Bitfarms: Time To Play Catch Up (NASDAQ:BITF)

asbe/iStock by way of Getty Photographs

After I final lined Bitfarms (NASDAQ:BITF) for In search of Alpha, I used to be impressed by how aggressively the corporate has been decreasing its debt burden. Three months later, we have now much less debt, extra manufacturing information, an earnings name, and a doubtlessly completely different setup for all the mining business. Whereas I feel many of the public miners will profit from that setup to a point, on this article I will lay out why I’ve personally determined to go lengthy BITF shares.

The Setup For Miners

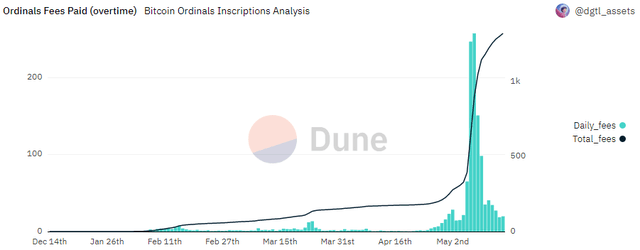

Earlier than we get to the data that particularly pertains to Bitfarms, we have now to acknowledge how the emergence of Ordinals and BRC-20 tokens has the potential to dramatically change the price marketplace for Bitcoin (BTC-USD) customers going ahead. Within the final a number of months, we have seen Ordinals go from what was seen as a foolish aspect attraction for “degens” to a respectable NFT protocol that’s liable for $36 million in charges paid to Bitcoin miners.

Ordinals Charges (Dune Analytics/dgtl_assets)

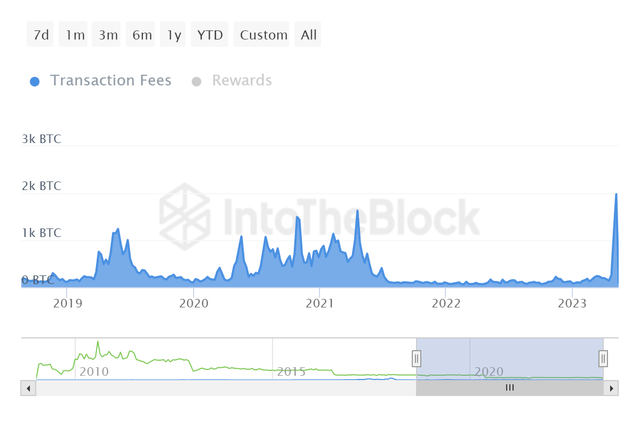

I detailed why I felt Ordinals had the potential to result in battle inside the Bitcoin group again in early February, and that evaluation is nearer to coming to fruition. No matter whether or not everybody likes Ordinals or not, this can be a important basic improvement for the miners. Regardless of short-lived spikes to charges over time, the business has been virtually solely reliant on recent BTC provide emissions from the block reward.

Payment rewards (IntoTheBlock)

Earlier this month, we had the most important spike in transaction charges paid to miners for the reason that 2017 bull run. This price spike is attributable to Ordinals and BRC-20 tokens. A strong price market adjustments the sport for miners as a result of it reduces the destructive impression of the halving subsequent yr if community charges can proceed to be a rising portion of complete miner income. We do not know to what diploma these transaction charges will probably be sticky. It might be straightforward to dismiss this bounce in charges as simply one other short-lived spike like we have seen previously, however I am much less sure of that.

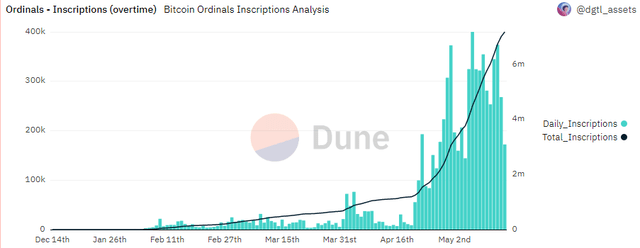

Ordinals Mints (Dune Analytics/dgtl_assets)

Ordinals mints have not proven any signal of slowing down, and there may be now over $500 million in paper wealth underpinning the not too long ago emerged BRC-20 token market on Bitcoin. Once more, there isn’t any assure this pattern in exercise continues. But when it does, it advantages the miners. Even and not using a bigger share of income from charges, the setup for Bitfarms has additionally improved.

