Bitcoin: New Fantasy Despite Summer Lull And Uncertainties (Technical Analysis) (BTC-USD)

peshkov

With costs reaching practically USD31,000, Bitcoin’s restoration rally hit its peak on April 14th. This resulted in a doubling of costs inside a span of 5 months. Our preliminary two worth targets of USD25,000 and USD30,000 have been achieved.

Assessment

Nonetheless, since mid-April, Bitcoin (BTC-USD) in addition to the Grayscale Bitcoin Belief (OTC:GBTC) have been drifting right into a sluggish consolidation, reaching lows of round USD24,750 final Thursday, which represents a decline of over 20%. Because of this correction, the general market capitalization of the complete crypto sector decreased from USD1.26 trillion all the way down to USD1.02 trillion, a decline of roughly 19%. As a result of vital downward stress on most altcoins in current weeks, the Bitcoin dominance has risen to 48%.

Sturdy bounce within the final two days

However, prior to now two days, Bitcoin bulls have made a comeback. With a pointy restoration, costs have already rebounded by round 8.2% to roughly USD26,850. Whereas it isn’t but a sustainable pattern reversal, it’s a minimum of a transparent signal of life!

The rationale behind this improve is probably going the announcement that BlackRock, the world’s largest asset supervisor, has filed an utility with the US Securities and Alternate Fee (SEC) for a Bitcoin exchange-traded fund (ETF) primarily based on spot costs. The approval of such an ETF by the SEC is very unsure, as earlier Bitcoin ETF purposes have confronted vital resistance and considerations from regulatory authorities. If the SEC does approve BlackRock’s utility, a flood of recent Bitcoin ETF merchandise might enter the market.

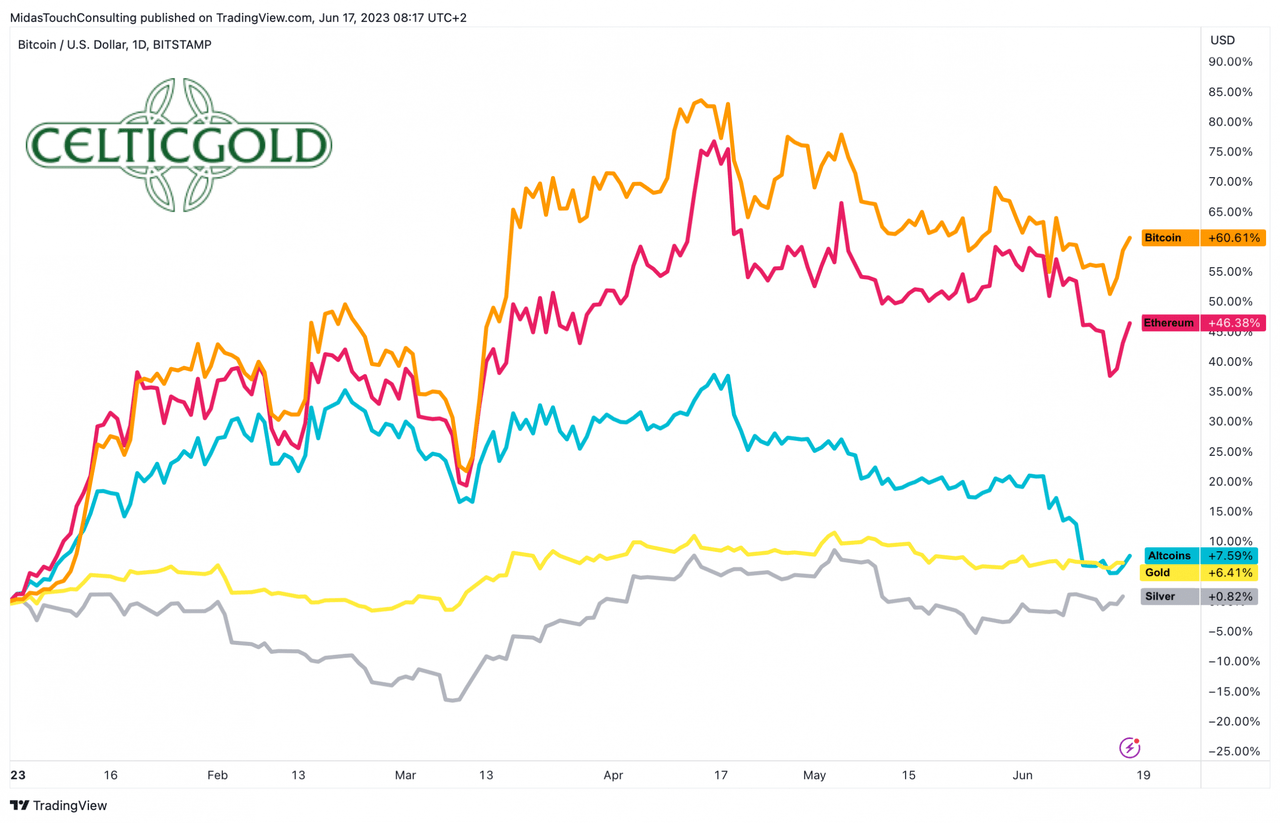

Bitcoin vs. Ethereum vs. altcoins vs. Gold vs. Silver in USD year-to-date, as of June seventeenth, 2023. (TradingView)

General, the value improvement because the starting of the 12 months has been clearly optimistic for each Bitcoin (+60%) and Ethereum (ETH-USD) (+46%). Nonetheless, altcoins have given again virtually all of their positive factors (+7.59%) as a result of upcoming delisting on the Robinhood buying and selling platform. Gold (XAUUSD:CUR) has gained 6.4%, whereas silver (XAGUSD:CUR) has made little progress to this point this 12 months, with a achieve of solely 0.82%.

