Bitfinex closes week main Bitcoin reserves in keeping with Glassnode

CryptoSlate analysts examined the detailed proof-of-reserves of main crypto exchanges exterior of Coinbase and Binance. It revealed that Bitfinex holds probably the most vital Bitcoin (BTC) reserves, with $3.5 billion value of BTC.

The information was obtained on Dec. 16 from OKX, KuCoin, Crypto.com, ByBit, Binance, BitMEX, and Bitfinex. OKX follows Bitfinex with the second largest BTC pool with greater than $1.5 billion in BTC, whereas Binance comes because the third with simply above $5 billion in BTC. BitMEX locations fourth, with simply over $1 billion in BTC. Crypto.com, ByBit, and KuCoin got here because the fifth, sixth and seventh with $700 million, $370 million, and $300 million, respectively.

Reserves in billions

Bitfinex, OKX, Binance, and BitMEX calculate their reserves in billions. Amongst all exchanges included on this evaluation, Bitfinex emerged because the alternate that held considerably extra BTC than the opposite six that launched their proof-of-reserves.

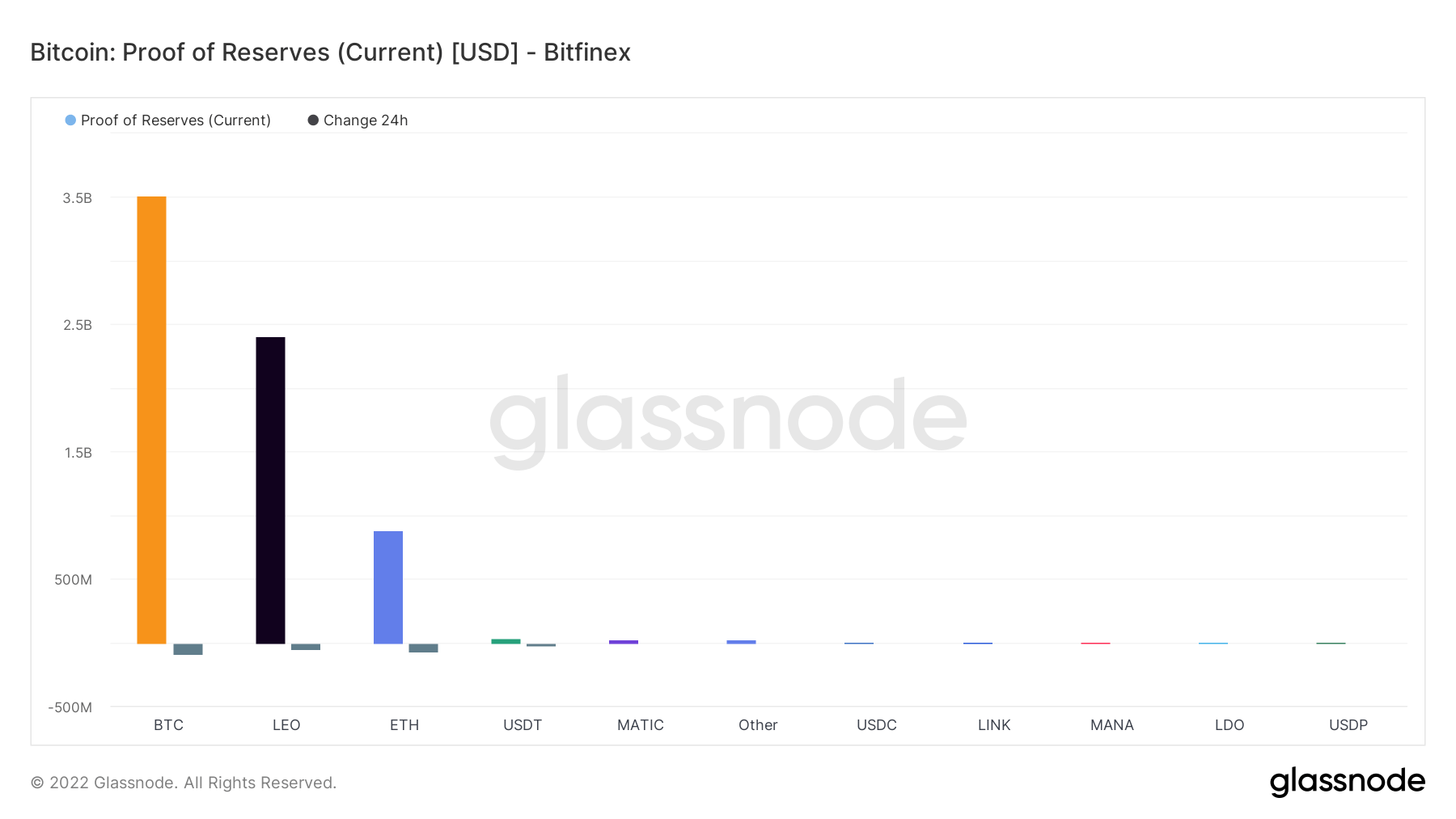

Bitfinex

In keeping with the numbers, Bitfinex entered the weekend with $3.5 billion in BTC and round $2.37 billion in UNUS SED LEO (LEO). The alternate additionally holds slightly below $1 billion value of Ethereum (ETH).

Proof of reserves – Bitfinex

Proof of reserves – Bitfinex

Moreover BTC, LEO and ETH, the chart reveals that Bitfinex holds eight extra property in thousands and thousands every.

Knowledge from Nov. 21 showed that 91% of Bitfinex’s reserves had been manufactured from BTC and ETH, which meant that Bitfinex held probably the most BTC. Despite the fact that its ETH reserves have shrunk, the alternate nonetheless holds the most important quantity of BTC.

One other research on the finish of November 2022 confirmed that Bitfinex held over $11 billion value of Tether (USDT), equating to 60% of the entire USDT provide. Nonetheless, the present knowledge point out that this quantity retreated to thousands and thousands inside two weeks.