Bitfarms Update

For Bitfarms particularly, we have now a continuation of the debt discount story from the prior quarter, progress in exahash, and a small bump in BTC on the steadiness sheet. Within the firm’s earnings presentation for Q1-23, Bitfarms famous debt on the steadiness sheet of simply $19 million as of the top of April. That is down from 24% from the $25 million in obligations that the corporate disclosed in February.

Bitfarms BTC Treasury EH/S January 2023 405 4.7 February 2023 405 4.7 March 2023 435 4.8 April 2023 465 5.0 Click on to enlarge

Supply: Bitfarms

Importantly, Bitfarms has been in a position to accomplish this continued debt discount during the last 3 months with out sacrificing the BTC on the steadiness sheet or considerably drawing down money. Within the meantime, the corporate has additionally continued to slowly carry on extra working exahash; transferring from 4.5 EH/s on the finish of December to five.0 as of Could fifteenth. Bitfarms is guiding for six EH/s in Q3 of this yr. 12 months up to now, Bitfarms has produced 1,676 Bitcoin at a median BTC per EH/s of 87.5:

Miner YTD Manufacturing Avg BTC per EH/s Iris Power (IREN) 820 94.3 CleanSpark (CLSK) 2,395 90.1 HIVE Blockchain (HIVE) 1,065 90.0 Bitfarms 1,676 87.5 Bit Digital (BTBT) 447 87.4 Click on to enlarge

Supply: Firm Filings by April 2023, creator’s calculations

This makes Bitfarms the fifth best miner by cumulative BTC mined in 2023 and the 4th most effective by common Bitcoin mined per exahash. Solely CleanSpark can declare higher effectivity with bigger manufacturing. However CleanSpark has a lot much less BTC and fewer money on the steadiness sheet than Bitfarms.