Whereas the SEC, underneath the management of Garry Gensler, has been intensifying its scrutiny of main crypto exchanges akin to Coinbase and Binance in current weeks, the sector has lacked momentum and optimistic catalysts. Even earlier than the normal summer season lull, the sector was severely impacted by excessive uncertainty. Nonetheless, with the BlackRock utility for a Bitcoin ETF, the sector might regain momentum, as a Bitcoin spot ETF is anticipated to deliver vital new inflows of capital and buying demand.

Technical evaluation for Bitcoin in US-dollar

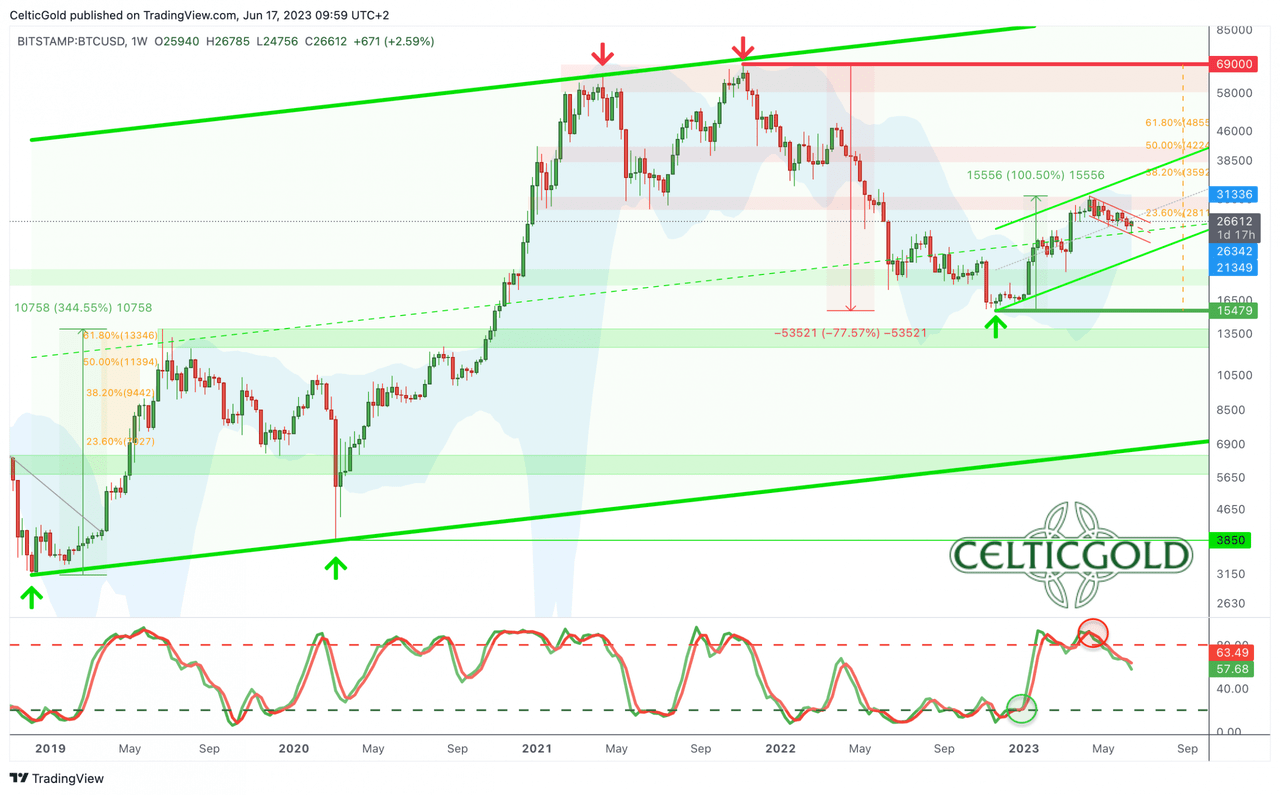

Bitcoin Weekly Chart – Tenacious and wholesome correction to this point

Bitcoin in USD, weekly chart as of June seventeenth, 2023. (TradingView)

Ranging from its low level on November twenty first at USD15,479, Bitcoin was in a position to recuperate fairly vigorously till April 14th. Nonetheless, the bulls ran out of steam at USD31,000, whereas crypto speculators indulged unabashedly within the meme coin hysteria surrounding Pepe and others. In hindsight, this was an unmistakable signal of the approaching finish of the primary wave of restoration and a short-term peak.

Though Bitcoin has retraced by 20.2% to USD24,750 within the meantime, there was a transparent lack of panic or a pointy wave. As an alternative, costs slid slowly and slightly leisurely south for the final two months. Nonetheless, the downtrend stays intact. But, the psychological degree of USD25,000, together with the mid-term trendline of the bigger overarching uptrend channel, a minimum of quickly halted the bears’ progress.

