Bloomberg Analyst Says Bitcoin and Gold Could Benefit From Potential Incoming Deflationary Phase – The Daily Hodl

Bloomberg’s senior item specialist Mike McGlone says another deflationary period might be showing up to the monetary scene, from which Bitcoin (BTC) and gold could benefit.

The expert tells his 47,700 Twitter devotees that falling gamble on resources might develop into a deflationary stage that helps the lead digital currency, the yellow metal and US bonds.

“Too Hot Stocks vs. Maturing Bitcoin? Plunging risk assets in 1H [first half] are taking away inflation at a breakneck pace, which may translate into pre-pandemic deflationary forces resurfacing in 2H [second half]. Primary beneficiaries of this scenario may be gold, Bitcoin and US Treasury long-bonds.”

Source: Mike McGlone/Twitter

As Bitcoin kept plunging over the course of the end of the week, McGlone anticipated that this week would see significantly more decreases in risk resources. He says the enormous downfalls could decrease the requirement for the Federal Reserve to keep up with its position on financial tightening.

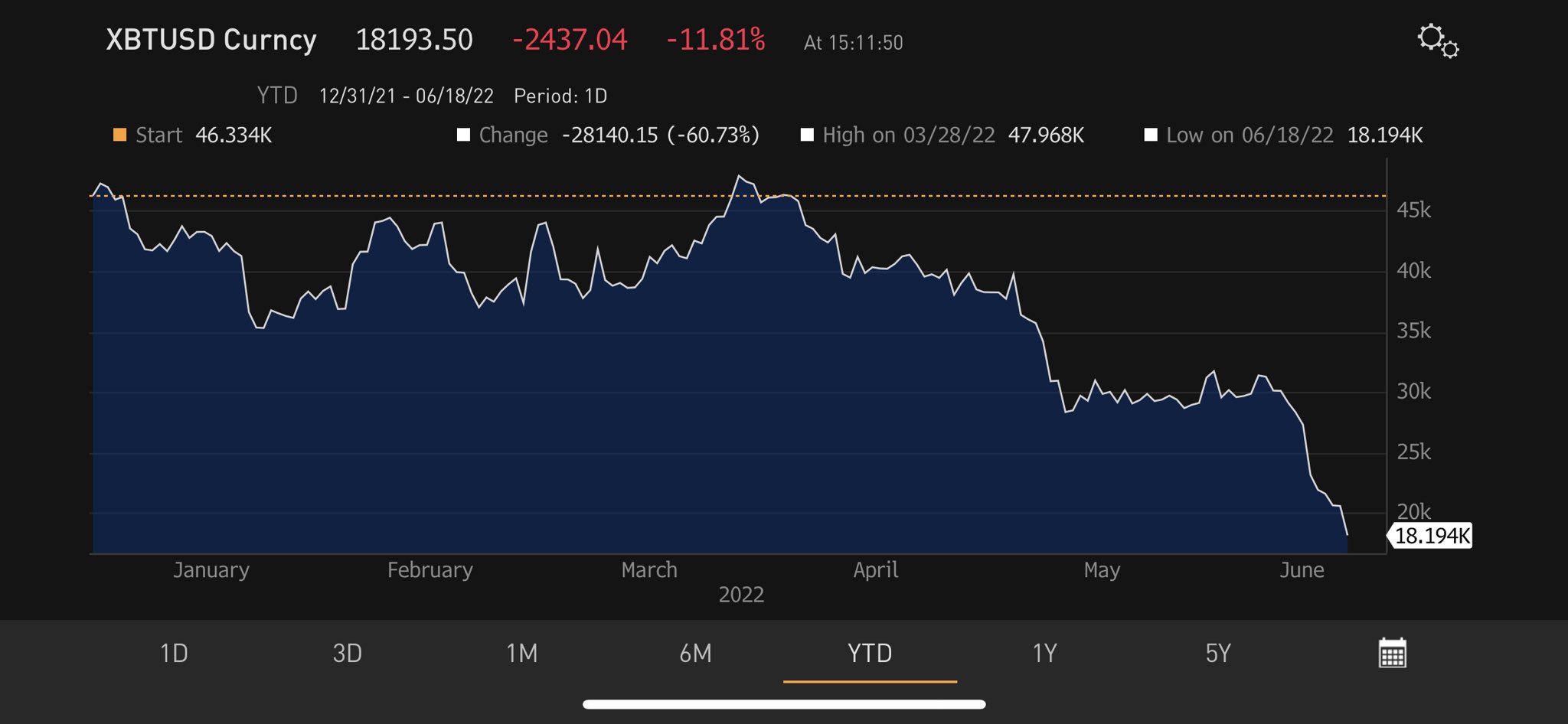

“Down over 10% on Saturday, Bitcoin pointing to a big risk asset decline week. Feds 75 bps [basis points] hike may be the last, risk asset deflation doing the tightening for them. 1929ish – aggressive rate hikes despite plunging stock market, global GDP and consumer sentiment.”

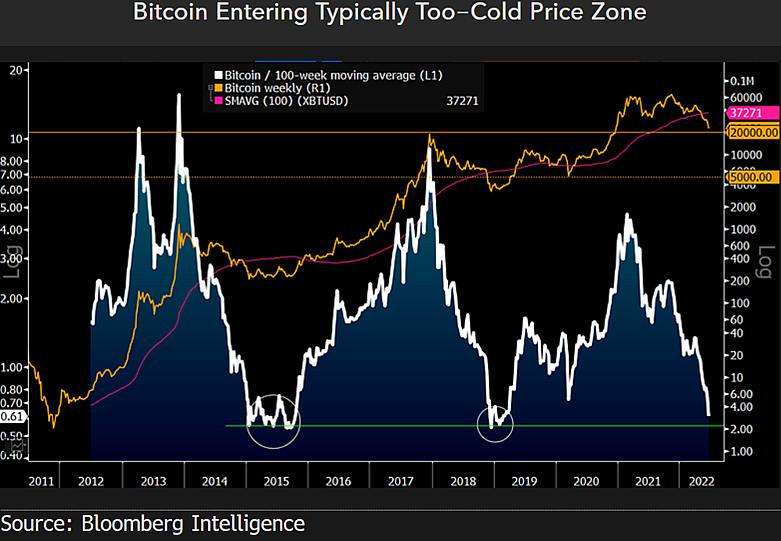

Last week, the Bloomberg investigator said that the $20,000 level for Bitcoin could be the new $5,000.