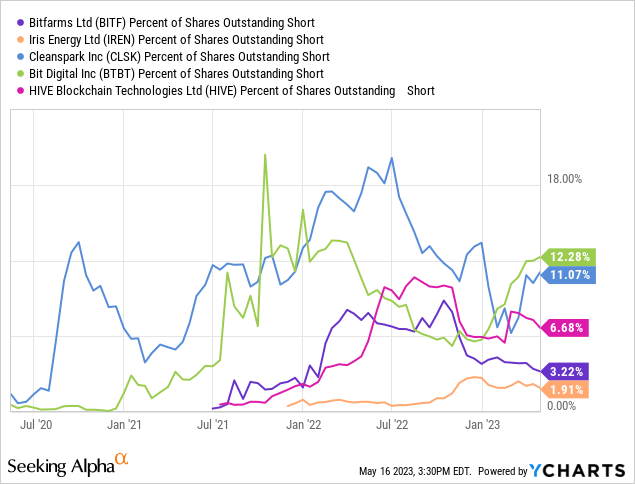

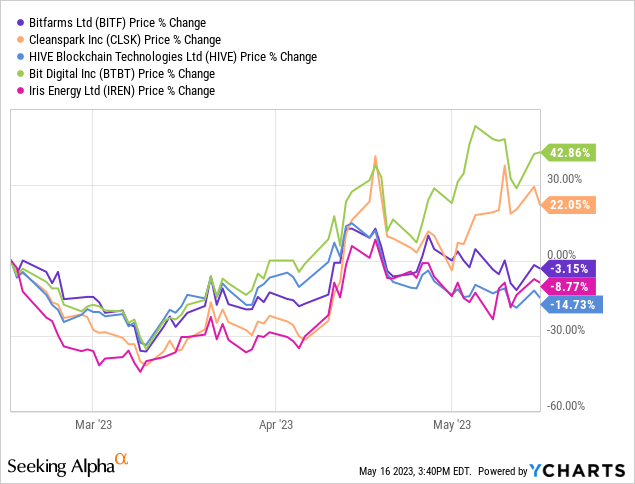

Information by YCharts

Information by YCharts

One thing else to think about is the pattern briefly shares as a share of shares excellent. For Bitfarms, that pattern has been decrease since This autumn of final yr, however that has not been the case for all of the miners with sturdy effectivity scores. Bit Digital and CleanSpark have seen their quick numbers begin to transfer again greater from early 2023 lows. Iris Power and Bitfarms are those which can be at recent lows for 2023 as of the article submission.

Dangers

Most of the identical dangers from my final Bitfarms article nonetheless apply. BITF continues to be very near $1 per share and may very well be at important threat of being non-compliant with Nasdaq itemizing necessities if the value of Bitcoin strikes decrease from present ranges. And there may be actually no assure that Bitcoin’s worth will stay within the $27-29k vary. Past that, if Bitcoin’s worth will increase, it creates a state of affairs the place extra competitors can viably begin mining for block rewards.

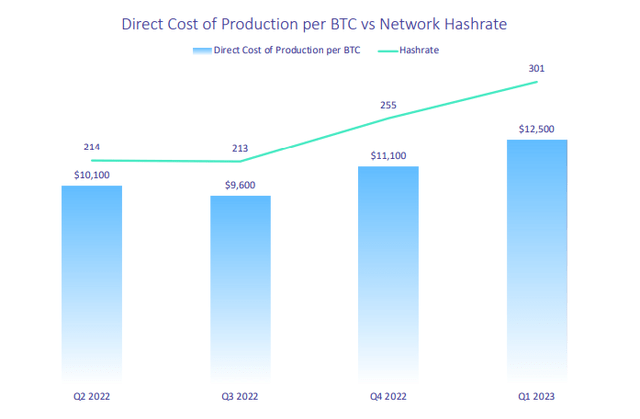

Value to provide (Bitfarms)

To sustain with world exahash enlargement, miners must continue to grow their very own working EH/s in step with the worldwide progress price, or they threat dropping mining share to friends. After all, this comes with a price, and we will see that the fee to provide a Bitcoin has been rising for Bitfarms within the graph above.

One other threat to think about is the corporate’s participation in market derivatives. CFO Jeff Lucas from the Q1 name:

We’re stepping in right here very fastidiously and really considerate right here. We’re not being overly aggressive by any means. And the purpose right here, fairly frankly, is the technique of insulating and defending our draw back right here. And proper now, we’re doing that primarily both by writing or by shopping for choices in place right here, although we’re on the lookout for another extra refined devices as we get extra superior right here. And in addition to a level on the upside, we do offset a few of that premium price by really writing some dramatically out-of-the-money calls right here.

There may be nothing improper with hedging manufacturing in an try and diminish income volatility as a result of BTC worth swings. However it’s nonetheless one thing that traders ought to think about. A lot of these inner applications can work nice when these working them guess proper. However incorrect guesses can in the end result in pointless losses. It might be a disgrace if Bitfarms had BTC known as away proper earlier than the halving.

Abstract

In February, I appreciated the enhancing basic story in Bitfarms and rated the inventory a purchase, despite the fact that I did not but have a place on the time. Since then, the inventory hasn’t actually gone anyplace, however the macro setup for the business is arguably significantly better. Bitfarms has decreased debt by $140 million in 10 months. It has proven a capability to lower that debt whereas rising each exahash and BTC on the steadiness sheet, and with out considerably diluting shareholders within the course of.

Information by YCharts

Information by YCharts

Regardless of the more and more favorable setup for the business and for Bitfarms particularly, it is lagging a number of of its bigger friends and even equally capitalized friends which have diluted to a bigger diploma. For my part, Bitfarms goes to play catch up, and I feel this can be a good time to take a shot on BITF shares.

Source link

#Bitfarms #Time #Play #Catch #NASDAQBITF