Nonetheless, a take a look at the weekly stochastic indicator nonetheless reveals a longtime promote sign, and the oscillator nonetheless has loads of room to maneuver additional down towards its oversold zone. Thus, the following robust assist on the weekly chart is prone to be discovered solely on the decrease Bollinger Band (USD21,352) and the decrease fringe of the uptrend channel (at present round USD21,460) of the previous eight months.

In abstract, the weekly chart is bearish, and a medium-term decline in the direction of roughly USD21,750 and USD22,250 nonetheless must be anticipated.

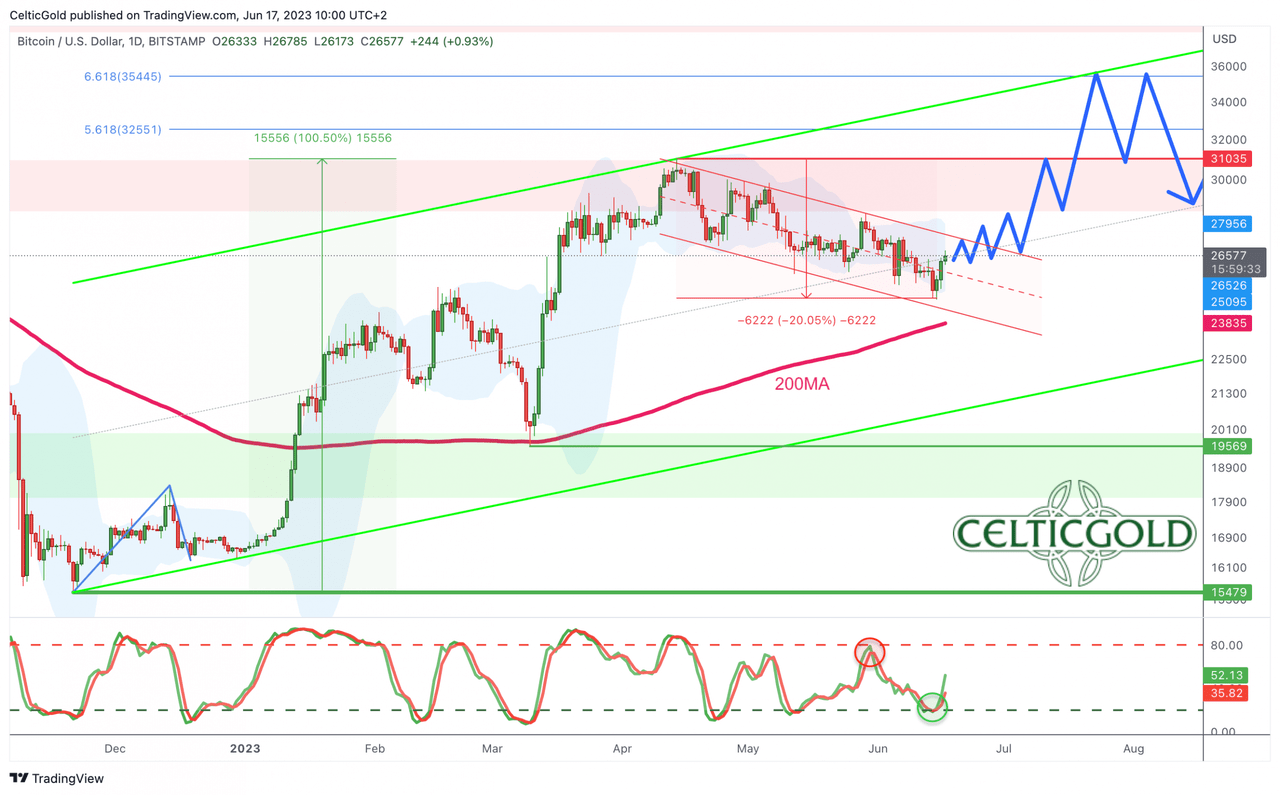

Bitcoin Every day Chart – Reversal above the rising 200-day shifting common

Bitcoin in USD, every day chart as of June seventeenth, 2023. (TradingView)

On the every day chart, a downtrend channel has shaped during the last two months, which might at present permit the bears some room on the draw back till roughly USD24,200. On the similar time, the 200-day shifting common (USD23,835) swiftly caught up with the present worth motion from under. A reunion with this broadly watched shifting common appeared extremely seemingly. Nonetheless, Bitcoin has already turned up earlier than reaching it, and the every day stochastic indicator is exhibiting a brand new purchase sign. Instant and vital worth declines are due to this fact unlikely within the close to time period, and the encounter with the 200-day shifting common could have been postponed indefinitely.

General, the every day chart has switched to a bullish stance. The down-wave seems to have discovered its low level at USD24,750. The continuing restoration ought to present us with extra perception into the state of Bitcoin shortly. If a transparent pattern reversal and a breakout from the downtrend channel will happen with costs above USD27,500, the trail to the upside could be clear. One other try to interrupt by way of the resistance zone between USD29,000 and USD31,000 might be doable in mid-summer already. Nonetheless, if the continued bounce stays weak, the arguments for a continuation of the correction in the direction of USD22,500 and decrease would strengthen.

