Bitcoin Is Dead As Predicted – Don’t Get Sucked In (BTC-USD)

KanawatTH/iStock through Getty Images

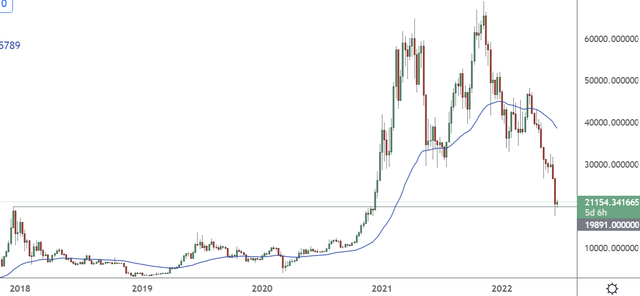

It’s been eight months since I called a top in Bitcoin (BTC-USD) and cautioned financial backers to remain away. The market dropped more than 70% from my article and has squashed dreams and uncovered the misleading investigators and symbols that dirty the business. In this article, I’ll examine my contemplations on BTC in the months ahead.

Bitcoin’s waste of time won’t see a quick comeback

I really called another Bitcoin top during the principal move above $60k in May of 2021. On the two events, Bitcoin had every one of the prerequisites for a high, which included:

Technical over-expansion and set up for a rectification. Tremendous theoretical interest and advancement. Nonsensical hallucination Ridiculous bullish forecasts and a flood in make easy money financial backers.

The first slump was a common rectification from a major bull trend.

BTCUSD (W) (Trading View)

Bitcoin flooded through the $20k high and pressed to new highs on hypothesis. The main pullback tried starting help and it was a fast recuperation with the low coming in June/July.

The reason that markets retest the high is normally that there is a slack from the underlying richness. Enough financial backers have liquidated some out on the way up and can uphold the following assembly. New financial backers that missed the main run are taken over by the”‘Fear of Missing Out.” The subsequent drop has accompanied a changing scene in the climate and in the administrative viewpoint for BTC. Since it was a more extended and more profound pullback, we can anticipate that sideways development in the months should come.

You can likewise see that the rectification in BTC was a basic re-visitation of the past title highs of 2017. The business sectors never show signs of change yet neither does human brain research. As we hit the most recent lows, be careful with those encouraging you to purchase the most recent plunge. Not a single one of them got both of these tops in Bitcoin-even the very rich people who course Bitcoin meetings to enjoy hero worship and affirmation bias.

There were some new all-time highs for BTC this week, however just in Google looks for “Bitcoin is Dead” and “Bitcoin Dead”.

The decentralized dream has been exposed

I referenced in the above section that the latest convention in Bitcoin was a straightforward retest of the highs before the market viewpoint changed. Yet, what has changed in the new slump? The response is everything.

Bitcoin is enduring an onslaught from legislatures and an efficient power energy political push. I talked finally in my past posts about the approaching guideline yet many couldn’t draw an obvious conclusion. Stablecoins have been flipped completely around. I likewise said that national banks had their eyes on stablecoins and they were a gamble. Loan fees are flooding and set to go higher. The modest cash climate and financial exchange bubble not just established the climate for a buyer market in other option and speculative resources; it likewise gave the subsidizing. There is currently less requirement for the exorbitant loan fees of decentralized finance (DEFI) projects because of taking off rates on government paper. The market covers of DeFi projects have dropped more than 80%, close by their Total Value Locked (TVL) which is likened to a bank run and that cash isn’t returning not long after high-profile aftermaths in Terra, Three Arrows Capital and Block-Fi. Institutional reception was drawing nearer in 2021 however the brakes have been rammed on once more.

The certainty factor is the huge issue now and financial backers will be unfortunate to secure their reserve funds in crypto projects They have seen that the market covers and reception depend on speculative flows.

The next large issue includes the breaks in the decentralized dream. Decentralization was intended to be the key selling point of cryptographic money and Bitcoin however that thought is presently a chuckling stock.

Many of the new digital currency devotees are likewise financial backers who lost to the goldbug advertisers and were hostile to Federal Reserve and hostile to Big banks. They saw their new innovation and their philosophy as better than the ongoing monetary framework yet those fantasies have been exposed.

