Bitcoin Reacts To Russia Ukraine Invasion

The beneath is from a new version of the Deep Dive, Bitcoin Magazine’s premium business sectors pamphlet. To be among quick to get these experiences and other on-chain bitcoin market examination directly to your inbox, subscribe now.

Bitcoin continued to behave like a high beta, risk-on asset similar to most of the overvalued tech sector. As Russia’s announcement of military intervention was proliferating across financial markets, U.S. equity markets reached as far down as -3% in the night session, with bitcoin also plummeting to a low of $34,300, before bottoming and aggressively rebounding to a high of $40,000 in a large short squeeze.

Bitcoin cost weighted by ceaseless trade financing rates

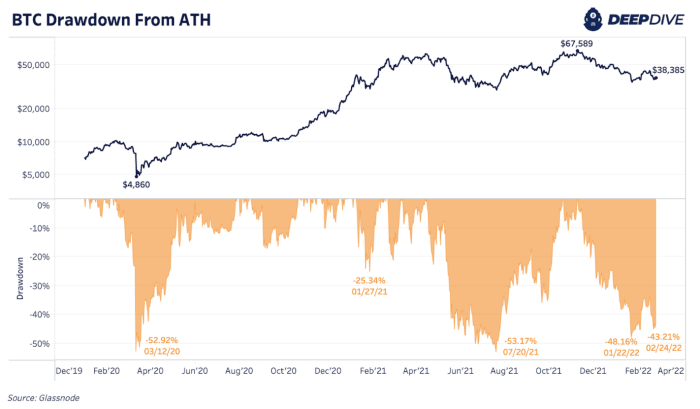

Bitcoin cost drawdown from record-breaking highs

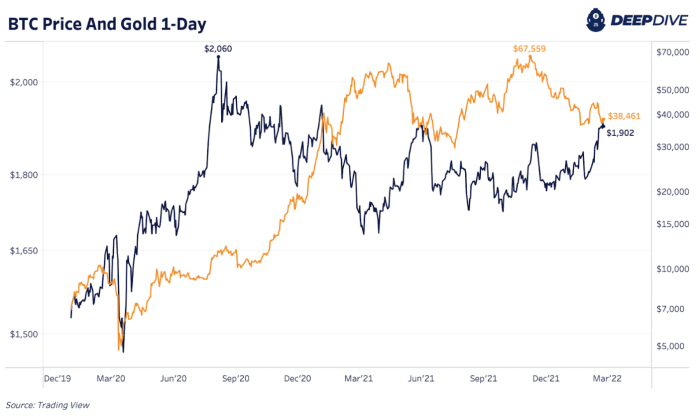

At the hour of composing bitcoin is down 43% from its highs from November, and 12% off the lows set toward the end of last night. At the end of the day the Nasdaq shut a remarkable 3.4% in the green in the day by day meeting, as hazard resources exchanged as though greatest dread and vulnerability were estimated in soon after the conflict presentations. Gold at first popped and hit more than a one-year high, contacting $1974 an ounce prior to dropping pointedly, in a reverse example from U.S. value markets and bitcoin.

Bitcoin value contrasted with the cost of gold on a one-day time frame

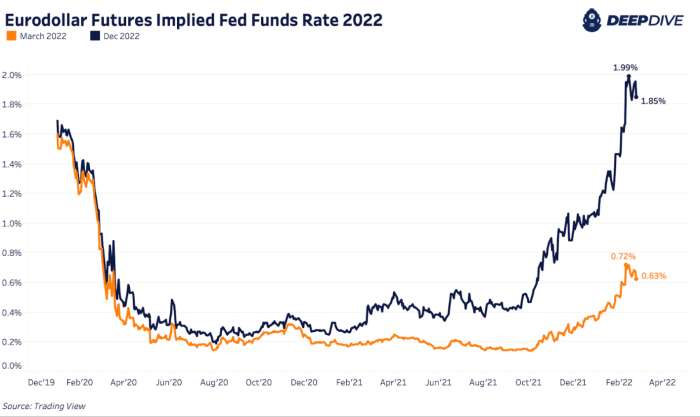

As an aftereffect of the contention, the business sectors have in no time estimated in lower Federal Reserve Board rate climbs for 2022. Looking at the eurodollar fates market, the suggested government subsidizes rate has now dropped more than 10 bps for March and somewhat something else for the remainder of the year.

Eurodollar prospects inferred Fed reserves rate for 2022

A improvement that will be vital to watch is if the Fed strolls back the course of events for fixing money related approach because of the episode of battle in Ukraine. If history is any point of reference, this could in all likelihood be the situation as national banks value the chance to redirect liability regarding strategy blunder and keep on facilitating markets.

Source link

#Bitcoin #Reacts #Russia #Ukraine #Invasion