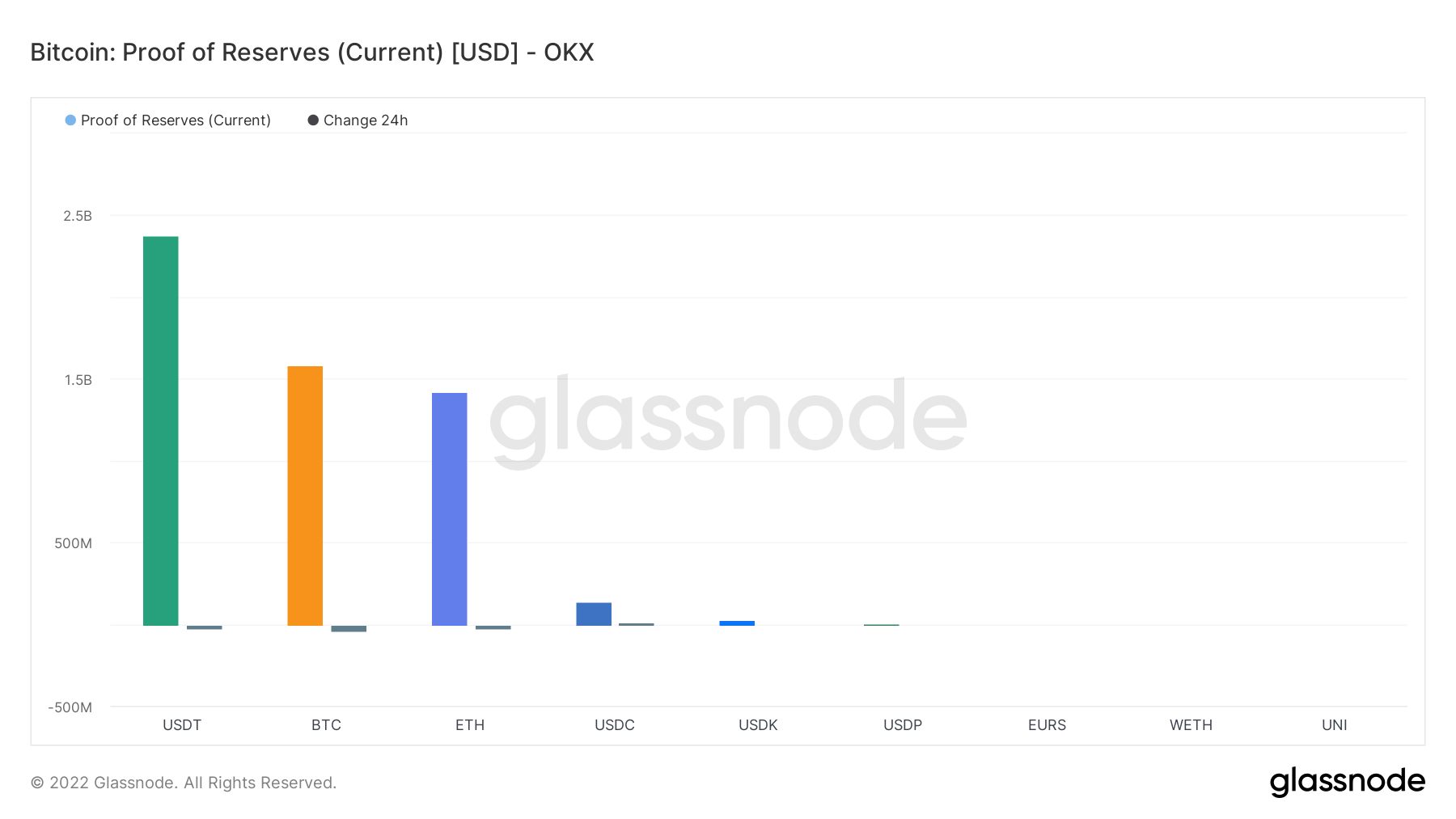

OKX

OKX is the one alternate included on this evaluation that measures its BTC reserves in billions. The alternate’s BTC reserves quantity to simply above $1.5 billion.

Proof of reserves – OKX / Supply: Glassnode

Proof of reserves – OKX / Supply: Glassnode

Along with the appreciable quantity of BTC, OKX additionally holds round $2.43 billion in USDT. Moreover, the alternate has slightly below $1.5 billion value of ETH.

In keeping with OKX’s announcement, additionally it is backing all its customers’ property at 1:1 with actual funds.