Sentiment Bitcoin – New fantasy regardless of summer season lull and uncertainties

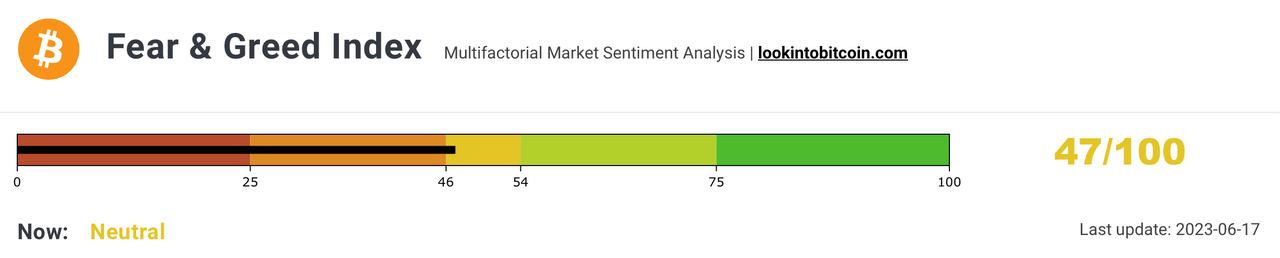

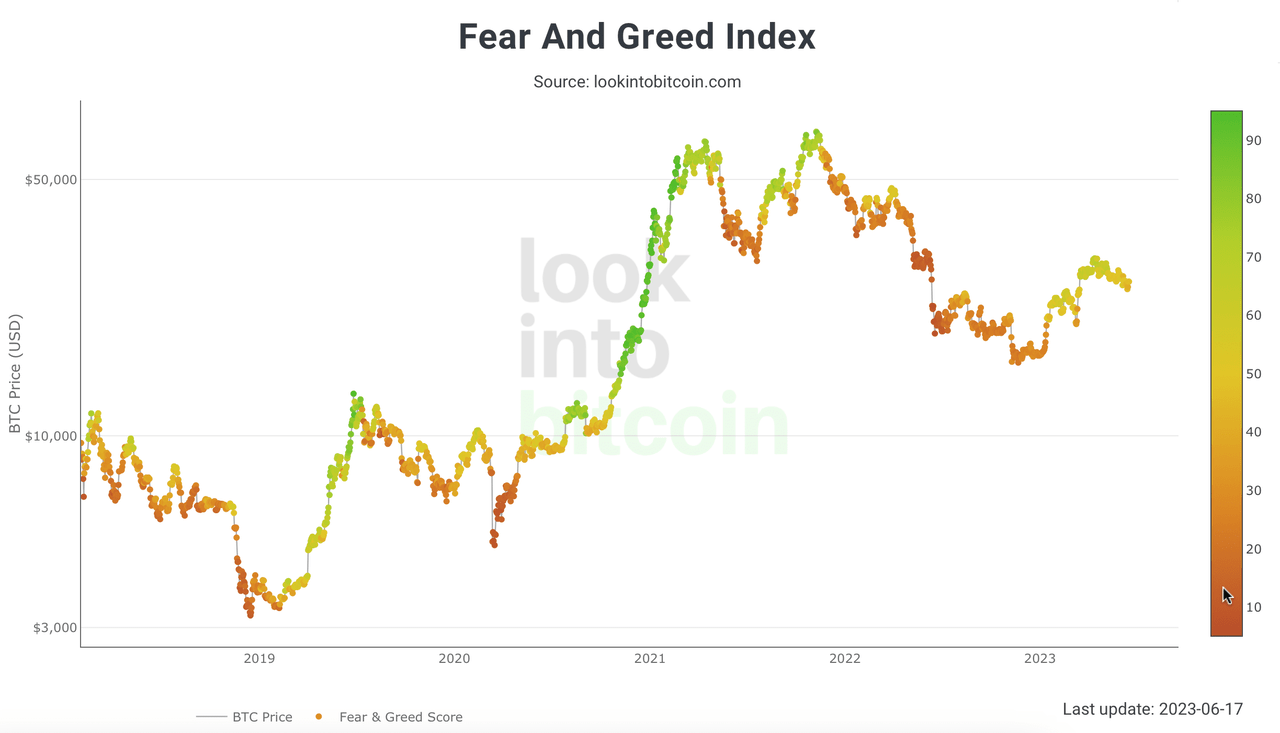

Crypto Worry & Greed Index, as of June seventeenth, 2023. (Lookintobitcoin)

Sentiment within the crypto sector has cooled down consistent with the declining costs in current weeks. In accordance with the “Crypto Fear & Greed Index,” the sentiment is impartial with a worth of 47.

Crypto Worry & Greed Index long run, as of June seventeenth, 2023. (Lookintobitcoin)

Within the bigger image, the restoration wave in April already failed to succeed in excessive sentiment ranges. Due to this fact, sentiment-wise, Bitcoin stays in a state of uncertainty. From this angle, the tip of the bear market can’t be declared but, because the restoration motion between January and April was nonetheless comparatively weak. On the similar time, the present sentiment doesn’t impede a continuation of the restoration.

General, Bitcoin is much from euphoria and extreme optimism. Nonetheless, there is no such thing as a contrarian shopping for alternative as a consequence of excessive ranges of worry and panic both.

