Bitcoin HODLer Accumulation Is Increasing

2 min read

The beneath is from a new version of the Deep Dive, Bitcoin Magazine’s premium business sectors bulletin. To be among quick to get these bits of knowledge and other on-chain bitcoin market examination directly to your inbox, subscribe now.

A key on-chain metric that we’ve talked about previously, and that we will cover today, is the Realized HODL (RHODL) Ratio. The proportion utilizes acknowledged cap HODL waves, which takes the first HODL Wave metric and loads the UTXOs in each age band by their acknowledged cost. Specifically the Realized HODL Ratio utilizes the one-week and the one-to-two-years Realized Cap HODL Age bands.

For a more top to bottom outline of this measurement, look at The Daily Dive: HODL Waves And Realized HODL Ratio.

By using this metric, we can better understand what’s happening with younger coins versus older coins. As younger coins become more dominant and the ratio rises, long-term holders hold less of the realized market value. As the ratio falls, long-term holders hold more market-realized value compared to younger coins. An overheated market would show much higher younger coin dominance.

In the previous bitcoin tops in 2021, we didn’t see the rise of younger coins relative to older coins like previous cycles. We saw the RHODL Ratio rise throughout the year, but it never became heated or overheated like the 2016 cycle. This can be due to a changing cycle, a more maturing market or the fact that we didn’t see the significant wave of new demand, younger coin buying, seen in past cycles.

The bitcoin cost, weighted by the RHODL ratio

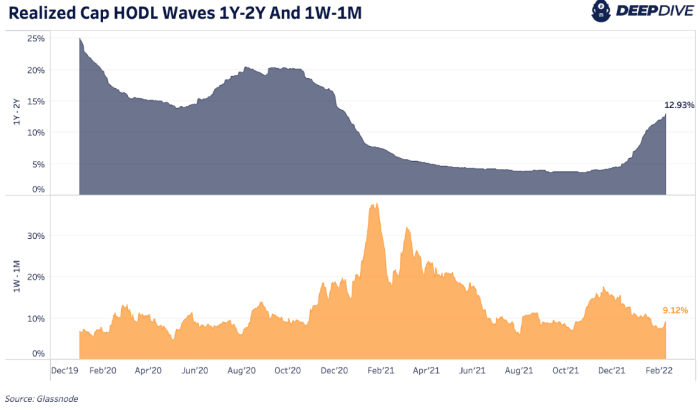

Over the last month, we’ve seen a huge expansion in the HODL Waves and Realized Cap HODL Waves one-to-two-years age groups. More coins are maturing into this band and are taking up more financial load in the RHODL Ratio computation as more long haul held inventory comes into the market. As an outcome, the RHODL Ratio is close to its 50th percentile inbetween a nonpartisan and cooled state.

Historically, we’ve seen the one-to-two-years age band top around half of supply, while it’s at present at 12.93%. We hope to be going into a pattern of expanded holder gathering post a neighborhood bitcoin value top. As aggregation proceeds and more established coins age in, the RHODL Ratio falls and makes bitcoin a more alluring recorded buy.

Realized cap HODL waves for one to two years, and multi week to one month

Source link

#Bitcoin #HODLer #Accumulation #Increasing