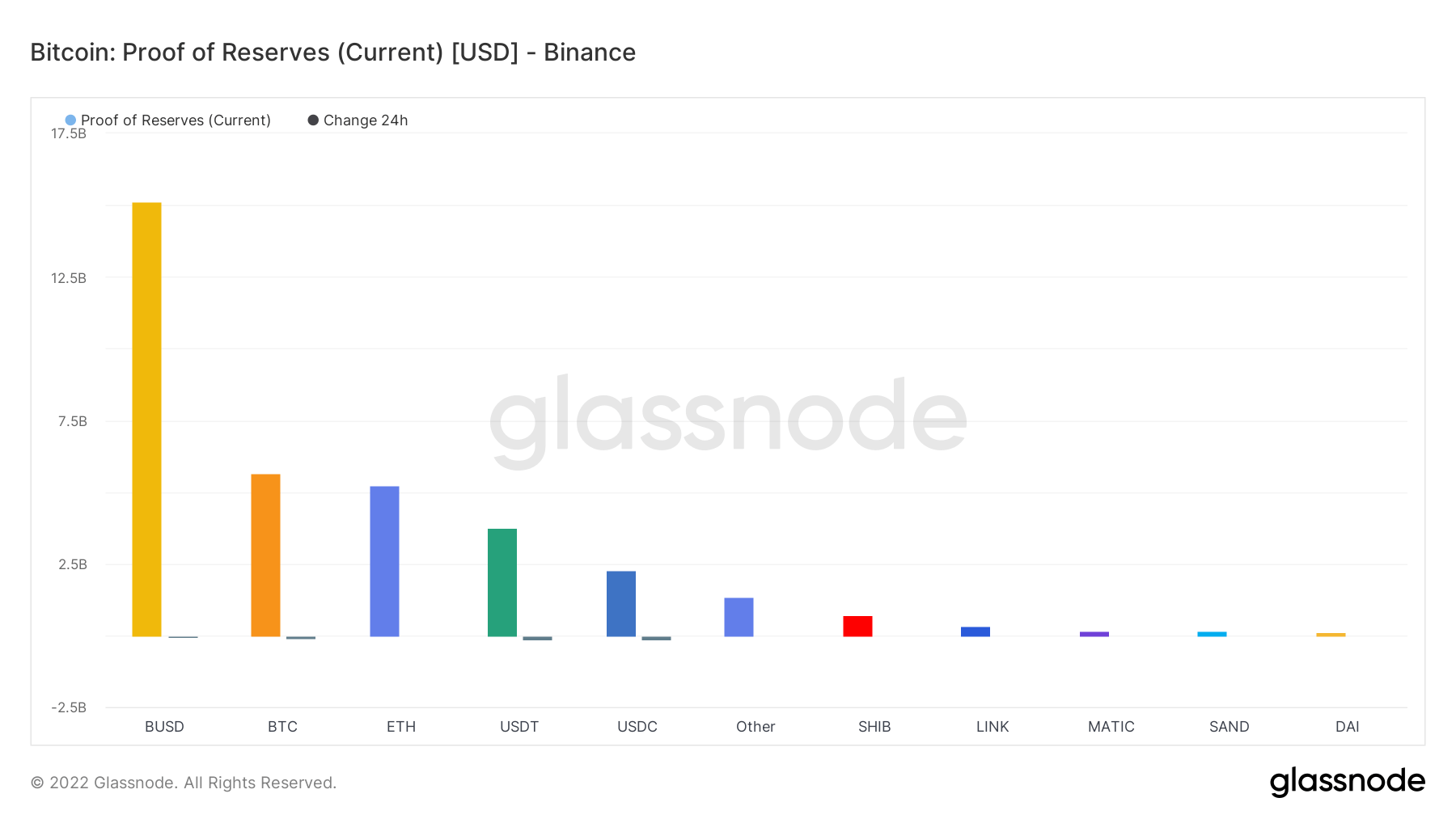

Binance

Binance locations third in rating with almost $5.6 billion in BTC. The alternate additionally holds $5 billion in ETH.

Proof of reserves – Binance / Supply: Glassnode

Proof of reserves – Binance / Supply: Glassnode

Regardless of the dimensions of its BTC pool, Binance holds $15 billion in Binance USD (BUSD), $6.25 million in USDT, and virtually $2.5 billion in USDC.

On Dec. 15, Binance experienced a withdrawal disaster the place its reserves shrank by $3.5 billion in 24 hours. Regardless of that, the alternate holds the most important general reserves amongst all different exchanges included on this evaluation.