During the 2018 bear market, the $5,000 cost region filled in as help for Bitcoin for about a year. In 2020, the $5,000 level likewise gone about as help for Bitcoin despite the fact that BTC momentarily penetrated the region several times.

“$20,000 Bitcoin may be the new $5,000 – The fundamental case of early days for global Bitcoin adoption vs. diminishing supply may prevail as the price approaches typically too-cold levels. It makes sense that one of the best-performing assets in history would decline in [the first half of 2022].”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email cautions conveyed straightforwardly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Actually take a look at Latest News Headlines

Disclaimer: Opinions communicated at The Daily Hodl are not speculation counsel. Financial backers ought to take care of any outstanding concerns prior to making any high-risk interests in Bitcoin, cryptographic money or advanced resources. Kindly be prompted that your exchanges and exchanges are despite copious advice to the contrary, and any loses you might bring about are your obligation. The Daily Hodl doesn’t suggest the trading of any cryptographic forms of money or advanced resources, nor is The Daily Hodl a venture counselor. If it’s not too much trouble, note that The Daily Hodl partakes in member showcasing.

Included Image: Shutterstock/Art Furnace

Source link

#Bloomberg #Analyst #Bitcoin #Gold #Benefit #Potential #Incoming #Deflationary #Phase #Daily #Hodl