Bitcoin Volatility Hits Historic Lows Amid Market Apathy

As we head into 2023, we need to spotlight the newest state of bitcoin’s quantity and volatility after a latest wave of capitulation. Final time we touched on these dynamics was in “The Bitcoin Ghost Town” in October, the place we highlighted that an especially low quantity and low volatility interval in bitcoin worth, GBTC and the choices market was a regarding signal for the following leg decrease. This performed out in early November.

Quick ahead and the tendencies of declining quantity and low volatility are again as soon as once more. Though this might be indicative of one other leg decrease to return available in the market, it’s extra possible indicative of a complacent and decimated market that few contributors need to contact.

Even throughout the November 2021 capitulation interval, there was a traditionally low interval of volatility. Typically probably the most market ache might be felt when having to attend for a transparent change in tendencies. The bitcoin worth is offering that ache as we’ve but to see the kind of explosion in market volatility that has outlined market pivots and main directional strikes prior to now.

SPX Bottoms

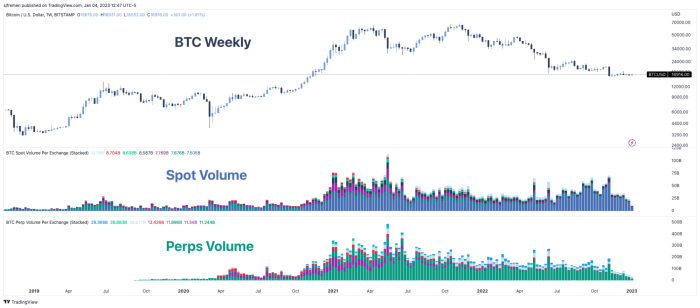

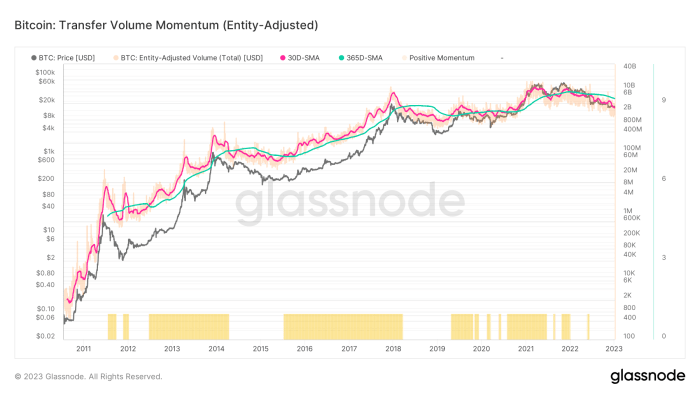

Whereas there are numerous other ways to outline, classify and estimate bitcoin quantity available in the market, all of them present the identical factor: September and November 2021 have been the height months of motion. Since then, quantity in each the spot and perpetual futures markets have been in regular decline.

Bitcoin quantity throughout spot and perpetual futures markets

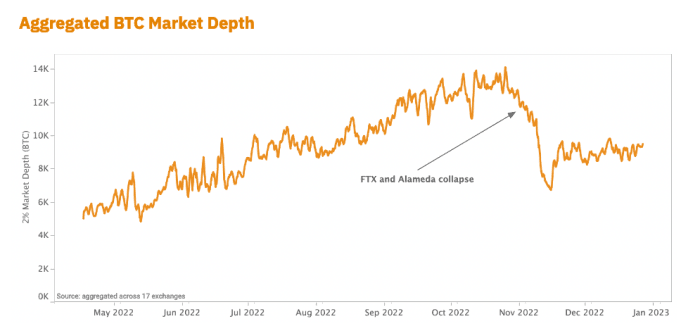

General market depth and liquidity has additionally taken a significant hit after the collapse of FTX and Alameda. Their destruction has led to a big liquidity gap, which is but to be stuffed as a result of lack of market makers at the moment within the area.

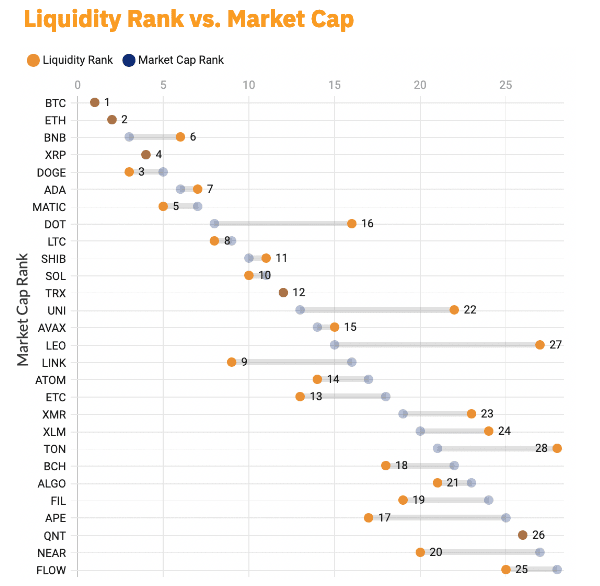

By far, bitcoin remains to be probably the most liquid market of every other cryptocurrency or “token,” however it’s nonetheless comparatively illiquid in comparison with different capital markets because the complete trade has been crushed over the previous couple of months. Decrease market depth and liquidity means property are liable to extra unstable shocks as single, comparatively massive orders can have a better impression on market worth.

