Bitcoin Supply Becoming Less Concentrated On Whales: Data

Data from Glassnode has revealed that the Bitcoin provide is step by step dispersing from whales and exchanges to smaller fingers with time.

Bitcoin Supply Is Slowly Exhibiting Dispersal In direction of Smaller Holders

In keeping with a brand new report printed by the on-chain analytics agency Glassnode, buyers holding lower than 50 BTC have not too long ago absorbed essentially the most important quantity of cash.

One thing that BTC critics typically maintain up towards the cryptocurrency is the distribution of the provision. They argue that the provision is closely concentrated round a couple of whales, offering the existence of huge wallets as proof.

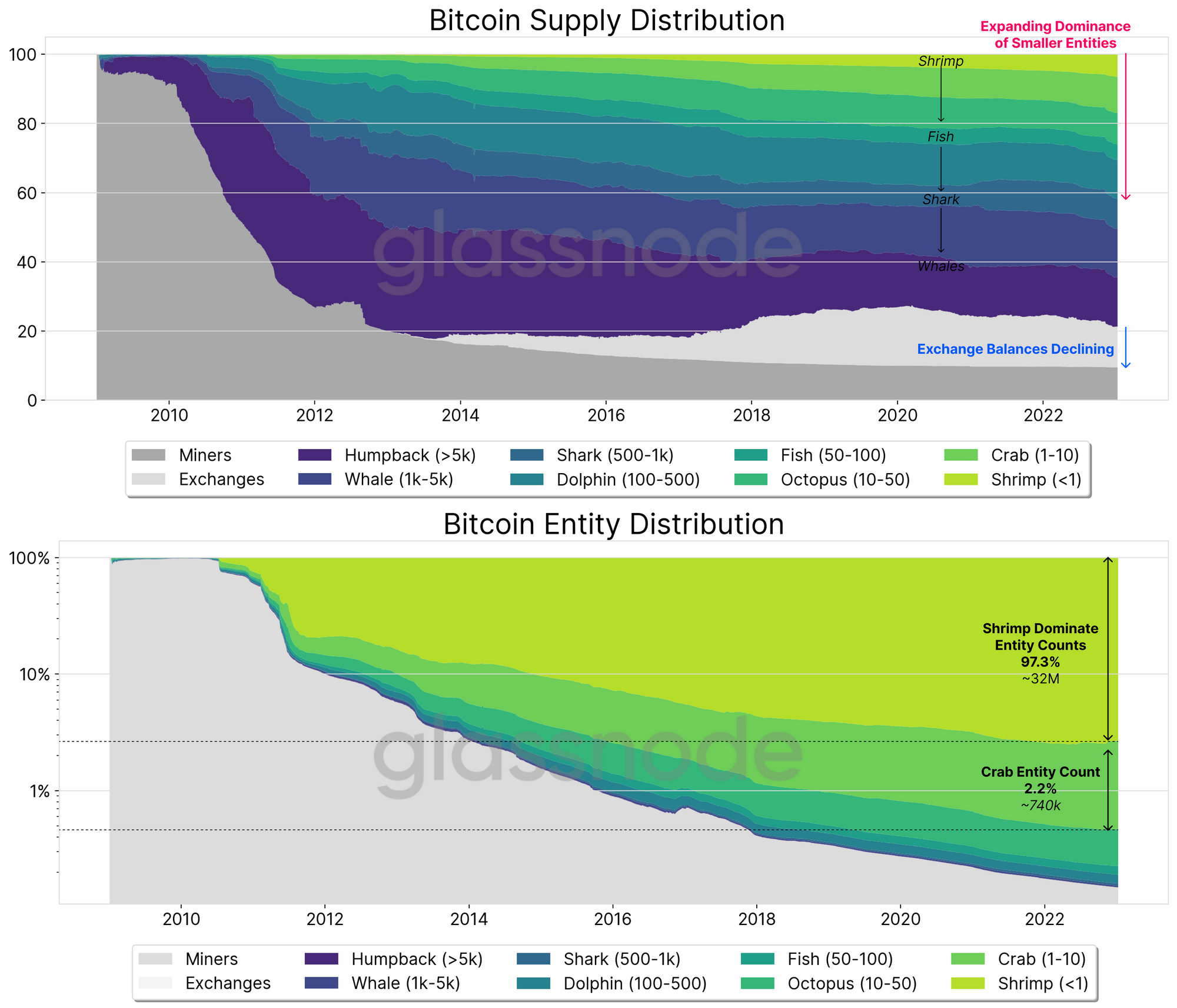

To verify whether or not this truth holds, Glassnode studied the provision distribution of the market by breaking down buyers into totally different cohorts. These holder teams are outlined by the analytics agency as follows: shrimp (<1 BTC), crab (1-10 BTC), octopus (10-50 BTC), fish (50-100 BTC), dolphin (100-500 BTC), shark (500-1,000 BTC), whale (1,000-5,000 BTC), and humpback (>5,000 BTC).

The provides held by exchanges and miners are additionally thought-about for the classification. A related indicator right here is the “yearly absorption rates,” which measures the yearly change within the provides of the totally different cohorts as a proportion of the entire quantity of issued cash (that’s, the contemporary provide miners produce).

First, here’s a chart that exhibits how the yearly absorption charges of shrimps and crabs have modified over the lifetime of the cryptocurrency:

Appears to be like just like the metrics have proven excessive values in current days | Supply: Glassnode

As displayed within the above graph, the Bitcoin shrimps and crabs have not too long ago been observing all-time excessive absorption charges of about 105% and 119%, respectively.

Which means that the provision held by the shrimps has grown by 105% of what miners produced through the previous 12 months, whereas the crabs have added an much more important proportion at 119%.

Even when the BTC miners launched 100% of what they mined the previous 12 months, these cohorts nonetheless have absorbed an additional provide. The place did these extra cash come from? The absorption charges of the opposite cohorts would possibly maintain the reply to it.