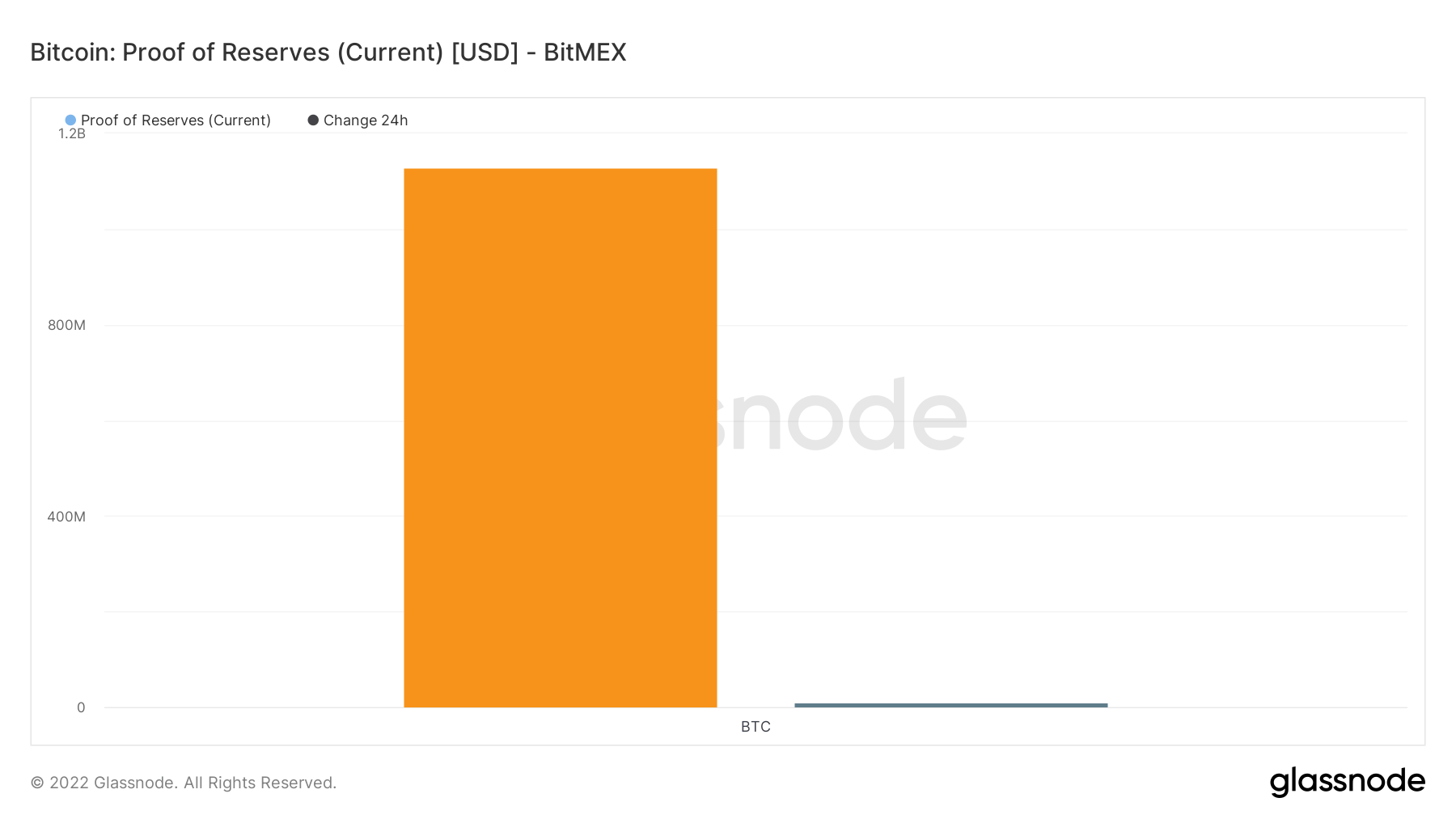

BitMEX

BitMEX holds the fourth largest BTC reserves, with round $1.1 billion. The information doesn’t disclose some other asset kind beneath BitMEX’s reserves.

Proof of reserves – BitMEX / Supply: Glassnode

Proof of reserves – BitMEX / Supply: Glassnode

The alternate additionally announced that it plans to put off round 30% of its workers in early November.

Reserves in thousands and thousands

Different exchanges included on this evaluation measure their reserves by way of thousands and thousands. Amongst the remaining 4, Crypto.com holds probably the most BTC.