Supply: Kaiko Q4 Report

Supply: Kaiko Q4 Report

On-Chain Apathy

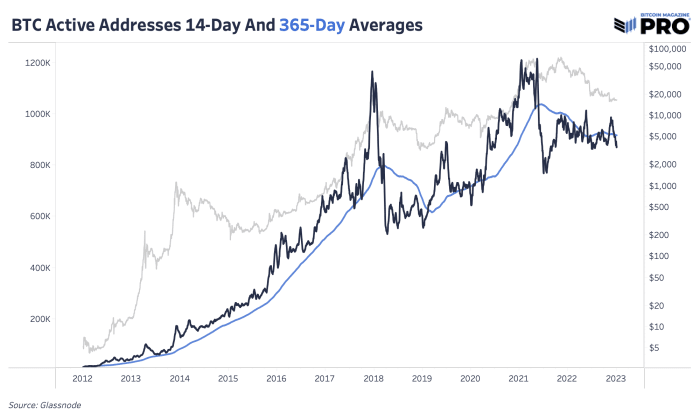

As anticipated within the present atmosphere, we’re additionally seeing extra market complacency when on-chain information. Though persevering with to rise over time, the variety of lively addresses — distinctive addresses lively as both a sender or receiver — stay pretty stagnant over the previous couple of months. The chart under highlights the 14-day transferring common of lively addresses falling under the operating common over the past yr. In earlier bull market situations, we’ve seen progress in lively addresses outpace the present development pretty considerably.

Shifting averages of lively bitcoin adresseses

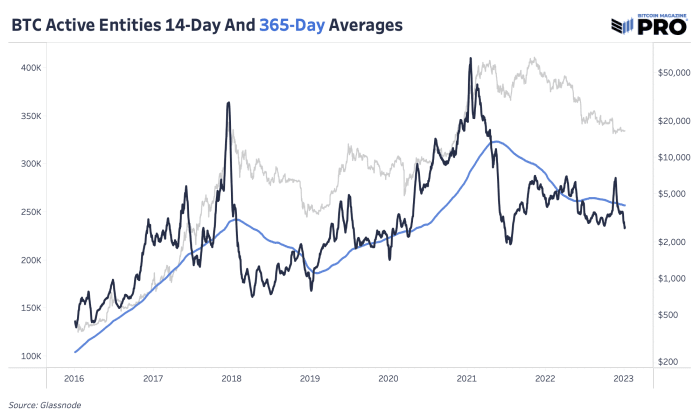

Since deal with information has its flaws, Glassnode’s information for lively entities reveals us the identical development. General, bear markets reversing are the results of many elements, together with progress in new customers and a rise in on-chain exercise.

Shifting averages of lively bitcoin entities

Bitcoin switch quantity momentum

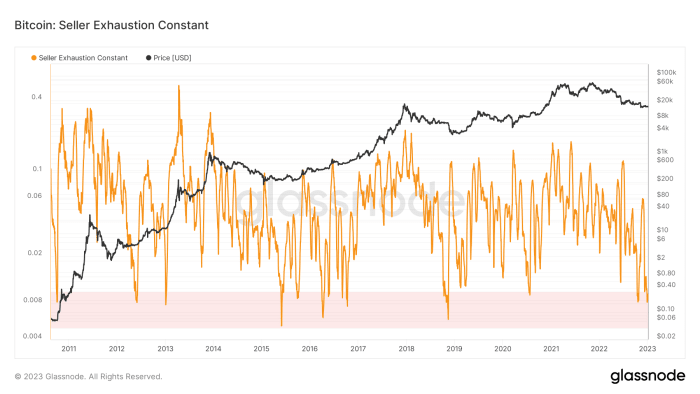

Bitcoin vendor exhaustion ranges

In our July 11 launch “When Will The Bear Market End?”, we made the case that the brunt of the price-based capitulation had already been felt, whereas the actual ache forward was within the type of a time-based capitulation.

“A look at previous bitcoin bear market cycles shows two distinct phases of capitulation:

“The first is a price-based capitulation, through a series of sharp selloffs and liquidations, as the asset draws down anywhere from 70 to 90% below previous all-time-high levels.

“The second phase, and the one that is spoken of far less often, is the time-based capitulation, where the market finally begins to find an equilibrium of supply and demand in a deep trough.” — Bitcoin Magazine PRO

We consider time-based capitulation is the place we stand right this moment. Whereas trade charge pressures can definitely intensify over the brief time period — given the macroeconomic headwinds that stay — the situations that look prone to persist over the brief and medium time period look to be a sustained interval of chop with extraordinarily low ranges of volatility that depart each merchants and HODLers questioning when volatility and trade charge appreciation will return.

Like this content material? Subscribe now to obtain PRO articles instantly in your inbox.

Related Previous Articles:

Source link

#Bitcoin #Volatility #Hits #Historic #Lows #Market #Apathy