Bitcoin Miners Resume Selling, Will BTC Price Maintain $60,000? | Bitcoinist.com

Bitcoin is maintaining its position above the $60,000 price mark, but recent moves by miners may disrupt this stability soon. The recent halving reduced the block reward from 6.25 BTC to 3.125 BTC, reducing miners’ rewards by half for verifying transactions and mining new blocks. Miner revenues have dropped significantly post-halving, according to a report by Kaiko, putting pressure on miners.

Bitcoin Under Increased Pressure

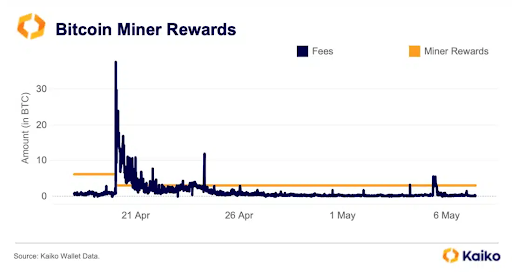

Bitcoin miners depend on two revenue streams: mining rewards and transaction fees. Each halving historically increases selling pressure from miners, and data indicates a decrease in the Bitcoin hash rate post the April halving, resulting in the lowest mining profitability in three years.

Miners with high operational costs must find alternative income sources to sustain their operations. Many are left with no choice but to sell some of their BTC holdings. Marathon Digital and Riot Blockchain, two major miners, hold over $1.6 billion worth of BTC combined.

Interestingly, the surge in Bitcoin network fees pre and post-halving has somewhat compensated operational costs but has necessitated selling. Kaiko reports that network fees contributed to 16% of Marathon Digital’s BTC earnings in April, up from 4.5% in March.

However, recent trading activity and volume decline indicate a drop in revenue from network fees, raising the probability of miners selling their holdings.

Source: Kaiko

What’s Next For BTC?

At the moment, Bitcoin is valued at $61,888 and has dropped by 1.20% in the past 24 hours. The next few months will be critical in determining the impact of halving and miner sell-off on Bitcoin’s price. Strong demand and miners holding onto their assets could stabilize or even boost the price.

Fortunately, there are several catalysts for price surges that could counterbalance the impending miner sell-off. Bitcoin stands a chance at maintaining the $60,000 price level, especially with mainstream adoption through Spot Bitcoin ETFs and whale accumulation of BTC. Data shows that short-term holder whales are now accumulating around 200,000 BTC weekly.

BTC reclaims support above $62,000 | Source: BTCUSD on Tradingview.com

Featured image from Money, chart from Tradingview.com

Source link

#Bitcoin #Miners #Selling #BTC #Price #Hold #Bitcoinist.com