BITO ETF Offers Regulated Way To Ride Next Bitcoin Rally

Lauren DeCicca

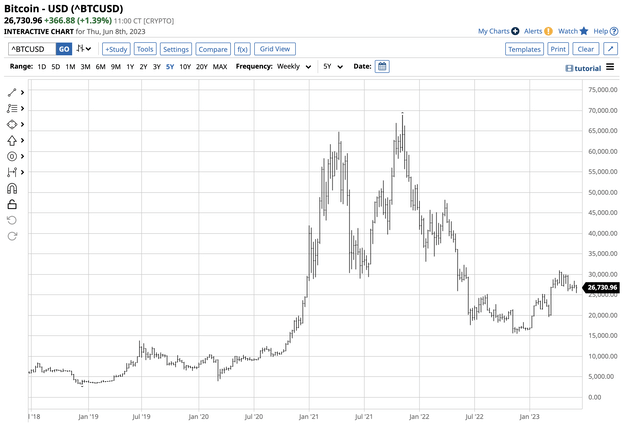

After reaching a $68,906.48 excessive in November 2021, Bitcoin ran out of its unbelievable upside steam, resulting in a 77.5% plunge to the $15,516.53 November 2022 low. The decline was ugly, nevertheless it was not the primary time the main cryptocurrency tanked, and former declines since 2010 had been much more vital on a proportion foundation.

Bitcoin is a protocol implementing a public, everlasting, decentralized ledger that revolutionizes conventional finance. Bitcoin is a digital foreign money that acts as cash and a type of fee outdoors the management of any individual, group, or entity working in a worldwide setting.

In late 2017, the Chicago Mercantile Trade rolled out futures contracts on Bitcoin. Whereas bodily Bitcoin is usually unregulated, the futures fall underneath the CFTC’s supervision. The ProShares Bitcoin Technique ETF product (BITO) tracks Bitcoin futures costs increased and decrease.

Bitcoin rallies from the November 2022 low

The decline from the November 2021 excessive was ugly. With some crypto devotees calling for $100,000 per token or increased, Bitcoin plunged, inflicting latecomers to the asset class greater than slightly ache.

Bodily Bitcoin Value Chart (Barchart)

The chart highlights the 77.5% fall from the file peak. In the meantime, the main crypto practically doubled at the latest $30,970.16 mid-April 2023 excessive earlier than settling right into a buying and selling vary at over $25,000 and under the $30,000 stage.

Consolidation is a cleaning

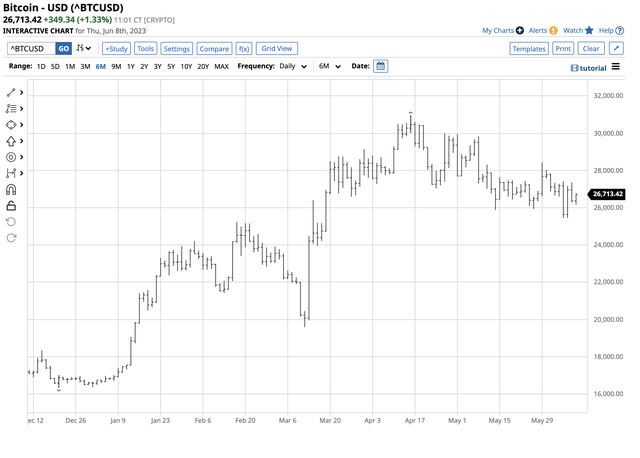

A big value transfer usually results in a quiet interval in markets, and Bitcoin has been no exception.

Quick-Time period Bodily Bitcoin Chart (Barchart)

The six-month chart illustrates that the short-term development is marginally bearish, as Bitcoin has made decrease highs and decrease lows since April 14. Nevertheless, the worth motion has been consolidating far above the November 2021 low. Technical assist under the underside finish of the present buying and selling vary is on the $20,000 stage, with a wall of resistance at $30,000 per token. Whereas this may occasionally seem to be a variety for an asset, in Bitcoin, it’s slim, contemplating that the highest crypto was as little as 5 cents in 2010 and as excessive as practically $69,000 in late 2021.

Consolidation durations cleanse markets of weak longs or shorts, and cryptos have many passionate individuals on each ends of the spectrum.

The case for increased Bitcoin and cryptocurrency costs

The next elements assist an eventual break to the upside:

Fiat currencies derive worth from the religion and credit score of the nations that difficulty the authorized tender. Financial and political elements that might result in de-dollarization have eroded fiat foreign money values over the previous years. Debt and geopolitical tensions have challenged the U.S. greenback and different fiat reserve currencies, function within the worldwide monetary system, opening the door for options. Bitcoin and different cryptocurrencies have stuffed the void for some technologically savvy buyers and merchants. Extra companies are accepting Bitcoin and the opposite main cryptos as a way of trade. Rising acceptance favors increased costs. Responding to prospects’ requests, the main monetary establishments have allowed for investments within the burgeoning asset class. Recollections of the appreciation that took Bitcoin from 5 cents in 2010 to just about $69,000 per token in late 2021 assist speculative exercise within the asset class. The lack of religion in governments has elevated the demand for property that transcend the cash provide management. Bitcoin’s worth is a perform of bids and provides out there, with out authorities intervention to regulate or decide value ranges towards fiat currencies.