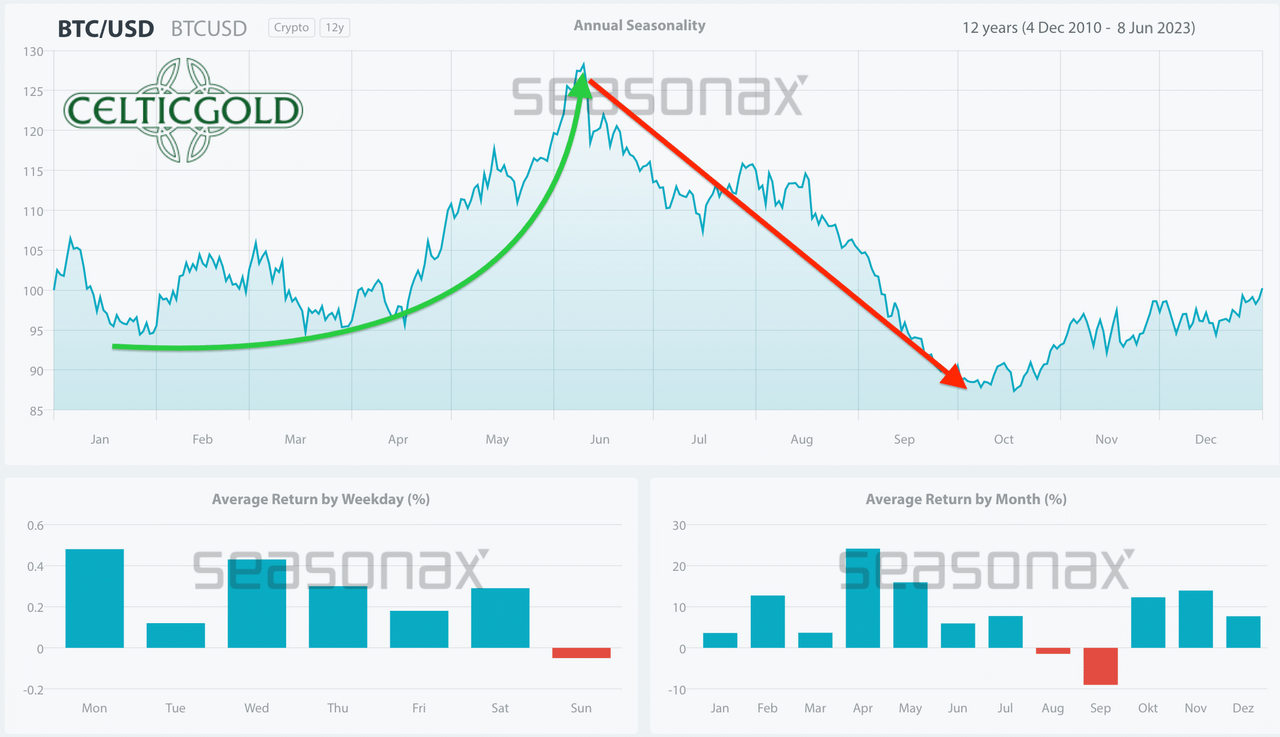

Seasonality Bitcoin – Is the early summer season rally beginning now?

Seasonality for Bitcoin, as of June eighth, 2023. (Seasonax)

The seasonal sample has solely partially performed out this 12 months, as Bitcoin reached its excessive level in April already and has been falling since then. Maybe Mr. Gensler disrupted the standard rally in Might and June. Nonetheless, the restoration of the previous two days could have now offered the delayed begin sign for the power section in early summer season. In that case, the following two months ought to ship a powerful rally within the sector.

Alternatively, if we persist with the early peak in April, in keeping with the seasonal statistics, a mean correction of roughly 4 months ought to observe. On this state of affairs, Bitcoin could doubtlessly attain an vital low level not earlier than early August.

General, the present scenario truly contradicts the seasonal sample, which might be unfavorable from now till autumn. Nonetheless, it is doable that this 12 months, the standard rally between mid-April and mid-June merely happens two months later.