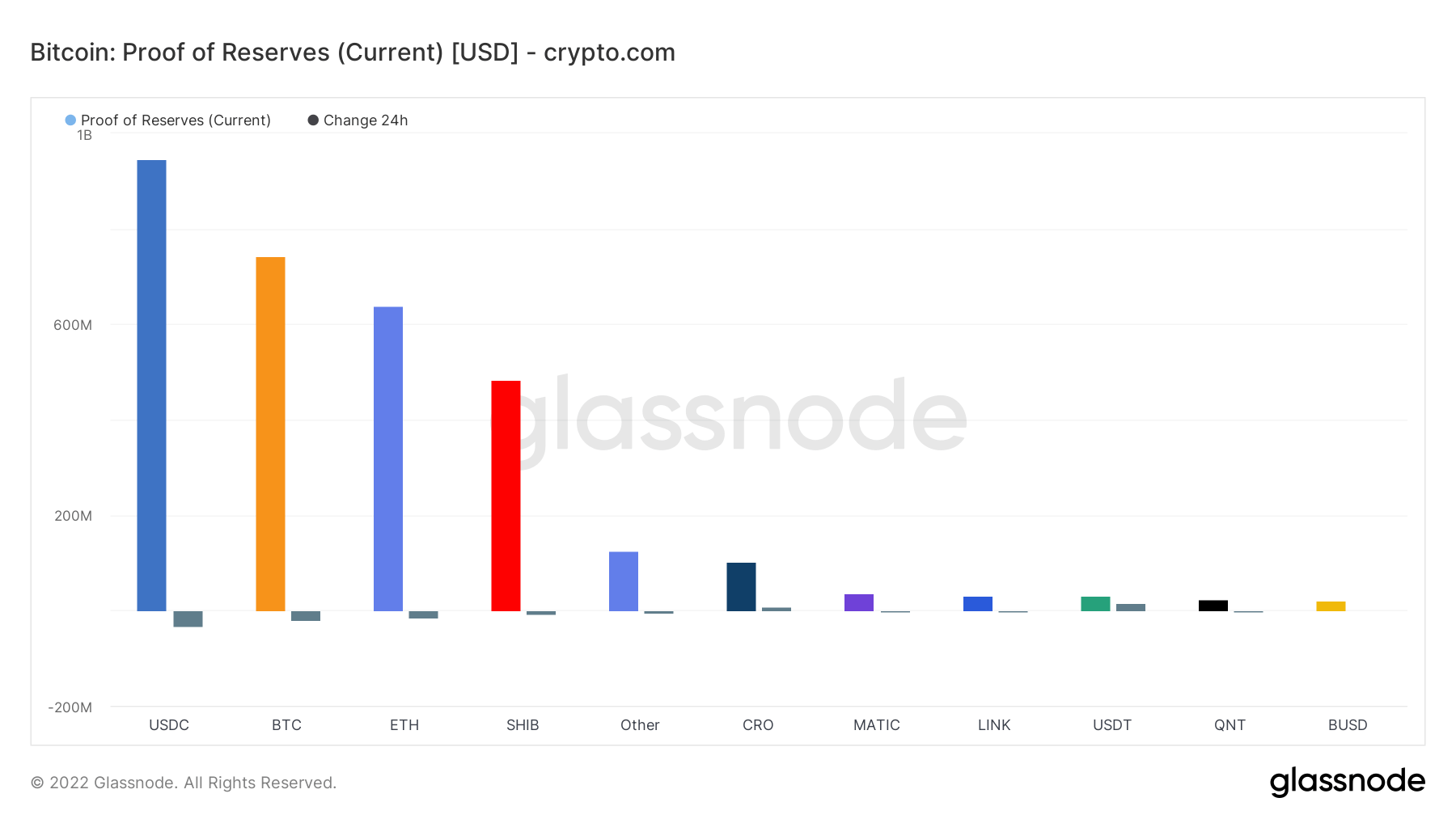

Crypto.com

Crypto.com entered the weekend with almost $700 million value of BTC and simply above $600 million in ETH.

From Nov.21, 52% of Crypto.com’s reserves had been manufactured from BTC and ETH, which equated to 53,024 BTC and 391,564 ETH. Present knowledge means that the alternate shrunk its BTC reserves whereas rising its ETH holdings.

Proof of reserves – Crypto.com

Proof of reserves – Crypto.com

Crypto.com additionally holds over $900 million value of USD Coin (USDC) and round $500 million in SHIBA INU (SHIB).

The alternate released its proof of reserves on Dec. 6 and confirmed that each one property had been totally backed by 1:1 on the alternate, with additional reserves to spare. Nonetheless, the audit agency Mazars Group audited the proof of reserves, which revealed that it was getting ready to drop its shoppers on Dec. 16.