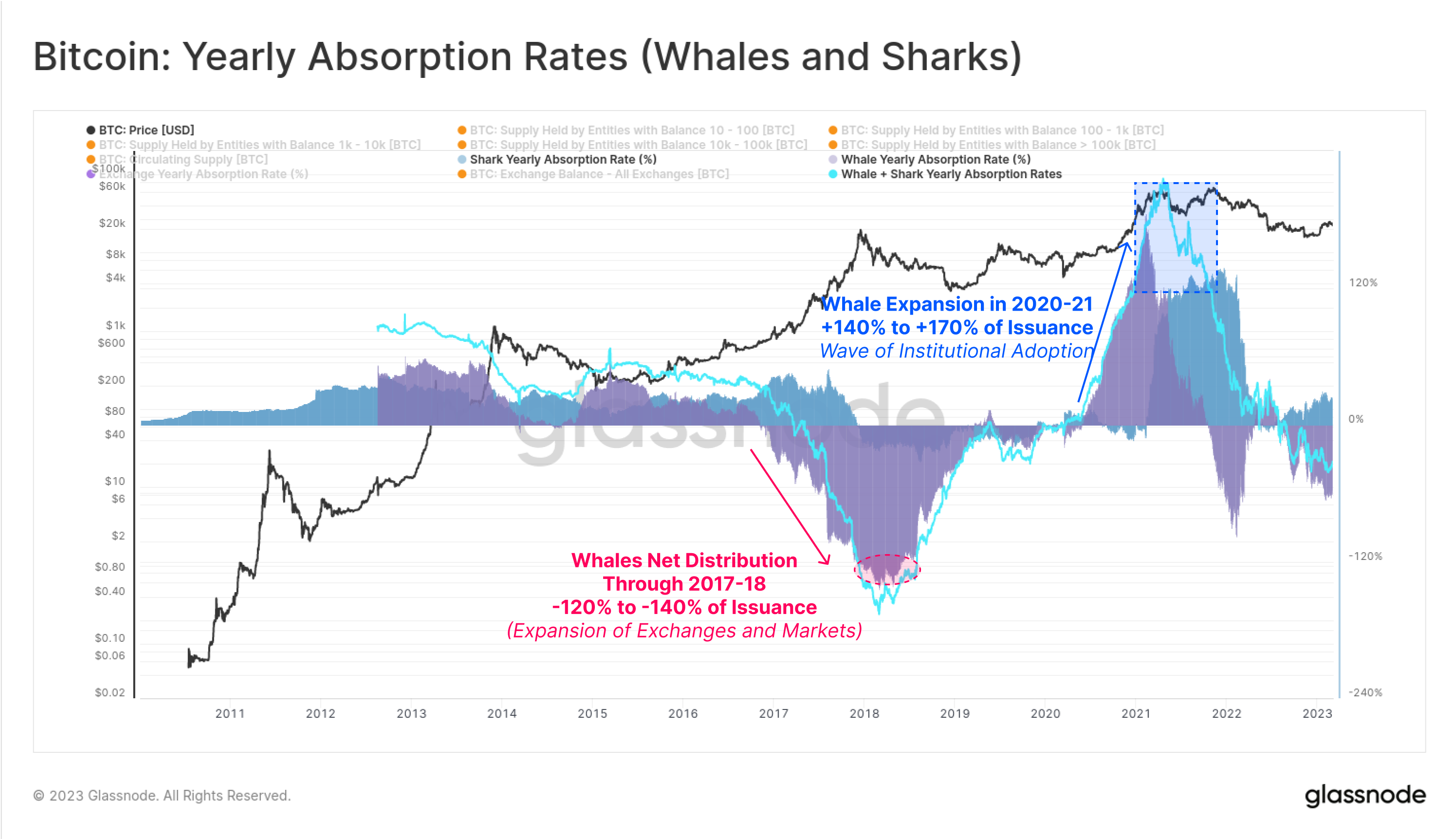

The absorption charges of the sharks and whales | Supply: Glassnode

From the chart, it’s obvious that sharks have had a barely constructive yearly absorption charge not too long ago. Nonetheless, the whales have seen a unfavorable indicator worth, implying that this cohort has been distributing through the previous 12 months.

The mixed change within the provides of each these cohorts can also be a internet unfavorable for the reason that distribution of the whales far outweighs regardless of the sharks gathered throughout this era.

