When looking at the net daily transfer volume on exchanges with a 30-day moving average applied, it can be seen how different this recent sell-off and subsequent derivatives market liquidation was compared to the one seen in April/May.

During the May sell-off, 5,149 BTC were deposited per day on average during the peak of the sell-off. Comparatively, today 1,178 BTC have been withdrawn from exchanges per day on average over the last month.

Net transfer volume of bitcoin from and to cryptocurrency exchanges.

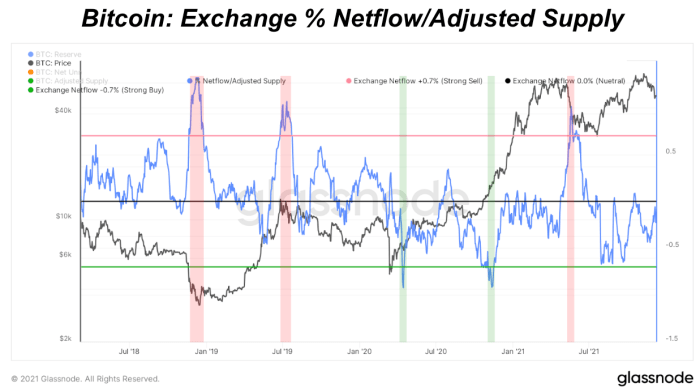

We can also take the 30-day moving average of exchange netflow and adjust it by adjusted supply (circulating supply adjusting for lost coins).

The green and red arbitrary thresholds are times when 0.7% of bitcoin’s adjusted supply were withdrawn or deposited on exchanges respectively.

Bitcoin on exchanges, percentage of netflow/adjusted supply.

Source link

#Bitcoin #Exchange #Balance #Hits #ThreeYear