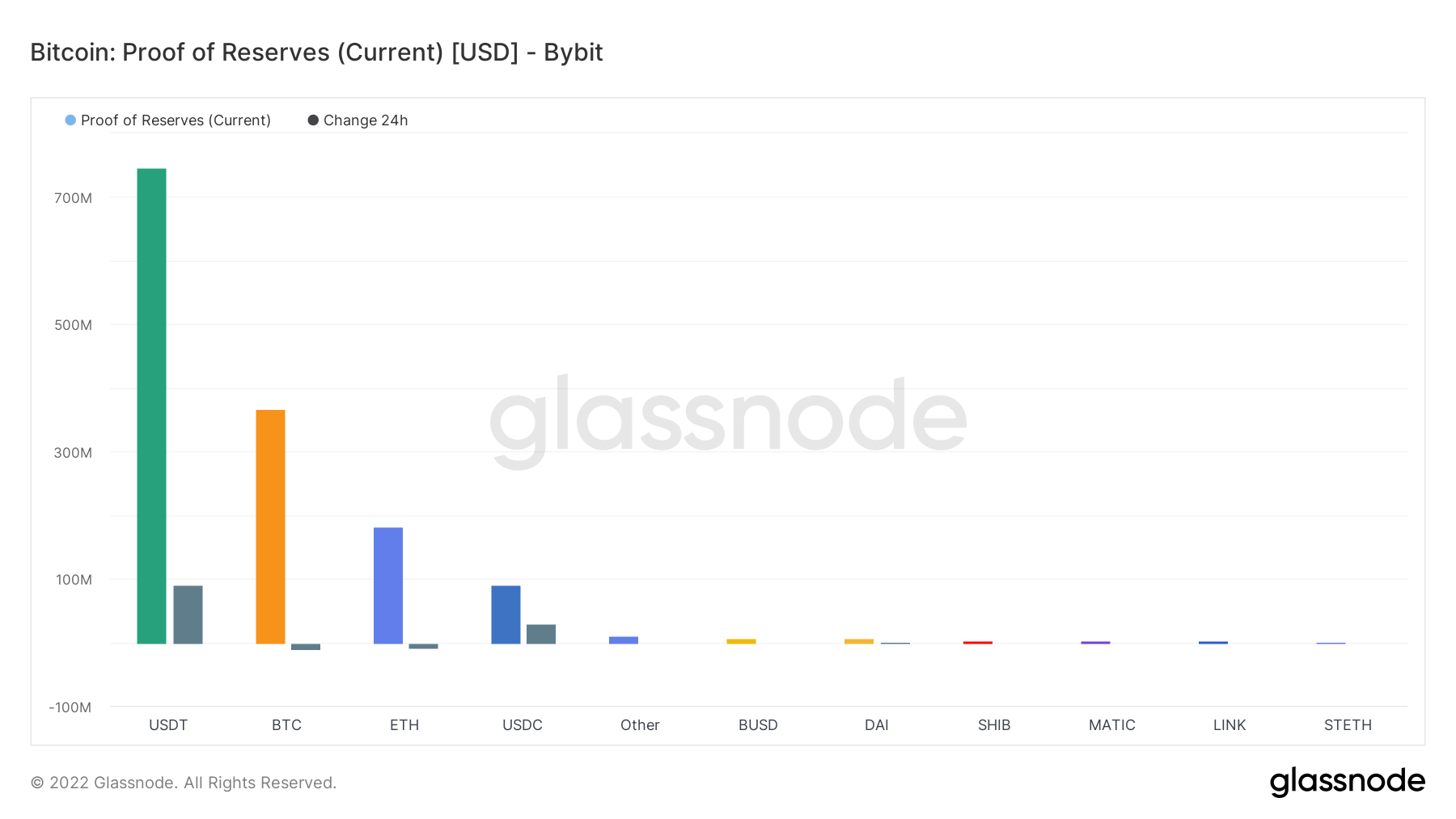

ByBit and KuCoin

Based mostly on the BTC reserves’ rating, ByBit and KuCoin come fourth and fifth, respectively, with solely slight variations of their reserves.

The numbers present that ByBit holds almost $370 million in BTC and virtually $200 million in ETH. As well as, the alternate additionally has over $700 million USDT and almost $100 million USDC stablecoins.

Proof of reserves – ByBit

Proof of reserves – ByBit

ByBit not too long ago announced that it will be updating its withdrawal limits based mostly on verification ranges and planning to put off round 30% of its workers attributable to difficult market situations.

