Bitcoin Holders Who Bought In Last 5 Months Now In Profit

On-chain knowledge reveals that the typical Bitcoin short-term holder is again in revenue as BTC continues the sharp upwards momentum.

Bitcoin Is Now Above Quick-Time period Holder Realized Value

As per knowledge from the on-chain analytics agency Glassnode, the BTC value is now above the typical value foundation of the short-term holders. The related indicator right here is the “realized price,” derived from the idea of the “realized cap.”

The realized cap is a capitalization mannequin for Bitcoin that goals to discover a kind of “true” worth for BTC by placing every coin’s worth at not the present BTC value (as is the case within the regular market cap) however as an alternative the value at which the coin was final transferred.

When the standard market cap is split by the entire variety of cash in circulation, the BTC value is returned (a incontrovertible fact that’s not shocking within the least, because the market cap is calculated by multiplying the value by the entire variety of cash, to start with). If the identical concept is utilized to the realized cap, a “realized price” could be obtained.

This value is critical as a result of it represents the typical value foundation (that’s, the value at which the typical holder acquired their cash) within the Bitcoin market. Which means if the common value sinks beneath the realized value, it’s truthful to conclude that the typical investor is holding at a loss.

The Bitcoin market is split into primarily two holder teams: the “short-term holders” (STHs) and the “long-term holders” (LTHs). The STHs embrace any traders who acquired their cash inside the final 5 months (155 days, to be extra exact), whereas anybody holding cash for longer than that falls into the LTH cohort.

Now, here’s a chart that reveals the pattern within the realized value for the whole market, in addition to for these two holder teams individually, over the previous few years:

Seems just like the LTH realized value is the best for the time being | Supply: Glassnode on Twitter

As proven within the above graph, Bitcoin has damaged above the $17.8k STH realized value within the newest rally, which implies the typical investor who purchased within the final 5 months is now again within the inexperienced. However, the typical LTH continues to be very a lot underwater presently, as their value foundation is greater than $20k.

BTC is now heading towards the market’s realized value of $19.7k. Traditionally, this degree has supplied resistance throughout bear markets, and an actual breakthrough above the extent has typically resulted in a return towards bullish momentum.

It stays to be seen whether or not Bitcoin can overcome this resistance this time, assuming that the rally continues lengthy sufficient to retest the extent.

BTC Value

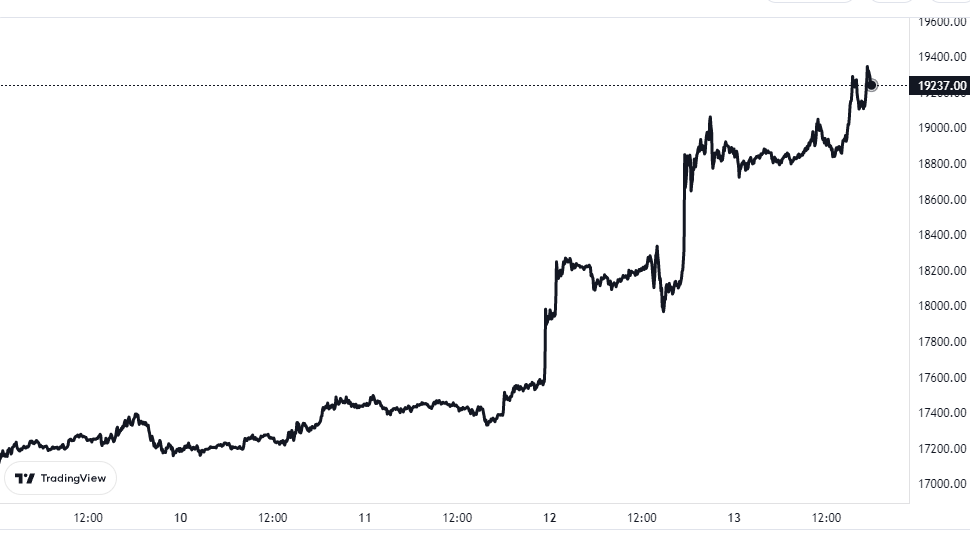

On the time of writing, Bitcoin is buying and selling round $19,200, up 14% within the final week.

The worth of the crypto appears to have shot up | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Source link

#Bitcoin #Holders #Bought #Months #Profit