Bitcoin whale exercise alerts chance of a historic bull run in BTC if this happens

Bitcoin value drifted decrease on Tuesday as whale curiosity in BTC declined.

Whale transactions price $1 million in Bitcoin have hit the bottom community ranges since December 2020.

If BTC value continues sliding decrease, a spike in transactions by massive pockets buyers might sign an enormous bull run within the asset.

Bitcoin value continued its decline for the seventh day in a row. Giant quantity transactions, valued $1 million or larger have hit a historic low as whale curiosity in BTC deteriorates. If BTC value continues sliding a spike in whale transactions may very well be a traditionally bullish sign for the asset.

Additionally learn: Binance CEO Changpeng Zhao believes external factors are driving fear among BNB holders

Bitcoin whale exercise might sign a bull run on one situation

Bitcoin community’s massive pockets buyers and their actions have usually influenced the asset’s value. Primarily based on knowledge from crypto intelligence tracker Santiment, BTC’s ranging costs overlapped with declining whale curiosity.

Within the chart beneath, there’s a correlation between Bitcoin value and transactions price $1 million or larger. Analysts at Santiment consider if BTC value continues to slip and whale transactions spike, it might be a historic bullish sign for the most important asset by market capitalization.

Bitcoin whale transactions price $1 million hit lowest level since Dec 2020

Regardless of BTC’s steep value drop, holders are nursing their losses. The biggest asset by market capitalization lately skilled traditionally low volatility

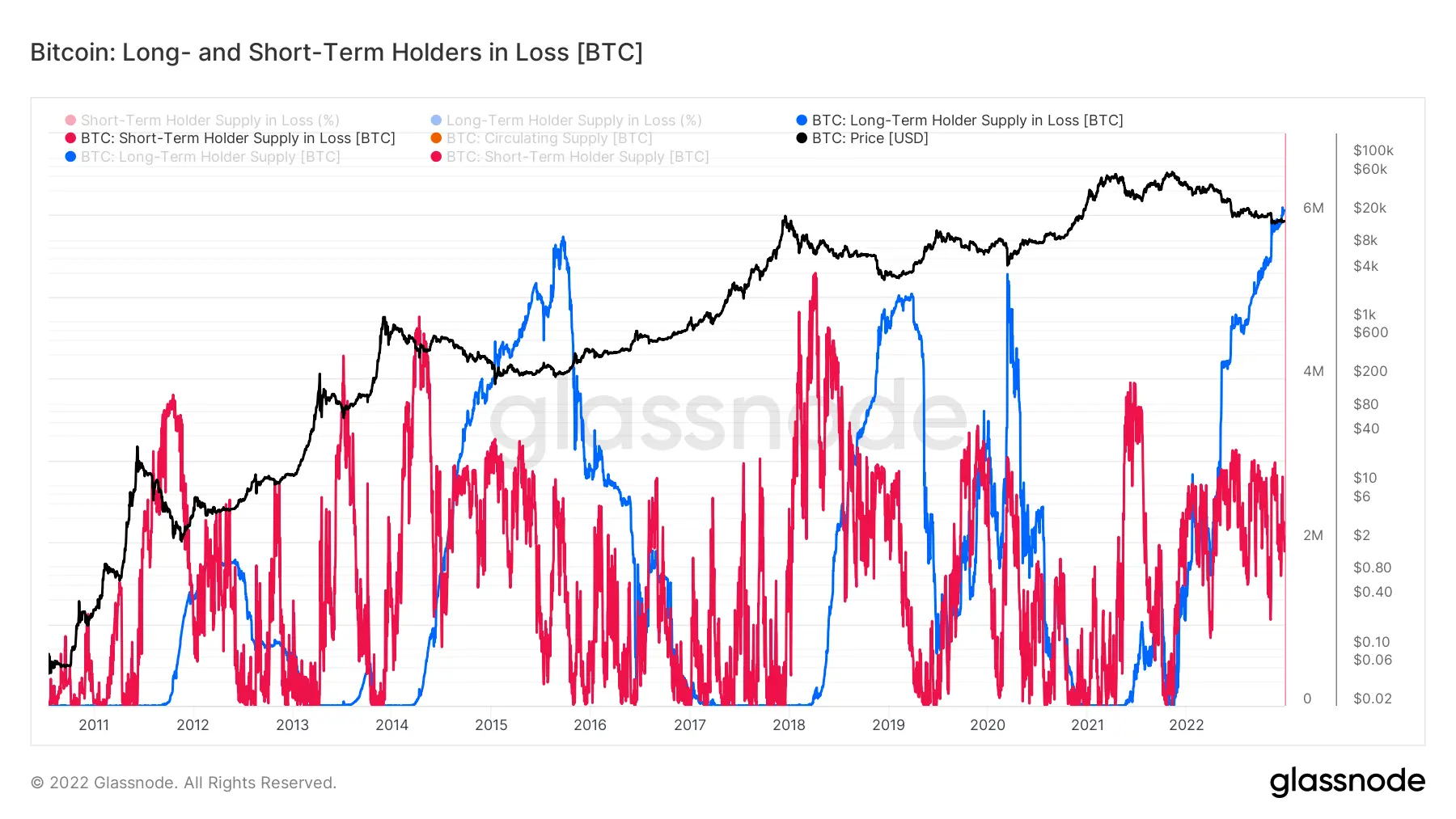

Bitcoin hodlers are sitting on a report 8 million BTC in unrealized losses. Information from on-chain analytics agency Glassnode reveals that each short-term and long-term holders are sitting on extra unrealized losses than ever earlier than.