In the most recent couple of months, we have seen allegations of illegal tax avoidance, burglary, and the seizing of blockchain accounts. Let me know how “The New Monetary System Inc.” is any not quite the same as the current? The response is that the ongoing framework really has regulation.

It was Reuters who blamed the Binance trade for being engaged with the laundering of $2.35bn. The organization invalidated the claims however it just adds to the wariness towards the business. The breakdown of the LUNA project likewise prompted an investigation by Seoul police over the misappropriation of funds.

Aside from the unregulated climate, I have additionally noticed the absence of decentralization and infringement from unified outsiders is something we were told didn’t exist in Bitcoin and the blockchain. The Canadian government punctured that contention when it held onto digital money accounts from the significant trades. We likewise saw the Solana blockchain, where financial backers in an outsider application voted to concede crisis powers to hold onto a ‘whale’ account that undermined unpredictability. That was because of abundance influence which is additionally wild in the unregulated area. A third episode saw the Celsius project freeze all withdrawals on the stage as it turned into the most recent DeFi danger. The records are as yet secured with little assistance from the undertaking and a TechStory article summarized the venture philosophy of ongoing times:

“Almost every YouTube channel was recommending Celsius and that’s why I thought it was safe.”

Connect the specks and act accordingly

Investors ought to overlook the most recent slump in Bitcoin and look somewhere else. The venture will revitalize and offer expectation however it is probably going to move sideways over the course of the following couple of months and perhaps lower.

Warren Buffett said as of late that assuming he was offered a 1% stake in the entirety of America’s farmland he would compose a really look at there and afterward for $25bn. He would do likewise for a 1% portion of every one of America’s lofts, yet not really for Bitcoin. He really said that he wouldn’t take the entire stock of BTC for $25.

“The apartments are going to produce rent and the farms are going to produce food,” he added. “If I’ve got all the bitcoin, I’m back wherever [Satoshi] was,” Buffett added.

I have attempted to surrender financial backers a heads on Bitcoin over the course of the past year since drawing an obvious conclusion was simple. The public authority is glad to allow financial backers to become acclimated to advanced cash however each breakdown in BTC just inches us nearer to computerized cash gave by the Federal Reserve, or the Treasury.

The most recent market breakdown has featured that the public authority doesn’t actually need to hold onto Bitcoin. The market is uncovering itself completely all alone and leaving financial backers with an absence of confidence and confidence backs money.

The organizer behind Terra, Do Kwon, who was at the focal point of the LUNA breakdown contention said of his Terra stablecoin:

“I still believe that decentralized economies deserve decentralized money – but it is clear that $UST in its current form will not be that money.”

As the residue chose Mr Kwon’s fantasy, essentially he had the prescience to comprehend that the venture had lost financial backers’ trust and a shot at mass reception. We can now say the equivalent regarding numerous other crypto ventures and I accept Bitcoin is no different.

The highs from the 2017 market flood denoted a finish to hypothesis and because of an absence of institutional hunger, it took BTC three years to enter the 2017 highs. With the assortment of headwinds and harmed financial backer trust, it wouldn’t shock me to see extended sideways activity in the coin for one more year or something like that. That projection is most likely a ball park for the proceeded with ascend in financing costs also.

Join the spots and act accordingly.

Conclusion

I’ve said over the course of the past year that the administrative climate was surrounding Bitcoin. Close by a pushback from Green legislators, it has added a few headwinds to Bitcoin. The greater hit came from expansion and the subsequent ascent in loan fees and the vanishing of speculative streams. At the time I likewise cautioned that national banks had a sharp dislike for stablecoins and the most recent issues at a portion of the DeFi projects have taken care of the controllers’ responsibilities for them. The primary BTC skip actually had speculative streams in its sail. The second has been more extended and won’t bounce back without any problem. Decentralized finance has been uncovered by the activities of the DeFi banks and financial backers are losing the vital major for BTC, which is confidence. Numerous enormous partnerships were beginning to consider BTC on their asset report in mid 2021 however the most recent breakdown has closed down that methodology for now.

Source link

#Bitcoin #Dead #Predicted #Dont #Sucked #BTCUSD