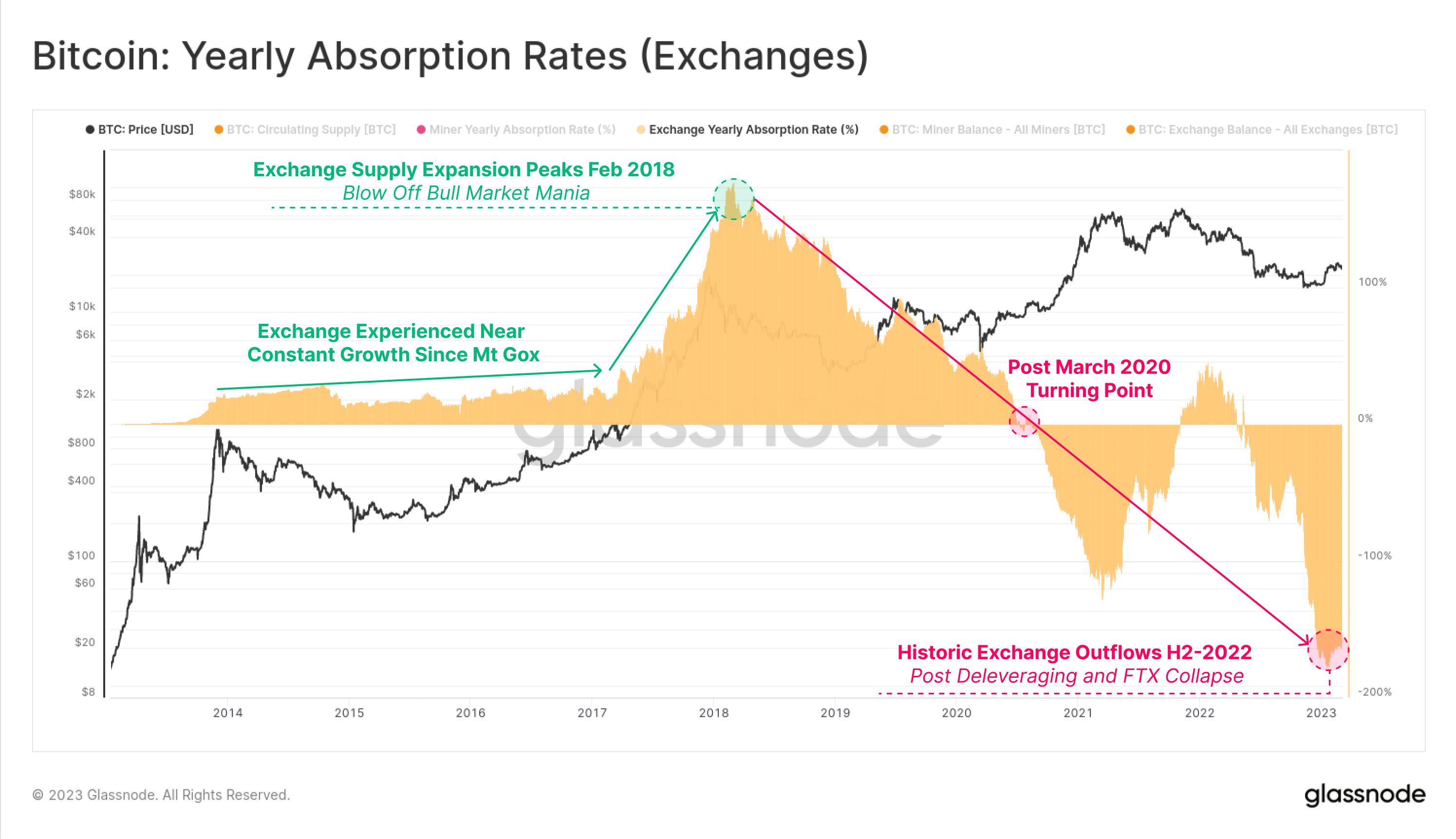

Data for the absorption charges of the exchanges additionally exhibits unfavorable values, implying that these platforms have launched many cash into circulation.

The extremely unfavorable absorption charges proven by exchanges | Supply: Glassnode

The smaller Bitcoin entities have been choosing up the cash distributed by these cohorts. Apparently, whereas this shift within the provide has been excessive not too long ago, it’s a development that has held up all through the years.

Because the chart beneath highlights, the provision held by smaller entities (with lower than 50 BTC) has step by step gained dominance all through the cryptocurrency’s historical past.

The rise of the shrimps and different small buyers | Supply: Glassnode

Although the share of the whales might have been fairly important in some unspecified time in the future, as we speak, their holdings have shrunk down to only 34.4% of the whole circulating provide, which, though nonetheless sizeable, is far lesser than the 62.7% across the time of the primary halving, the occasions that minimize downs BTC mining rewards in half, again in 2012.

The gradual provide shift additionally appears to be in direction of the smallest entities, that are the retail buyers. This can be a signal that cryptocurrency is changing into extra dispersed as adoption will increase.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $24,300, up 10% within the final week.

BTC observes a pullback | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com

Source link

#Bitcoin #Supply #Concentrated #Whales #Data