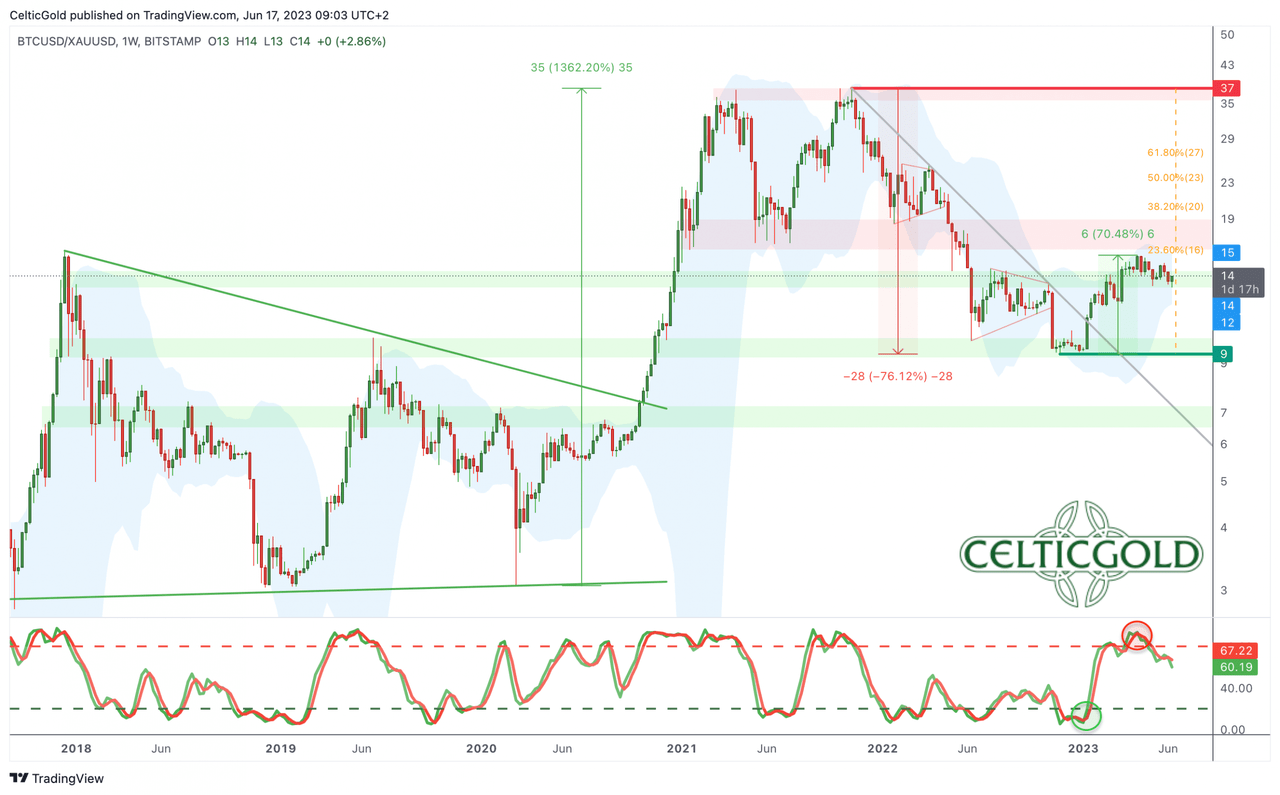

Sound Cash: Bitcoin vs. Gold

Bitcoin/Gold-Ratio, weekly chart as of June seventeenth, 2023. (TradingView)

In spring, Bitcoin reached its peak greater than three weeks earlier than gold. In the course of the restoration, the Bitcoin/Gold ratio initially climbed to fifteen.25. With Bitcoin buying and selling at round USD26,650 and gold at USD1,957, at present, one Bitcoin prices roughly 13.62 ounces of gold. Vice versa, one ounce of gold at present prices about 0.073 Bitcoin. General, because the starting of the 12 months, Bitcoin has clearly been the quicker horse, outperforming gold by an element of 10!

In the course of the correction, the ratio lately dropped again to 12.8. Nonetheless, since Thursday, Bitcoin has been turning upwards once more, and the restoration because the starting of the 12 months could proceed. Moreover, the decrease Bollinger Band on the weekly chart opposes considerably decrease ratio values (under 12). Due to this fact, for individuals who want to regulate their “safe haven” allocation in favor of Bitcoin, now, or at ratio values round 12, would seemingly be an acceptable time to take action.

In abstract, the Bitcoin/Gold ratio has corrected as anticipated. Though the weekly stochastic indicator is much from being oversold, we anticipate a restoration over the following two months, with ratio values round 15.

Macro replace – Misleading calmness

After quite a few financial institution collapses in March, which even led to a financial institution run within the U.S., the scenario has considerably calmed down in current weeks.