Cryptos have turn out to be another asset class with rising participation for these causes and extra. Furthermore, futures, ETF merchandise, and crypto-related firms buying and selling on inventory exchanges have allowed market individuals to put money into the asset class with out cryptocurrency wallets or holding cryptos on unregulated trade platforms. Whereas the regulated merchandise present some sense of safety, they proceed to offer volatility and correlation when costs transfer increased or decrease.

The case for decrease Bitcoin and cryptocurrency costs

On the extremes, crypto devotees like Jack Dorsey imagine that Bitcoin will “change the world.” Others, like Charlie Munger, assume Bitcoin is “disgusting and contrary to the interests of civilization.” The case towards Bitcoin and cryptos consists of:

There isn’t a intrinsic worth apart from the costs consumers and sellers set up. Whereas costs are clear, possession isn’t, resulting in a utility for nefarious purchases. The potential for systemic dangers has brought on regulators to crack down on cryptos. The SEC sued Binance and Coinbase for working as unregulated exchanges. In each civil instances, SEC Chairman Gary Gensler known as the crypto business the “Wild West,” undermining investor belief within the U.S. capital markets. China has banned Bitcoin and different cryptos because it plans to roll out a central bank-issued digital foreign money. Whereas the potential for systemic danger is low, with the market cap of the whole asset class at $1.122 trillion on June 8, it rose to over $3 trillion in late 2021. The upper the market cap, the extra the chance of destabilizing the monetary system. Whereas blockchain revolutionizes finance, and lots of personal and public sector monetary establishments have embraced the know-how, many view cryptocurrency as an undesirable offshoot of blockchain that will increase pace, effectivity, and file conserving. Cash is energy, and governments have rejected improvements that restrict or deny their management of the cash provide. Governments will seemingly embrace their digital currencies, however cryptos are one other story.

The controversy will seemingly proceed, with the temperatures rising with Bitcoin’s value. The boom-and-bust historical past means that the percentages favor one other increase interval of speculative frenzy.

BITO for Bitcoin bulls

Bitcoin bulls or speculators trying to take part within the subsequent rally if Bitcoin breaks above the $30,000 stage have funding choices. Probably the most direct route is thru the bodily market, which includes holding Bitcoin in a pc pockets or an unregulated trade with further dangers. The pockets requires a password, which dangers hackers stealing the cryptos. The exchanges can go belly-up after a hack, authorities shutdown, or different causes. Trade prospects can lose all their cryptos with out recourse.

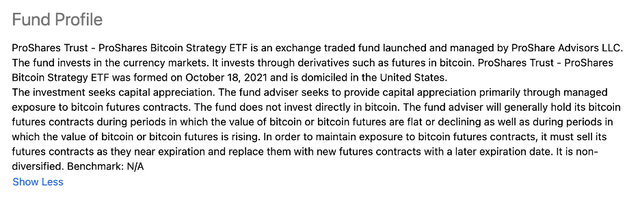

The ProShares Bitcoin Technique ETF product (NYSEARCA:BITO) provides two ranges of regulatory supervision. BITO’s fund abstract states:

Fund Abstract for the BITO ETF (Searching for Alpha)

BITO holds futures contracts regulated by the U.S. Commodity Futures Buying and selling Fee. The CFTC regulates futures markets. As BITO trades on NYSEARCA as an ETF, the Securities and Trade Fee provides one other regulatory stage. Whereas regulators or governments can ban Bitcoin, crushing the worth, the ETF will seemingly go alongside for the experience if Bitcoin takes off on the upside.

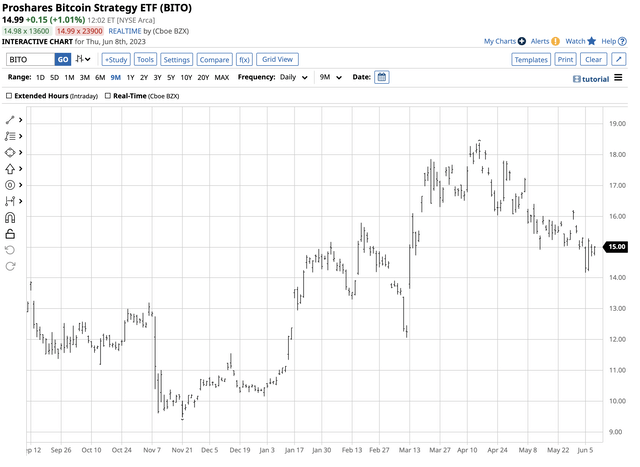

Bitcoin practically doubled from the November 2022 low to the April 2023 excessive.

Chart of the BITO ETF November 2022 low and April 2023 excessive (Barchart)

The chart exhibits the BITO ETF rose from $9.48 to $18.39 per share, or 94% from late November 2022 via mid-April 2023. BITO did a wonderful job monitoring Bitcoin’s value. At round $15 per share on June 8, BITO had $843.838 million in property underneath administration. The ETF trades a median of over 7.25 million shares every day and expenses a 0.95% administration price.

On the subject of Bitcoin, BITO, or any crypto-related funding, solely use the capital you’re prepared to lose, as danger is at all times a perform of the potential reward. Within the boom-and-bust cryptocurrency world, the potential for unbelievable income comes with the chance of a complete loss. Bitcoin and BITO are sleeping in a slim vary, however the value historical past tells us that one other explosive or implosive transfer is correct across the nook.

Source link

#BITO #ETF #Offers #Regulated #Ride #Bitcoin #Rally