Bitcoin: Lengthy and Quick-term holders in loss

This marks an essential milestone in Bitcoin’s value pattern within the ongoing bear market. Whale exercise and huge quantity transactions might set off a breakout within the digital forex, as consultants anticipate a BTC rally.

Bitcoin might discover its bear market backside in January 2023

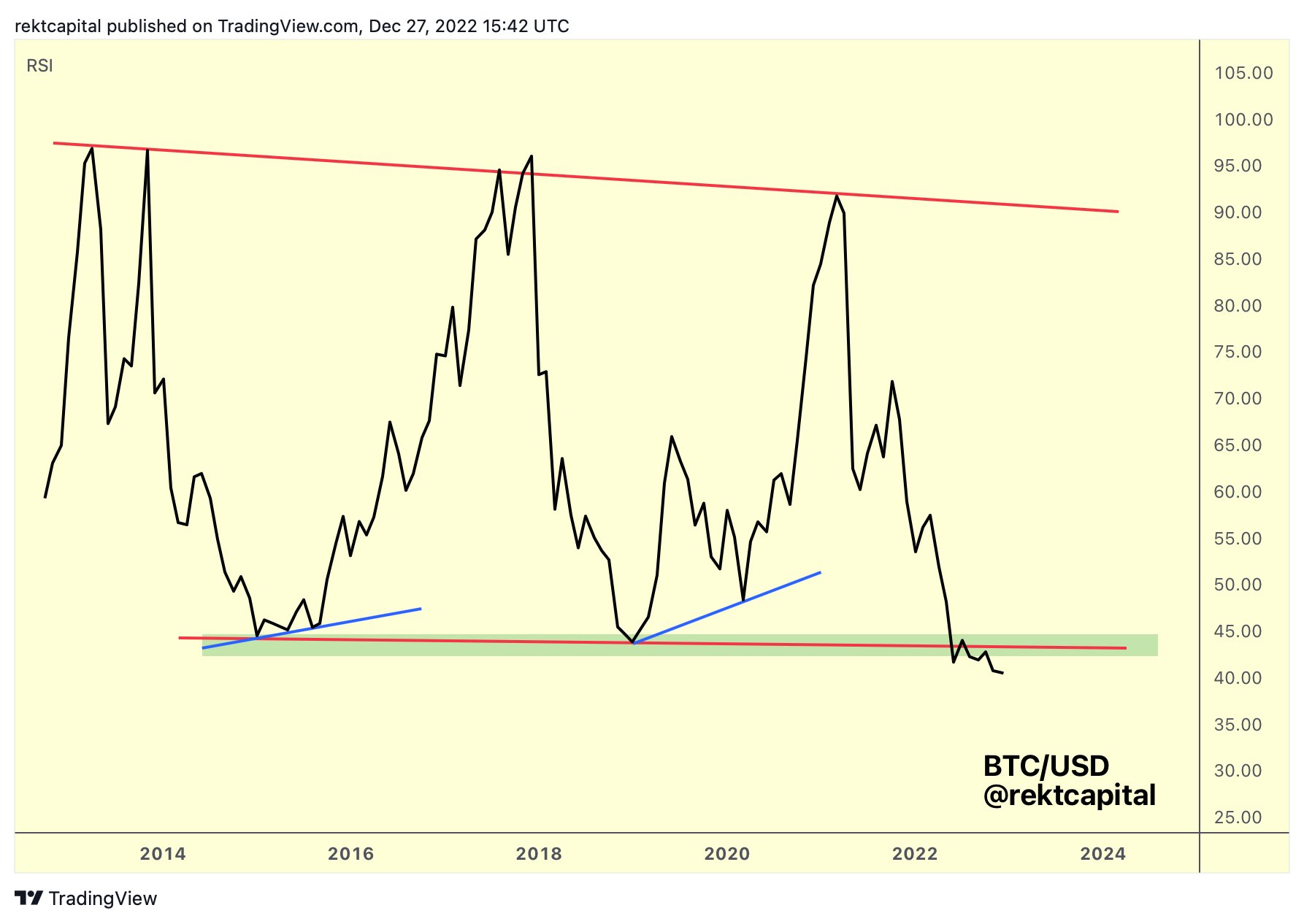

RektCapital, a crypto analyst and dealer evaluated Bitcoin’s latest Relative Energy Index (RSI). The momentum indicator is used to determine potential pattern reversals within the asset. Bitcoin RSI lately entered the oversold zone, an indication that has traditionally preceded a reversal and restoration with outsized Returns On Funding for long-term buyers.

The previous reversals from this space embrace the BTC value rally in January 2015, December 2018 and March 2020 – principally all bear market bottoms. The professional argues that the primary cryptocurrency by market cap is at present trying to find its first backside to construct macro bullish divergence.

BTC/USD value chart

The technical analyst believes BTC might hit its cycle backside by January 2023, and begin climbing larger, previous to the subsequent Bitcoin halving.

Source link

#Bitcoin #whale #exercise #alerts #chance #historic #bull #run #BTC #happens