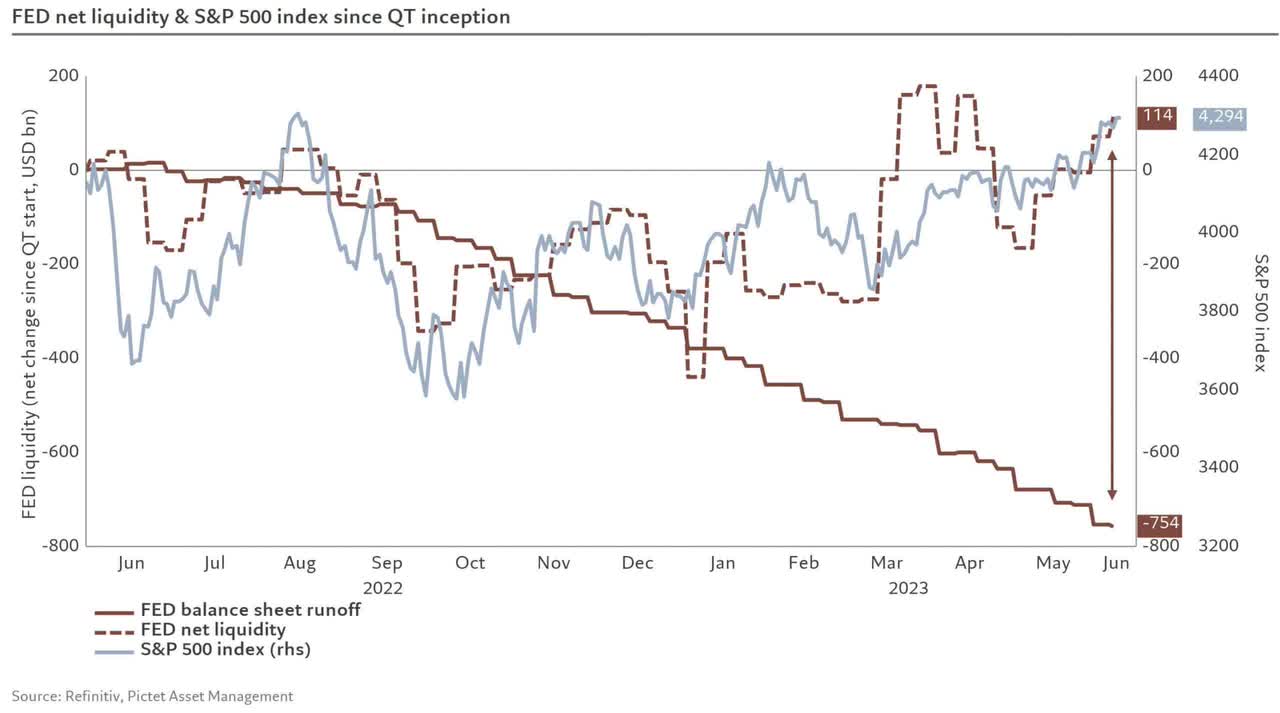

Fed steadiness sheet vs. internet liquidity vs. S&P 500, as of June ninth, 2023. (Pictet Asset Administration)

The rationale for this misleading calmness could be attributed to large liquidity injections (Financial institution Time period Funding Program) by the American central financial institution. As an alternative of implementing the deliberate “Quantitative Tightening” of USD750 billion, there’s now, in essence, a type of “Quantitative Easing Light” of roughly USD100 billion! The rise in internet liquidity is a results of US banks with the ability to borrow from the Federal Reserve (Fed) at a credit score price of 5% curiosity per 12 months to cowl their considerably decreased bonds at USD1.00 as an alternative of their actual worth of USD0.50. Whereas this credit score incurs curiosity, it has quickly pushed the issue into the longer term and prevented a liquidity disaster. That is why the inventory markets are rising, because the S&P 500 is up greater than 27.5% since final November. Little doubt, the crack-up growth is underway!

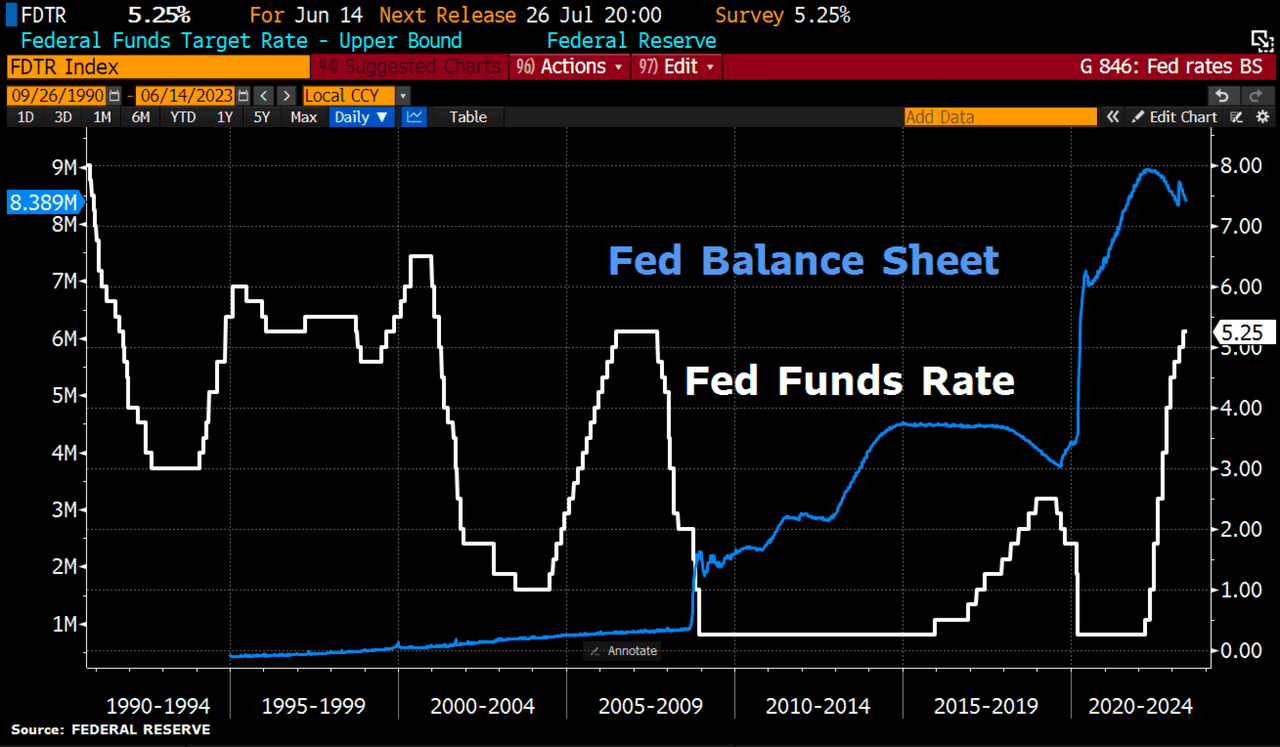

US Fed steadiness sheet vs. Fed funds charge, as of June 14th, 2023. (Holger Zschaepitz)

Final Wednesday night, the Fed determined to not additional improve rates of interest after greater than a 12 months of aggressive hikes. Nonetheless, Federal Reserve Chairman Powell indicated that the pause could solely be short-term, because the Fed implies two extra 25 foundation factors charge hikes later this 12 months.

