Bitcoin’s Correlation With Other Risk Assets To Watch For In 2023, Report Suggests | Bitcoinist.com

A report means that Bitcoin’s correlation with different threat property could possibly be related going ahead into the subsequent 12 months.

Bitcoin Moved Tightly With US Inventory Market Throughout Final Week’s Volatility

In line with the newest weekly report from Arcane Research, indicators from the Federal Reserve could possibly be one thing to concentrate to in 2023 as properly. Two property are stated to be “correlated” when their costs transfer in tandem with one another. Bitcoin has been exhibiting a correlation with the US inventory marketplace for some time now, and it looks as if this pattern hasn’t modified this week both.

The under chart reveals how BTC, Nasdaq, S&P 500, Gold, and DXY have modified in worth through the latest risky occasions:

Appears like solely Gold noticed optimistic returns between 13 and 17 December | Supply: Arcane Research’s Ahead of the Curve – December 20

Because the above graph shows, all the chance property noticed an increase within the buildup to and after the CPI launch, which turned out to be extra optimistic than anticipated, with Bitcoin seeing an particularly sharp uptrend because it hit a peak of $18,400. Nonetheless, because the FOMC assembly befell, tides began to shift towards the costs of those property. Then lastly, on Friday, each US equities and BTC noticed a selloff as their values quickly plunged.

Because of this all through these macro occasions, BTC remained correlated with Nasdaq and S&P 500. “In sum, this correlated response to important macro developments suggests that correlations with other risk assets will remain relevant in BTC’s price discovery onwards,” explains the report.

The latest excessive diploma of connection between these property may also be seen in additional concrete phrases via the “correlation” indicator, which measures in numbers whether or not Bitcoin and one other asset are tied or not proper now.

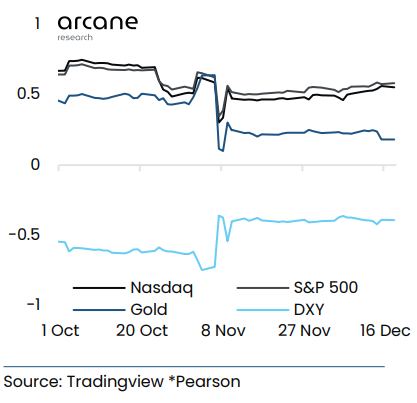

When the worth of this metric is larger than zero, it means BTC is positively correlated with the commodity as its value is transferring in the identical course because the asset. Then again, a adverse correlation implies BTC is responding to modifications within the different asset’s worth by transferring oppositely to it. Here’s a chart that reveals Bitcoin’s 30-day correlations with different property since October:

BTC appears to have been extremely correlated with S&P 500 and Nasdaq | Supply: Arcane Research’s Ahead of the Curve – December 20

From the graph, it’s obvious that Bitcoin has had a optimistic correlation with US equities in latest months. The upper the worth of the metric above zero, the extra correlated the property are. Thus, the present values recommend an honest diploma of interconnection between the chance property at the moment.

This correlation is prone to proceed into the subsequent 12 months so macro occasions like indicators from the Federal Reserve are one thing that traders ought to take note of, because the report notes.

BTC Worth

On the time of writing, Bitcoin’s value floats round $16,800, down 5% within the final week.

BTC has principally moved sideways lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Arcane Analysis

Source link

#Bitcoins #Correlation #Risk #Assets #Watch #Report #Suggests #Bitcoinist.com