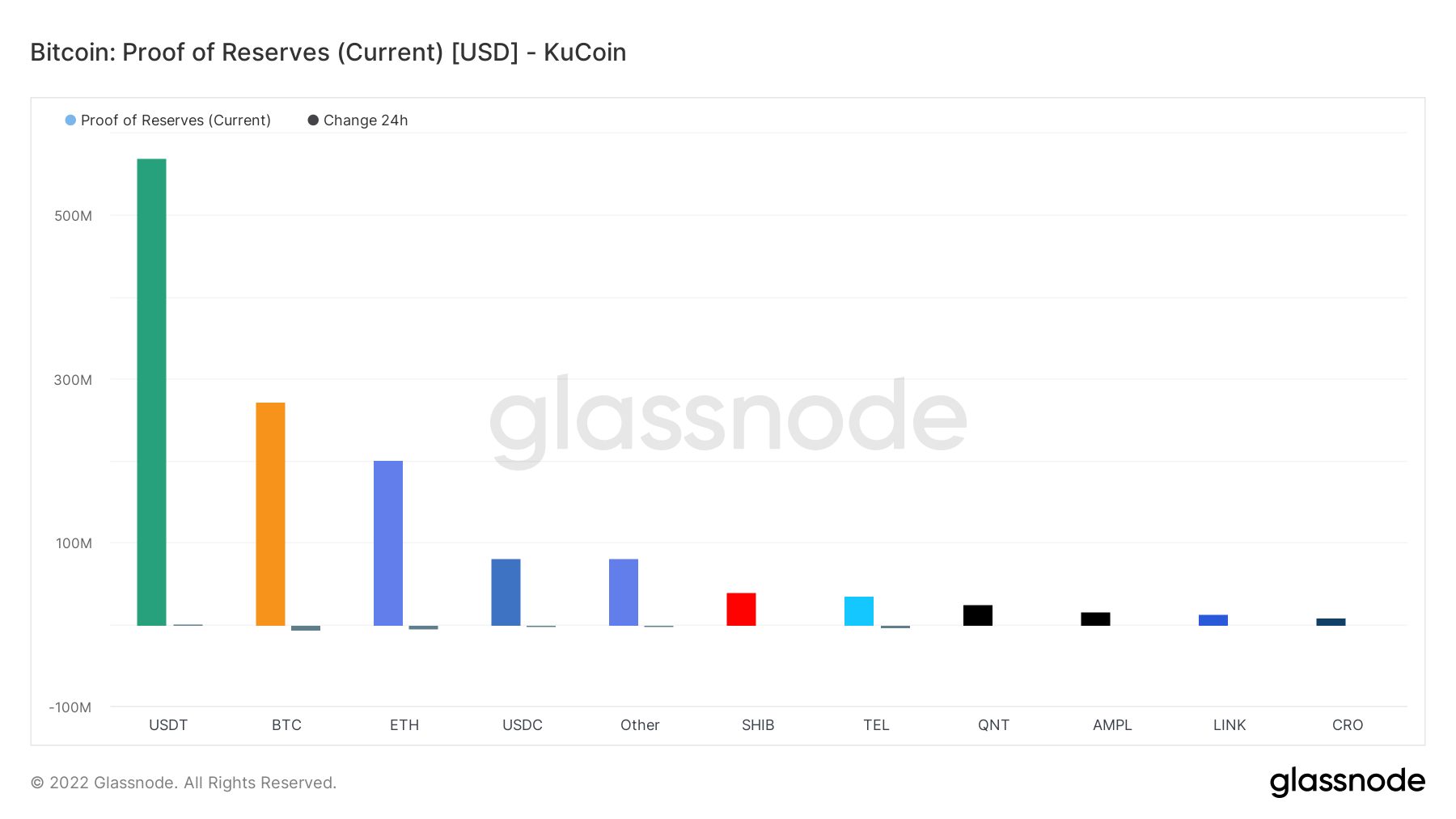

KuCoin, alternatively, holds rather less than $300 million in BTC and $200 million in ETH. The alternate has over $600 million in USDT and USDC stablecoins mixed.

Proof of reserves – KuCoin

Proof of reserves – KuCoin

Following the FTX fallout, KuCoin was one of many first exchanges that disclosed its holdings. On Nov. 11, KuCoin’s CEO, Johnny Lyu, announced the alternate’s holdings by way of his Twitter account. As well as, the alternate released its proof-of-reserves on Dec. 5, which the Mazars Group audited.

Read Our Latest Market Report

Get an Edge on the Crypto Market

Develop into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Worth snapshots

Extra context

Join now for $19/month Explore all benefits

Source link

#Bitfinex #closes #week #main #Bitcoin #reserves #Glassnode