With its rigorous tightening cycle, the Fed has already shattered the porcelain. The swiftly concocted rescue packages since March have solely masked the issues, whereas a large smoldering fireplace continues to burn behind the scenes of the monetary system.

Mountain climbing cycle introduced the tip of straightforward cash

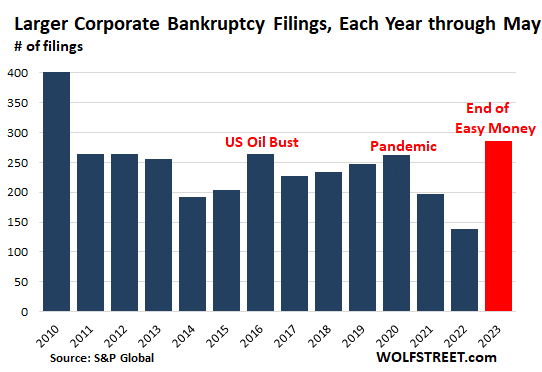

Chapter filings within the US, as of June 7, 2023. (S&P World)

For individuals who take some time to hunt details past the mainstream, they are going to uncover, for instance, that the variety of chapter filings within the US this 12 months has reached the best degree since 2010.

The underlying cause is that the elevated rates of interest have made debt far more costly. Moreover, the traders who’re supposed to purchase these money owed have change into extra cautious as a result of the simple cash, as soon as plentiful as a result of low rates of interest, is not available. Nonetheless, as soon as firms change into reliant on straightforward cash to maintain themselves as a consequence of excessive debt ranges, it turns into difficult to interrupt free from this dependency. In a method, the financial system is normalizing with rates of interest typical of the pre-QE period. However firms that might survive solely due to straightforward cash are actually feeling the stress.

Industrial actual property is the following shoe to drop

Moreover, the following storm is brewing, significantly within the US industrial actual property sector. At the moment, quite a few US banks are hurrying to cut back their publicity to this sector as a consequence of an imminent wave of cost defaults. PacWest lately offered a building mortgage portfolio price USD2.6 billion at a big loss, whereas HSBC is searching for to promote lots of of hundreds of thousands of {dollars} in industrial actual property loans as rapidly as doable. Many regional lenders, specifically, could have to contemplate promoting industrial actual property loans at a considerable low cost. Because the gross sales achieve momentum, the downward spiral accelerates, additional miserable property costs. It’s seemingly that almost half of the 4,800 American banks have already depleted their capital buffers and are doubtlessly bancrupt.

In the meantime, emptiness charges in places of work and retail shops in San Francisco for instance proceed to soar, whereas security considerations and drug abuse deter vacationers and guests. The town might change into one of many epicenters of the following apocalypse. Just lately, Unibail-Rodamco-Westfield (OTCPK:UNBLF) and Brookfield Corp. (BN) needed to switch possession of town’s largest purchasing middle to the lender after they have been not in a position to make funds on the USD558 million mortgage. Park Motels & Resorts Inc. (PK) has additionally halted mortgage funds for 2 downtown motels with excellent money owed totaling USD725 million.

A wave of cost defaults and bankruptcies is looming

The growth and bust cycle will proceed, because the tightest insurance policies from the Fed and the European Central Financial institution (ECB) in 15 years collide with excessive ranges of debt and adventurous by-product constructions. The foreseeable wave of cost defaults within the US and Europe can even hit the true financial system onerous, with default charges presumably not peaking earlier than the fourth quarter of 2024 and even later.

Previously, the Fed halted its aggressive rate of interest hike cycle again in June 2006. Nonetheless, the foremost monetary disaster solely started a 12 months and a half later! Due to this fact, the monetary markets are going through difficult instances forward. Whereas the buzzword “AI” is at present celebrated within the inventory markets, the low volatility is probably going simply the calm earlier than the following storm. Whereas treasured metals could present safety proper firstly of the disaster this time, Bitcoin will face difficulties throughout inventory market turbulence and should solely expertise sustained progress throughout subsequent rescue packages.

Conclusion: Bitcoin – New fantasy regardless of summer season lull and uncertainties

After sliding south for 2 months, Bitcoin has began a restoration prior to now two days. Quickly, it ought to change into evident from a technical evaluation perspective whether or not the “Bitcoin ETF fantasy” is sufficient to push the costs again above USD27,500. If profitable, an increase to round USD30,000 and even USD35,000 might be doable by mid-summer. Alternatively, as a result of lingering regulatory uncertainties, the sector could fall again into its current untimely summer season lethargy.

Source link

#Bitcoin #Fantasy #Summer #Lull #Uncertainties #Technical #Analysis #BTCUSD