Bitcoin Market Enters “Fear” Territory, Time to Buy the Dip?

Bitcoin has entered a correction after flying past previous highs at the beginning of November. BTC is currently trading at around $58,000 — nearly 16% below its all-time high price of $69,000 registered on November 10, according to the Clark Moody Bitcoin Dashboard.

The current bitcoin price dip is a below-average percent drawdown for BTC this year. Source: UTXO Management.

Whenever price dips, newcomers get nervous while long-timers enjoy buying the dip and stacking cheap sats. The difficulty of newcomers lies in the short-term vision of becoming a millionaire, usually propagated by some. At the same time, Bitcoiners can keep purchasing more BTC as the price drifts downwards. This dynamic is part of human nature, as one tends to sail according to the winds. However, generally, applying emotion in your investments can hurt your strategy, and the best strategy is to “play it cool.”

Armed with a foundational knowledge of Bitcoin and an experienced past of BTC’s ups and downs, Bitcoiners who have been part of the community for a while no longer get affected by the extreme fear that price dips inundate the market. They profit from it. Whenever bitcoin crashes, Bitcoiners are the first group to step up and meme “buy the dip” into reality because they know that, historically, the price trend has been upwards.

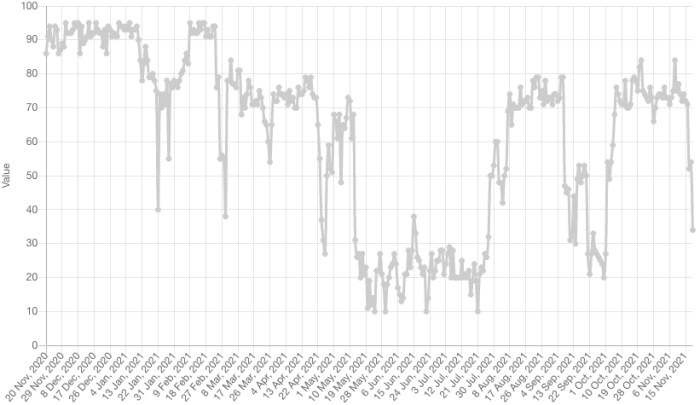

One tool to gauge market sentiment is the bitcoin Fear & Greed Index. When investors are too fearful, a good buying opportunity might occur, and the correction might be coming to an end. On the flip side, when investors are too greedy, a correction could be underway to halt the rally. A value of zero means “extreme fear,” while a value of 100 represents “extreme greed.”

Historical data of the bitcoin Fear & Greed Index. Source: alternative.me

The legitimacy and accuracy of this index and whether it can serve as a price prediction tool are certainly up to debate. However, the bitcoin Fear & Greed Index has highlighted some interesting correlations and can serve as an aid for investors to put their emotions aside and recognize opportunities.

At the time of writing, the index showcases a “fear” in market sentiment, with a score of 34, as bitcoin stays below $60,000. In the past, when things went south and sentiment plunged, the index reached single-digit marks, for instance, in March 2020 and in May 2021. Both periods saw a flash crash in price that effectively killed the hope of mainstream investors. However, Bitcoin didn’t die in both instances and hadn’t died in any other, a fact that reiterates the Bitcoiner motto of “buy the dip.”

That being said, there is no best time to purchase bitcoin. Those who wait for a dip can be left hanging while Bitcoin performs double-digit green months the same way those who instant buy can see the price crash in the short term. The heart of the matter is that, in the long run, it doesn’t matter when someone bought it but actually whether they did.

Source link

#Bitcoin #Market #Enters #Fear #Territory #Time #Buy #Dip